Interested in learning more about our gas & LNG solutions?

LNG: seismic shifts as Russia/Ukraine conflict makes waves

LNG is plugging the Russian gas supply gap. Prices are volatile; buyers are rushing to secure long-term deals.

3 minute read

Giles Farrer

Vice President Research, Commodities, Gas & LNG

Giles Farrer

Vice President Research, Commodities, Gas & LNG

Giles heads our LNG and gas asset research and manages our market-leading LNG Service & Tool and LNG Corporate Service.

Latest articles by Giles

-

Opinion

Debating the future direction of the LNG market

-

The Edge

Positioning for global LNG’s next big growth phase

-

Opinion

Third wave US LNG: a $100 billion opportunity

-

Opinion

LNG: seismic shifts as Russia/Ukraine conflict makes waves

-

Opinion

LNG regasification: why there’s still plenty of gas in the tank

-

Opinion

How coronavirus is driving down LNG demand in Asia and Europe – and hitting supply

Global gas and LNG markets have experienced a seismic shift as a result of Russia’s invasion of Ukraine. Spot prices are rising to record levels in both Asia and Europe and as gas buyers – especially in Europe – search for viable alternatives to Russian gas, LNG contracting activity has accelerated.

As the LNG world prepares to descend on Gastech 2022, we explore – drawing on the expertise of our LNG service – how the Russia/Ukraine war has shifted LNG contract patterns and influenced contract prices across key LNG markets.

Long term contracts off to a fast start

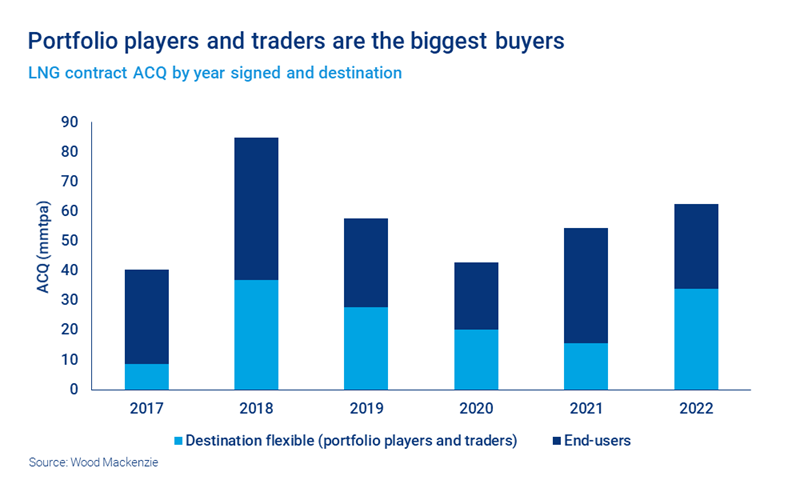

In reaction to record LNG prices, buyers have started signing up for long term deals. Annual volume signed under new long-term contracts in 2022, is already at its highest since 2018, with more than 60 mmtpa (million metric tonnes per annum) of LNG contracts signed – with the majority to be supplied from US LNG projects.

We expect further deals to be announced in coming months with US upstream players and European buyers showing increasing interest in taking US LNG offtake positions. This will likely make 2022 a record year for LNG contracting activity.

Despite the desire of European buyers to purchase additional LNG, the majority of contracting since the invasion of Ukraine has been by portfolio players and trading houses, signing up to buy more than 30 mmtpa of LNG under new Sales and Purchase Agreements (SPAs) and Heads of Agreements (HOAs) in 2022.

Portfolio players and traders are setting themselves up to supply LNG to Europe in the medium term and Asia in the longer term (when European demand is expected to begin to fall) – by taking large volumes of US LNG.

With the shift in trade patterns, LNG suppliers traditionally focused on supplying the Pacific Basin have now moved to secure supply in the Atlantic. This has included US portfolio players like Chevron and ConocoPhillips taking significant US LNG offtake positions for the first time.

US LNG taking advantage of the opportunity

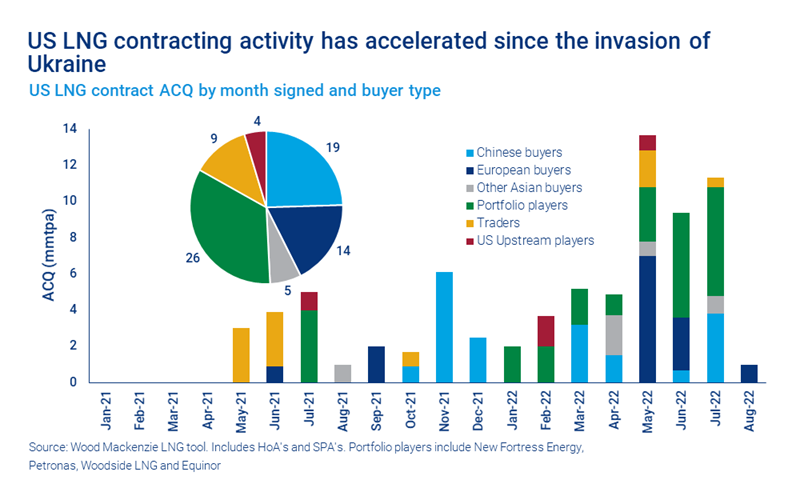

US LNG players are benefiting from the increased demand, with the majority of 2022 contracts being signed with new US suppliers. Activity to buy long term contracts from US LNG players was already ramping up last year, but since the invasion of Ukraine, this has accelerated, with 50 mmtpa of new LNG sales since February 2022.

US suppliers have a clear advantage against their competitors. They are fast to market: some projects can deliver in under 30 months from sanctioning, and with oil and spot LNG prices high, Henry Hub linked LNG is proving attractive to buyers.

Contracting activity will underpin major new LNG Final Investment Decisions (FIDs) for North American LNG projects in 2022 and 2023.

Prices for long term contracts are rising too

With increased activity in the US Gulf, the price of new Henry Hub-linked contract volumes has risen. While contracts with fixed components below US$2/mmbtu FOB were available earlier in the year, fees have increased by at least US$0.20-0.30/mmbtu in recent months. With a number of inflationary pressures on the US Gulf Coast, there is also a risk fees could increase further as projects push toward Final Investment Decisions.

Although few oil-indexed deals have been signed, oil-indexed slopes for deals under negotiation have also risen, with prices for a new 10-year deal, starting supply from 2024, rising to at least 12.5% to 14% of Brent, up from 10% in 2020.

Is China stealing a march on Europe in the race for LNG?

Despite the desire of European buyers to wean themselves off Russian gas and purchase additional LNG, Chinese buyers are still signing up for long term LNG contracts from the US.

They have continued to follow a strategy of procuring low-cost LNG and have also not cancelled Russian contracts.

Along with South East Asian buyers, Chinese buyers have also been tempted by spot price discounts on Russian LNG supplies.

How long will European buyers be in the market?

European buyers have returned to the market in 2022 to sign new long-term contracts for US LNG.

And in March, the EU and US governments signed an accord calling for the supply of 50 billion cubic metres (bcm), or 35 mmtpa, of new US LNG supply into Europe by 2027.

However, European deals have been slower than anticipated. Western European buyers are looking for shorter-term deals that suit energy transition schedules. But shorter term is not good for US sellers, who need 15 to 20-year contracts starting from 2026 for financing purposes.