Sign up today to get the best of our expert insight in your inbox.

Distributed energy resources have yet to achieve the full value stack in PJM

One value stack layer does not exist yet and realising another layer will require greater ambition from customers and aggregators

7 minute read

Ben Hertz-Shargel

Global Head of Grid Edge

Ben Hertz-Shargel

Global Head of Grid Edge

Ben leads research across electrification and grid technologies, drawing on a decade of executive experience.

Latest articles by Ben

-

Opinion

eBook | Power surge: can US electricity supply meet rapidly rising demand?

-

Opinion

Large load tariffs: a looming challenge for utilities

-

Opinion

The new grid defection: breaking down the large load co-location fight at FERC

-

Opinion

Uncertainty dominates the 2025 US power outlook

-

Opinion

Uncertainty dominates the 2025 US power outlook

-

Opinion

US DOE shows that virtual power plants are very real

Wood Mackenzie’s DER Playbook Series offers clients the data and strategies they need to monetise distributed energy resources (DERs) and flexible demand within organised power markets. The following article draws from the first instalment of the series, which explores opportunities in PJM, the largest US power market.

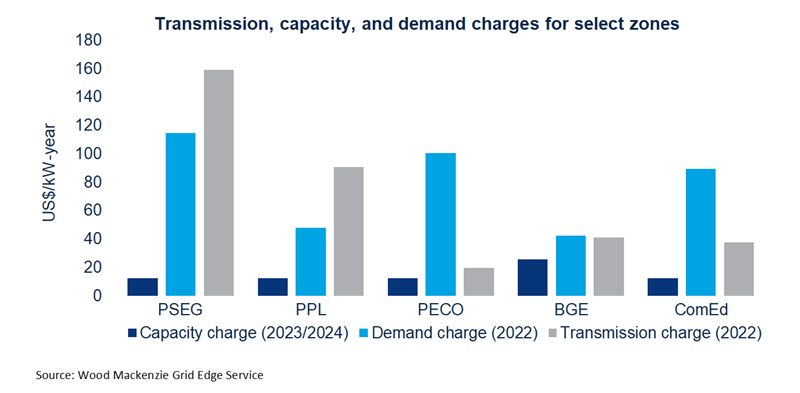

The value stack in PJM is missing a layer

The earnings potential of behind-the-meter (BTM) resources, which include DERs and flexible demand, are often characterised in terms of a value stack. Definitions of the stack vary but each layer is generally categorised as providing either customer, distribution or wholesale value. Customer value is primarily on-bill savings, achieved through capacity, transmission and demand charge management. In many PJM zones, transmission and demand charges have become far greater than capacity charges, reflecting the fact that PJM, like most RTOs, has become transmission and distribution constrained while saturated with generation.

There is no distribution layer to the value stack within PJM, in that there are no opportunities for BTM resources to be compensated for relieving congestion at the distribution system level. Utility demand response (DR) programs do exist, but the capacity they procure is bid by the utility into PJM’s system-wide capacity market, either as supply-side Capacity Performance or – in the case of three Exelon utilities – demand-side Price Responsive Demand.

For most participants, there are only two wholesale layers to the value stack

Emergency capacity is the foundational wholesale layer to the DER value stack. 98% of DR revenue in PJM is earned in the capacity market, a statistic that includes the participation of BTM assets such as generators and batteries. In PJM, as in all other ISOs and RTOs, legacy market rules force BTM resources to participate as DR, even if they have generation or storage characteristics.

The rules would change under PJM’s compliance proposal for FERC Order 2222, allowing DER aggregations to participate as more flexible, bi-directional resources, not restricted to offsetting site load.

Market rules enforce a tradeoff between DR capacity revenue and on-bill capacity charge savings. Every kW of reduction of a customer’s capacity tag – their average coincident peak demand, which determines their capacity charge – reduces the maximum size of their bid into the capacity market. Whether to pursue off-bill revenue or on-bill savings depends on a number of factors and is customer specific.

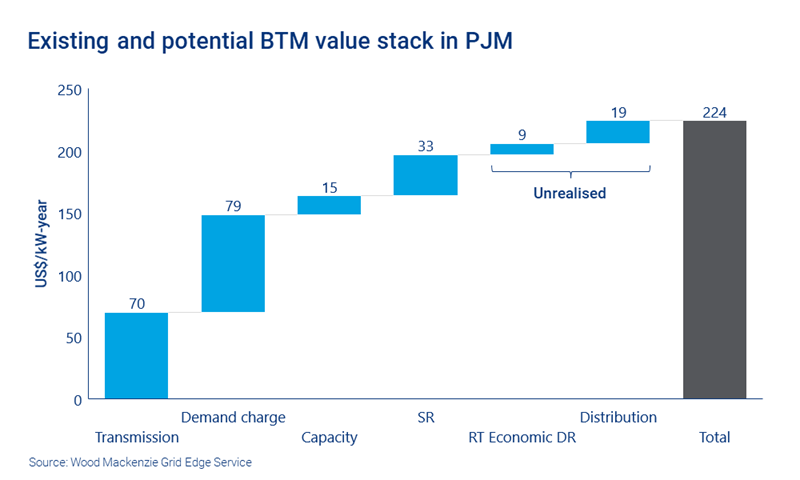

The second wholesale layer of the value stack, which is available to fast-responding resources only, is to provide Tier 2 Synchronized Reserves (SR). SR is the go to of commercial and industrial aggregators. It offers hourly capacity payments that amounted to US$33/kW-year in 2021 yet is typically dispatched under 20 times per year and, in each instance, for under 10 minutes.

However, the SR market is small – smaller than even the Frequency Regulation market – with under 500 MW of procured capacity available to DR resources each hour.

It is at this point that the value stack tops off for nearly all BTM resource owners – on-bill savings, capacity market participation (if forgoing capacity charge management) and SR (if fast responding).

Economic DR: the elusive energy value layer

The revenue component that is conspicuously missing from the list is energy. None of these value stack layers enables resources to profit when energy prices are high and, equivalently, to relieve the grid during conditions of stress that are short of a contingency. As Elliot Mainzer, the CEO of CAISO said recently on the Energy Gang podcast with respect to California, there is a need “to get the demand side, get the load flexibility out of emergency conditions – [to provide] much more sort of preemptive, flexible demand that can be a real reliability resource.”

Economic DR is the missing piece to the puzzle in PJM. It is the participation model that allows BTM resources to earn energy revenue. As long as the customer is not incentivised to reduce consumption based on their retail rate, every kW they reduce with respect to a baseline is compensated at the locational marginal price (LMP). The usefulness of Economic DR is to catch peaks: scarcity prices that rise above the opportunity cost of regular operations. The murky condition that the customer not be incentivised to reduce net load turns out to be more onerous for generator-based DR than curtailment-based DR. And it can disqualify generator owners from participating when grid conditions, rather than fuel prices, drive elevated energy prices.

Extremely few resources take advantage of Economic DR, leaving energy value on the table. This is largely due to the following hurdles:

- Mindset. The mindset of homeowners and companies who are not large buyers of power is that they’re not price sensitive. They’re rarely exposed to the price of power, so when the price is high, it seems complicated and inconvenient to curtail their consumption. Batteries may seem like the solution to this problem but there are virtually no BTM batteries in PJM due to a lack of state subsidies. That will likely change with the Inflation Reduction Act’s standalone storage ITC.

- Technical requirements. Economic DR participation in the day-ahead energy market is low effort but low reward at only US$1-2/kW-year. Catching peaks in the real-time energy market is more lucrative, at closer to US$9/kW-year – 72% of capacity revenue from PJM’s latest capacity auction. However, taking advantage of this market requires both predicting peaks well and following the market’s 5-minute dispatch – a high technical bar.

- SR tradeoff. Economic DR and SR cannot be provided during the same interval. Aggregators steer customers to SR since it offers a capacity payment during most hours.

Customer mindsets will change over time as electrification, the proliferation of DERs and general volatility in the power sector make opportunities for active participation unignorable. Technical requirements, moreover, will remain a hurdle for most customers going forward. On the other hand, the automation of flexible loads like EV chargers, heat pumps and energy storage (including hydrogen electrolysers) will enable portions of facilities to participate in real-time Economic DR.

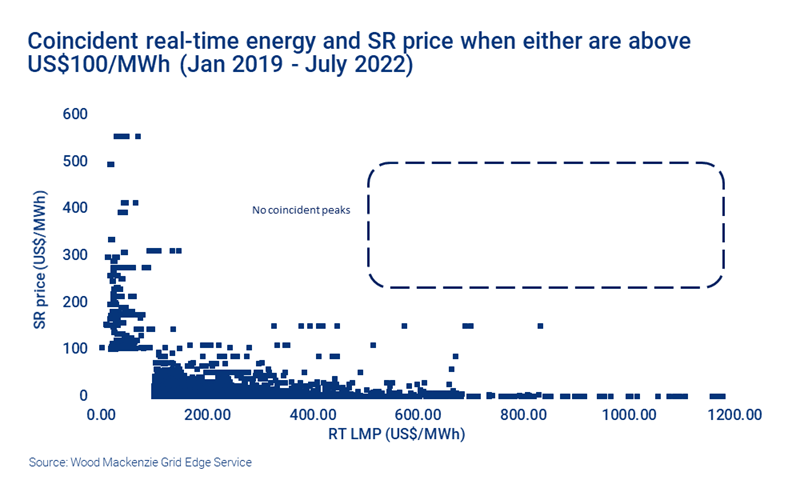

The last hurdle may not be a genuine obstacle either. A comparison of coincident real-time energy and SR prices reveals that they peak at different times across all PJM zones

Most of the value in RT Economic DR lies in the top 20 peak hours of the year. So, it is possible to catch those while still capturing SR revenue – including SR peak prices – during all other hours. In fact, there is a much more specific statistical relationship between RT energy and SR prices that could inform a bidding strategy for both markets.

Economic DR represents a specific opportunity for competitive energy suppliers, who lag pure-play aggregators when it comes to DR innovation. While the Economic DR rules are set up to disallow double dipping, nothing prevents a customer and competitive suppliers to double dip collectively.

The customer receives Economic DR revenue for curtailing while the supplier avoids procuring high-price energy in realtime. This strategy holds even if the supplier is well hedged because it frees up part of their hedge for another customer or to be liquidated in the market.

Completing the value stack

The magnitude of the transmission, demand charge and SR layers means that the bulk of the value stack is already on the table for BTM resources. Executing on those opportunities is challenging however.

Transmission and capacity charge management requires aggregators to successfully predict and prevent zonal and system-wide coincident peak demand; demand charge management requires site load forecasting and regular load shifting, for which BTM generators are not well-suited; and SR is a small market that will be available only for a small subset of resources.

Economic DR, by contrast, represents a market that will never saturate. And while utilities today do not procure distribution-level capacity, this will change once electrification, DERs and extreme weather stress the distribution systems to the point that utilities (or regulators) must take action. New York State, for example, which borders two PJM states, has mandated no less than five Distribution Level DR programmes for investor-owned utilities.

Using prices from the Commercial Supply Relief Program as a proxy for future distribution layer value in PJM, BTM resources should expect US$19/kW-year in annual revenue.

The two unrealised layers of the DER value stack would materially improve the economics of BTM resources. It is, therefore, in the best interest of customers and aggregators to work toward Economic DR participation today and advocate for distribution DR programmes when grid conditions in PJM warrant.

Subscribers to Wood Mackenzie’s Grid Edge Service can access the DER Playbook.