Our top five takeaway messages from the CCUS conference 2023

The CCUS landscape is evolving, and here’s a recap some of our biggest learnings from the event

3 minute read

Mhairidh Evans

VP, Global Head of CCUS Research

Mhairidh Evans

VP, Global Head of CCUS Research

Mhairidh leads our global research on carbon capture, utilisation and storage (CCUS).

Latest articles by Mhairidh

-

Opinion

Can CCUS help achieve Net Zero?

-

Opinion

Can CCUS momentum overcome headwinds to the industry?

-

Opinion

Carbon management frequently asked questions part 3: CCUS

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

-

Opinion

Our top five takeaway messages from the CCUS conference 2023

-

Opinion

The UK’s journey to net zero: an uncertain path ahead

Carbon capture, utilisation, and storage (CCUS) is gaining pace as a key energy transition technology. As companies and governments recognise its important role, our analysis shows CCUS emerging from a niche market towards a mainstream investment theme. Yet, achieving net zero ambitions at pace and with investible opportunities remains challenging.

Wood Mackenzie hosted its first dedicated CCUS conference on 11 October in Houston. 330 industry players from over 220 companies joined us to explore the key drivers and challenges of CCUS. Topics included the Inflation Reduction Act, CO2 sequestration at scale and the CCUS value chain.

What are the top five key takeaway messages from the event?

Read on to find out and fill in the form to get access to the slides we presented at the conference that focussed on the global CCUS landscape and why the US stands out.

1) A buoyant project pipeline is attracting attention from leading companies

We are tracking 1,400 million tons per annum (Mtpa) of proposed CCUS capacity development in different types of projects, globally. A third of this announced capacity is in the US alone. A confluence of supporting conditions in the US means that it is the most active market right now. Insights from project developers strongly shows they are re-allocating resources and building new project teams to capture the opportunity. Banks informed us that they are looking at ways to finance these new types of projects.

2) An urgent need to start building

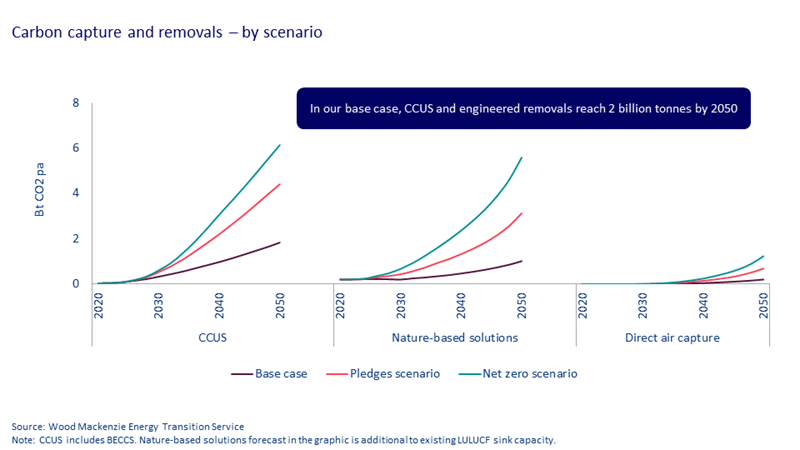

Our energy transition scenario modelling suggests that up to 700 Mtpa carbon capture and removal from CCUS and DAC is needed by 2030 to comply with global net zero goals. Less than 10% of that capacity exists today. A key theme discussed in panels at the conference was the need to move from plans and into execution.

Companies acknowledged that optimising project costs are front of mind before taking FID. We heard from technology and service providers that cost reductions are achievable, particularly through avoiding bespoke engineering where possible and adopting standardised, even modularised, approaches. Developers should be cautious about holding out for cost reductions for too long though as this would delay the build-out of critical infrastructure.

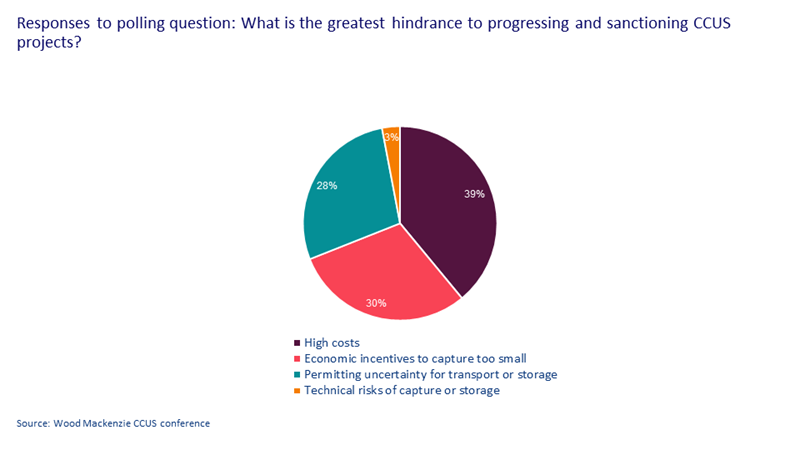

3) Permits pose challenges, technical risks not a hurdle for FID

While US policy has grown more supportive through the Inflation Reduction Act and Infrastructure and Jobs Act, the regulatory environment still has hurdles to overcome. Project developers spoke of frustrations over delays and lack of clarity in permitting for pipeline transportation and geological storage. The need for strong advocacy via community engagement and education came up several times, as did ongoing bids for primacy on Class VI well permitting in Louisiana and Texas.

4) Connecting the dots from capture to storage

With a complex value chain, involving multiple projects and owners, progressing CCUS developments will require new business models. We heard on the ground examples of this from companies who are coming together across capture, midstream transportation and storage provision. Projects looking to capture CO2 then utilise it for value-add products are less well advanced, both technically and commercially, though we see opportunity for those in the future.

Crucial to reaching FID is ensuring that each stage of a project is investible, which involves companies sharing risks and rewards in new ways. We heard how, on reflection, the business models and risk profiles for oil and gas exploration and production are quite different to that of those searching for and developing carbon storage sites. And the power of partnerships to make projects happen came through strongly too.

5) Nature based and engineered carbon removals matter

We concluded the conference with a structured debate between our research leaders on whether companies should prioritise nature-based or engineered solutions (such as DAC and BECCS) for carbon removals.

The case for nature-based solutions argued cost-effectiveness and co-benefits, while the case for engineered solutions argued scalability and permanence. A poll taken at the end of the debate suggested that our audience was evenly split, with a small majority voting to prioritise nature-based removal solutions (56%).

Our own models indicate that both are needed at scale, with nature-based solutions having the largest impact on carbon removals, and an equal impact on a CO2 volumes basis by 2050 as CCUS and DAC capture and removals combined.

Learn more

Fill in the form at the top of the page for access to the slide pack from our CCUS conference.

Explore more of our latest carbon-related insights here.