Green or blue? The colour of Australia’s hydrogen money

The race is on to dominate the low-carbon hydrogen industry

1 minute read

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

Latest articles by Prakash

-

The Edge

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Asia Pacific

-

Opinion

Energy transition outlook: Africa

-

The Edge

COP29 key takeaways

-

The Edge

Is it time for a global climate bank?

-

The Edge

Artificial intelligence and the future of energy

Australia has scored several firsts in the energy and natural resources world – among them, turning coal seam gas projects into an LNG value chain to become one of the largest LNG exporters globally, and setting up a huge stationary battery project in South Australia and pairing it with a wind farm. What’s more, it has well established credentials in running and developing complex, remote and automated mining projects.

But can Australia lead the way in the global green hydrogen race? We explored this topic in a panel session at our recent APAC Power & Renewables Conference. Read on for a brief introduction, and fill in the form to download the accompanying presentation slides.

The hydrogen race is well underway

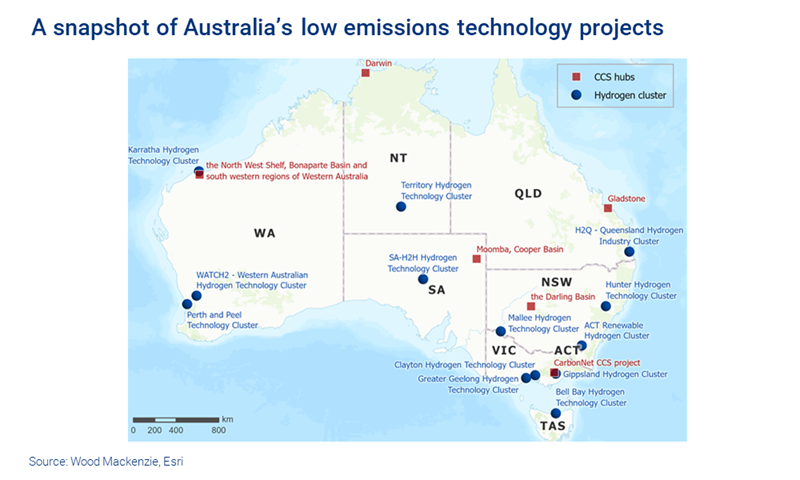

It’s no great surprise that Australia has turned its attention to developing green and blue hydrogen to reduce its CO2 emissions, with eventual plans to export to key demand regions, mostly Japan, South Korea and Europe. It has already begun to assemble its supply chain: we estimate that there are currently 13 hydrogen clusters and six carbon capture and storage (CCS) hubs currently in development across the country – primarily green hydrogen projects, but also blue.

Blue hydrogen is created from fossil sources, with the carbon emissions captured and stored. Green hydrogen is produced from non-fossil sources using electrolysis and renewable energy. Blue hydrogen is cheaper to produce, but green hydrogen is more appealing to governments reluctant to sustain hydrocarbon-related industries.

Green hydrogen manufacturing capacity, therefore, has been growing at an exponential rate. In Australia, we believe the green hydrogen pipeline has ballooned from less than 2 GW electrolyser capacity to 5 GW in just the last six months and counting.

Of course, this is still a mere fraction of the near 1,000 GW electrolyser capacity needed globally by 2050 to meet our global demand forecasts, but we expect growth to continue at a brisk pace.

Blue in the short term, green down the line

Australia’s well-publicised drive for hydrogen supremacy has garnered a lot of attention – not only in terms of whether green hydrogen will triumph over blue, but also how quickly the country will be able to scale up its green hydrogen projects and bring them to market. Wood Mackenzie believes that blue hydrogen will grab market share for the next 10-15 years, as it is 2-3 times cheaper than green hydrogen today, but that green hydrogen will dominate long term.

As Attilio Pigneri, Chief Executive of H2U – The Hydrogen Utility, commented in our panel discussion: “There is a window of opportunity for blue projects with the right conditions, in terms of the right size, the right location, carbon capture and storage option, to come into the market.” His company is building two green hydrogen/ammonia facilities in Australia. At some point, however, he added, there is likely to be “less development risk, a much quicker turnaround for capital” for green hydrogen.

“That doesn't mean that there won't be very important blue projects around the world, and it doesn't mean that blue projects won't play a role in this transition,” Dr. Pigneri added. “But at the end of the day, the market dynamics are pretty clear.”

Wood Mackenzie also believes hydrogen costings – particularly those for green hydrogen – will have to fall quite a bit in the longer term to stimulate demand, to around US$2/kg or lower on a delivered basis versus US$7 now. In around a decade, green hydrogen is likely to cost around the same as blue hydrogen to produce. The key is to overcome the logistics and carrier options that will allow competitive transportation of hydrogen on the seaborne market.

“Price is important to get the hydrogen industry going in a tradable fashion,” Jeremy Stone, a non-executive director of the Australian subsidiary of leading Japanese utility J-POWER, said at our conference. His firm is currently involved in building a blue hydrogen supply chain in the Australian state of Victoria. “I think blue hydrogen is certainly the way to go because of the price point, but it does build up infrastructure, valuable infrastructure, which can be built by renewable hydrogen. So, pipelines, liquefaction or ammonia shipping skillsets. I think it's a pathway.”

Build it and they will come

The hydrogen industry is very much nascent, with a need to develop firm offtake agreements, carbon pricing and cost-effective transportation. While the carbon price is likely to come down with the decline in hydrogen costs, it remains to be seen what type of offtake agreements will dominate – pure liquid hydrogen, liquid hydrogen organic carriers or ammonia/methanol.

“I think every single hydrogen project has the same challenge now,” Mr. Stone said. “There are lots of ways to produce hydrogen or ammonia, and there's lots of potential, but I think most of us lack locked-in offtake agreements, and I think we're probably some time off before doing that. We've still got a few years in front of us to try and join the pieces together.”

“I think it is worth being flexible and open minded about how the market can develop,” Dr. Pigneri added. “At the end of the day, we need to do two things: we need to develop the hydrogen down to those price points that are required for the market to be activated, but also, we need to make sure that we design the value chain.”

Either way, for Australia, the seaborne route will be key when it comes to transportation, though it will take time to build a comprehensive network. Here, J-POWER has been a pioneer, building an export terminal for its Australian liquid hydrogen and an import terminal to receive it in Kobe, Japan.

“The world's first liquid hydrogen carrier should be arriving in our waters at the end of this year, early next year,” said Mr. Stone. “That would be at the pilot scale. Full commercial scale, we're looking towards the end of this decade, so a 2030 sort of timeframe.”

For a complimentary selection of slides from this panel discussion at the Wood Mackenzie APAC Power and Renewables Conference, fill in the form at the top of the page. The pack includes charts on:

- Green hydrogen projects in Australia

- Hydrogen economics case study

- A lifetime opportunity to harness renewable energy