How are global NOCs tackling the energy transition?

National oil companies lag the Majors on the decarbonisation journey – but are under growing pressure to pick up the pace

1 minute read

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael focuses on Latin America and its national oil companies as a senior analyst on our Corporate Research team.

Latest articles by Raphael

-

Opinion

What does Milei mean for oil and gas in Argentina?

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

Unwrapping key players in Colombia's upstream sector

-

Opinion

Are NOCs rising to the energy transition challenge?

-

Opinion

How are global NOCs tackling the energy transition?

Despite their scale, national oil companies (NOCs) have until now largely escaped the heavy scrutiny experienced by international oil companies (IOCs) around emissions. Partly as a consequence, the energy transition strategies of most NOCs significantly lag those of their leading IOC peers. But in light of high prices and rising intergovernmental pressure, state-owned companies have a golden opportunity to change tack and help to drive the energy transition forward.

Our report National Oil Companies: strategies for the energy transition provides our analysis of the decarbonisation and diversification strategies of NOCs globally. Fill in the form to access a complimentary extract, or read on for an introduction.

Why are NOCs so critical to the energy transition?

Put simply, NOCs account for more than half of global oil and gas output, making them among the biggest global emitters of greenhouse gases. The 18 key NOCs covered in our report will produce 60 million barrels of oil equivalent per day (boe/d) in 2022; that compares to only 23 million boe/d for the Majors.

As a result, NOCs will be responsible for half of forecast upstream direct (Scope 1 and 2) emissions between now and 2030. What’s more, that figure is expected to rise in future as NOCs exploit their high levels of remaining resource and available capital to seek significant production growth.

How much are NOCs doing about emissions reduction?

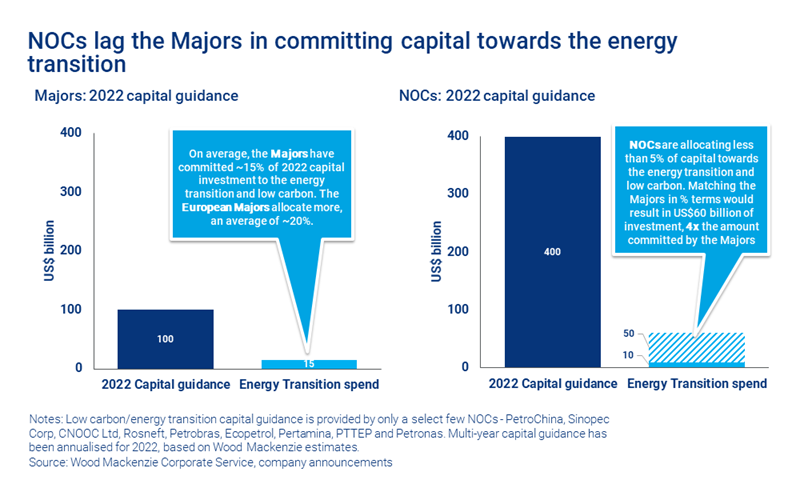

Despite the scale of their emissions, most NOCs are doing far less than their IOC peers to address the issue. NOCs have provided guidance that indicates that they will spend four times the amount of capital that the Majors will spend in 2022. Out of this capital forecast, NOCs are currently committing less than 5% of capital to decarbonisation. In comparison, the Majors have allocated around 15% of 2022 capital investment to low-carbon projects, driven by regulatory, investor and public pressure. (The European Majors allocate more, at an average of around 20%).

As intergovernmental pressure increases, NOCs will be pushed to follow the example set by the Majors. However, expect the pace of change to be slower, at least in the short term. With emissions reduction targets still mostly dictated by government and country-level climate goals, many NOCs have yet to make a net zero commitment.

What strategies can NOCs take as they face the energy transition?

Some NOCs could double down on their current approach. Middle East and Russian NOCs in particular have access to vast volumes of low-carbon oil and gas reserves, which could limit their exposure to future carbon costs. The largest resource holders currently continue to target production growth of 2-3% over the next decade. Those taking this approach set targets for emissions intensity, but not for absolute reduction, and decarbonisation or renewable projects remain at the planning stage.

Other NOCs are harnessing their existing resource base to fuel a low-carbon transition. Some are targeting an increasing role for gas to support national decarbonisation goals, and allocating capital to, for example, carbon capture and storage (CCS) at the planning or pilot stage.

Finally, a few are taking the first steps to diversify into renewables and alternative energy projects that align with their existing portfolio strengths and corporate capabilities. NOCs with limited reserves who face a shorter remaining lifespan for their resources have a greater incentive to take this approach.

We are seeing NOCs targeting a range of low carbon opportunities, from electrification to CCS, biofuels, hydrogen and ammonia. For an overview of NOC moves in this direction, fill in the form to download the report extract.

Will NOCs accelerate their energy transition strategies?

Current high prices mean NOCs are set to generate a cash flow windfall of around US$110 billion per year over the next five years. That will provide financial flexibility, and with it a golden opportunity to switch gears.

Sustained higher prices would allow NOCs to raise dividends and help service post-pandemic national debt at the same time as allocating capital to both upstream investment and low-carbon opportunities. If NOCs matched the Majors’ capital allocation to the energy transition the effects could be dramatic.

Find out more about the NOCs strategic response to the energy transition

The full report includes benchmarking of current strategies as well as three case studies on potential energy transition playbooks for NOCs. Fill in the form at the top of the page for a complimentary extract.