The Majors’ accelerating tilt to new energy

When will spend on low carbon catch up with oil and gas?

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

Big Oil is determined to show it’s part of the solution for climate change. That much is clear from the rapid acceleration of investment in new energy. I asked Tom Ellacott and Greig Aitken of our Corporate Research team how they see the Majors’ strategic positioning evolving.

How much has spend ramped up?

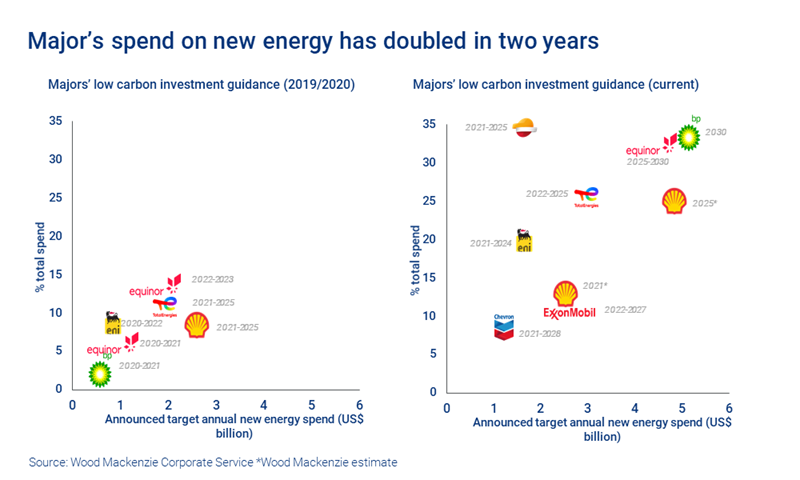

It’s doubled since 2019/20. Two years ago, the Euro Majors were planning to spend an average of US$2 billion a year on new energy, 10% of total investment. An intense period of business development has strengthened the opportunity set. Budgets for all of the Majors are now aimed at an average of US$4 billion a year, almost 25% of total investment – though timescales vary across the group. Repsol’s target of 35% out to 2025 is the most aggressive.

Another big change from two years ago is that the US Majors have entered the fray, as we predicted. We expect Chevron and ExxonMobil to follow the upward trend. Their plan to allocate 10% of spend to low-carbon opportunities is only an opening salvo.

What are the Majors investing in?

Mostly renewables, the immediate growth opportunity as the world electrifies. Solar, onshore wind and offshore wind are among the few low-carbon technologies that are commercial and scalable, and diversifying Majors can build the exposure they seek. TotalEnergies is aiming for a 10-fold increase in capacity to around 50 GW net by 2030, as is BP; both could be in the top five renewables players by then. Utilities’ renewables targets (Enel 120 GW and Iberdrola 95 GW) perhaps indicate where Big Oil will eventually go as it morphs into Big Energy.

Geographical diversification is an increasingly important theme for the Majors in renewables. We’re likely to see renewables portfolios expand to an international footprint much like E&P. Equinor’s 15 GW of projects are held across 14 countries (including holdings via affiliates), ditto BP (15 countries) and TotalEnergies (17 countries). Intensifying competition is forcing companies to look further afield to capture new opportunities. TotalEnergies has set up a network of 50 ‘renewables explorers’ across 50 legacy countries.

With increasing renewables investment, Big Oil is morphing into Big Energy

The other big focus for spend is developing the customer base. Shell and BP plan to spend more than 10% of their total five-year budget on marketing and retail. Customers will be a key part of their integrated, full value chain approach to low carbon: from producing electrons through to providing energy solutions for the industrial, commercial and retail segments. Energy trading will play a critical part in boosting margins through the value chain. The customer proposition will embrace multiple services, including EV charging, energy efficiency and distributed energy resource management.

Where do CCS and hydrogen fit?

All of the Majors want a piece of these emerging technologies that will undoubtedly play a big role in the world achieving net zero. Investment is still modest, but budgets for both are going to get a lot bigger as they move towards commercialisation and are scaled up.

Project pipelines are already growing exponentially. The Majors’ CCS pipeline has doubled in six months, with ExxonMobil having more than twice the gross project capacity of the others.

Hydrogen project pipelines, too, are in their infancy but growing rapidly. The Majors’ existing production of hydrogen at refineries gives them an early advantage in the market. All see blue (linked to CCS) and green hydrogen as a huge growth opportunity. Equinor (5 mmtpa, gross capacity), Shell (3 mmtpa) and BP (2 mmtpa) are the early leaders.

The Majors’ CCS and hydrogen pipelines are growing as they see huge growth opportunity.

Do the returns in new energy justify the pivot?

It’s not clear cut. Renewables projects on their own deliver mid-single-digit returns and vie for capital with upstream projects, many of which deliver superior IRRs at current prices. Risk adjusted, though, the gap with upstream is narrower, and integration also boosts the overall returns from renewables.

The bigger picture is that the increase in capital allocation to renewables is strategic. The Majors are on a mission to reshape and futureproof the business. The commitment to new energy and low carbon is a long-term bet on an irreversible shift in the energy mix. And they need to do it now to stay investible.

How big can investment in new energy get?

Oil and gas will continue to dominate earnings and cash flow for years to come. We estimate that even for Equinor, which has the most aggressive growth strategy, new energy will contribute only 15% of operating cash flow in 2030 based on today’s commercial assets. Of course, as companies add to their portfolios, the contribution will get bigger.

The tilt of investment in favour of low-carbon energy technologies is only going one way, and now they are on board, the US Majors are going to catch up. We think investment for the group will double again in the next five years.

As the Majors push towards their net zero goals, we reckon the peer group leaders’ spend on new energy versus oil and gas will get close to 50:50 by 2030.