India in crisis

Covid-19 cases surge as the threat of lockdown looms

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

Can emissions taxes decarbonise the LNG industry?

-

The Edge

Can carbon offsets deliver for oil and gas companies?

-

The Edge

Re-thinking energy transition supply chains

-

The Edge

Diverging views on the role of gas in the energy transition

-

The Edge

COP28 preview: five things to look for

-

The Edge

WoodMac’s Gas, LNG & Future of Energy conference – five key takeaways

India’s Covid-19 crisis shows no sign of slowing. The country has reported new cases above 300,000 per day for two weeks straight, though experts think the true number is likely to be far higher. Yet despite increasing calls for the government to impose a nationwide lockdown to reduce the rate of infection, Prime Minister Narendra Modi has so far resisted, citing the economic impact on an already suffering population.

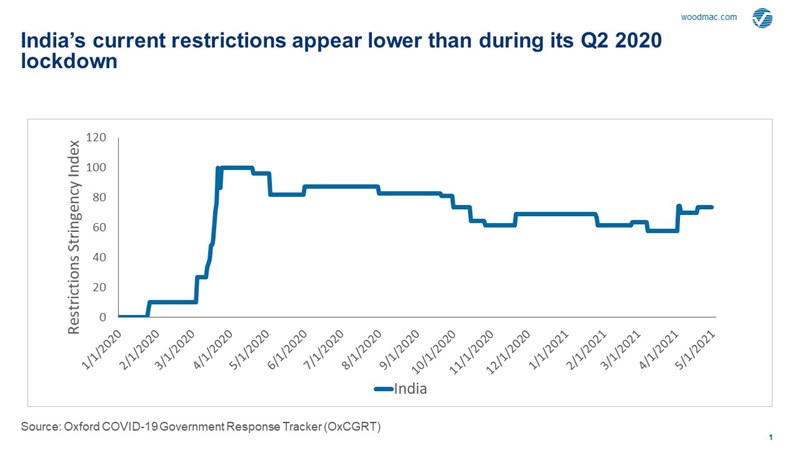

Compounding this terrible human tragedy, the crisis is also impacting India’s near-term economic performance as travel is curtailed and local restrictions enforced. This is inevitably impacting the country’s energy markets, with all sectors being impacted. However, without a nationwide lockdown along the lines of that seen in Q2 2020, energy demand has so far proven relatively resilient, despite the more severe levels of infection compared to 12 months ago.

Given the scale of the crisis facing India and the potential for a further nationwide lockdown, I turned to our experts to hear how they are assessing the impact across the economy and energy sectors.

Economic downside if lockdown is introduced

India’s second peak of Covid-19 cases has led us to trim the country’s GDP forecast to 9% year-on-year in 2021, from 9.9% previously. But there is further downside risk if lockdown measures and restrictions on movement are tightened further. And while current localised restrictions appear inadequate in comparison to the severity of the pandemic, tighter restrictions come with expectations of additional financial support from the government; India’s stimulus measures have been modest since the start of the pandemic, totalling 9% of GDP. If a nationwide lockdown is enforced, the government will need to provide much more.

With the domestic economy gripped by the pandemic and the looming risk of a nationwide lockdown, external demand and export-orientated industries are now critical to the economic recovery in the short term.

Peter Martin, Head of Economics

Oil demand remains resilient, though risks are rising

During last year’s lockdown, India’s oil demand fell by 1.2 million b/d year-on-year in Q2, equal to about a 25% drop. Road traffic was particularly impacted, recording a peak decline of some 45% during April 2020. We’ve not seen anything this severe yet in the current crisis. And while many states and territories have implemented restrictions in movement, without a full nationwide lockdown, we expect the impact on oil demand to be more modest: road traffic oil demand in April 2021 is estimated to be down by about 20-25%.

Ironically, it is the scale of the current crisis that is offering some support to oil demand. Responding to such large numbers of infections is resulting in a significant increase in personal mobility and transportation of medical equipment and supplies. Meanwhile, under current restrictions much of India’s economic activity is still permitted, particularly within the industrial sector.

This will encourage a recovery in mobility, particularly aviation as domestic flight numbers follow last year’s pattern of resumption. As such, we expect demand losses to be concentrated in Q2 at around 200,000 b/d, with gasoline, diesel and jet fuel combined accounting for most of this contraction.

Of course, there are significant downside risks to this view, particularly if the duration and extent of the crisis increases. If lockdown is extended for the entire month of May in those states with the most severe current restrictions, then we could see loss of oil demand for Q2 2021 in the range of 300,000 b/d to 500,000 b/d. Should a nationwide lockdown be imposed then losses will inevitably increase further.

Qiaoling Chen, Senior Analyst, APAC Oils & Refining Research

You might be interested in: India’s 21-day lockdown – Impact on commodities?

India’s natural gas market staying strong, but challenges emerging for LNG importers

While current restrictions have had an impact on natural gas demand across transport and small- to mid-sized industries, India’s major gas consumers have remained resilient through the crisis. With India’s exporters outperforming, bulk industrial gas demand in particular remains strong, consuming much of India’s excess gas supply.

That said, the power sector is facing challenges with spot LNG at around US$7-8/mmbtu (DES), incentivising coal into the system over gas. During the same period in 2020, LNG DES prices had fallen to around US$2-3/mmbtu, allowing gas to outperform less efficient coal plants in western India on an economic basis.

With higher LNG prices, the crisis is having a far greater impact on India’s LNG importers despite lesser restrictions compared to 2020. With excess contracted gas already in the network, domestic gas from the ongoing ramp-up in production by Reliance-BP is being prioritised by the end-users over LNG due to favourable pricing. Infrastructure bottlenecks also mean LNG buyers in India are finding it difficult to store their gas.

Given the impact of the crisis, we are now expecting India’s gas market to grow by around 5% in 2021, noticeably slower than the 8.7% recovery anticipated before the ongoing increase in infections.

Vidhur Singhal, Senior Analyst, APAC Gas & LNG Research

Thermal coal off to a flying start in 2021, but crisis beginning to bite

Despite state level restrictions, coal-fired generation in April not only grew by a whopping 59% compared to the same month last year but was even 7% higher than April 2019. However, this is only part of the story: coal-fired generation in April declined by 6% compared to March and coal generation is further expected to decline in May as more state levels restrictions are implemented. And although manufacturing sectors are exempted from most restrictions, overall power demand is being subdued by the crisis.

Thermal coal demand in non-power sectors is also being squeezed through Q2, with sponge iron and cement producers reducing capacity utilisation by about 30% from normal levels. But downside in thermal coal demand will not be as severe as Q2 2020’s 26% year-on-year decline, with demand sliding by a more modest 10% in Q2 2021 compared to pre-pandemic 2019. A downside of about 5 Mt thermal coal imports in Q2 is expected in current circumstances.

Sandeep Kalia, Principal Analyst, India Bulk Commodities

Very best wishes to all our clients, colleagues, friends and families in India.

APAC Energy Buzz is a weekly blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.