与我们分析师联系

The potential and opportunities in Guangdong LNG market

Guangdong is China’s largest gas-consuming province and LNG importer. And there’s still considerable room for growth. We use the newly developed China Regional Gas Model to study its gas market balance and LNG potential.

3 minute read

Kai Dong

Principal Consultant, APAC Gas & LNG Research

Kai Dong

Principal Consultant, APAC Gas & LNG Research

Kai focuses on China's gas market, covering market fundamentals, gas supply/demand balance and regional market analysis

Latest articles by Kai

-

Opinion

How Asia will drive global gas and LNG investment to 2050

-

Opinion

Video | Lens Gas & LNG: Exploring key trends in Asia Pacific’s gas and LNG market

-

Opinion

Asia Pacific gas & LNG: 5 things to look for in 2025

-

Opinion

Gas & LNG in Asia: the next 10 years

-

Opinion

The potential and opportunities in Guangdong LNG market

-

Opinion

China’s zonal gas transmission tariff: changes and implications

Ixchel Castro

Vice President, Head of Gas & LNG Markets

Ixchel Castro

Vice President, Head of Gas & LNG Markets

Ixchel leads our research on downstream markets in North and Latin America.

Latest articles by Ixchel

View Ixchel Castro's full profileMassimo Di Odoardo

Vice President, Gas and LNG Research

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo brings extensive knowledge of the entire gas industry value chain to his role leading gas and LNG consulting.

Latest articles by Massimo

-

Opinion

Dynamics shaping the European natural gas market

-

Opinion

Dynamics shaping the European natural gas market

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Gas, LNG & The Future of Energy: investment momentum builds in a volatile market

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Upside pressure mounts on US gas prices

Miaoru Huang

Research Director, Asia Pacific Gas and LNG

Miaoru Huang

Research Director, Asia Pacific Gas and LNG

Miaoru leads our Northeast Asia gas research.

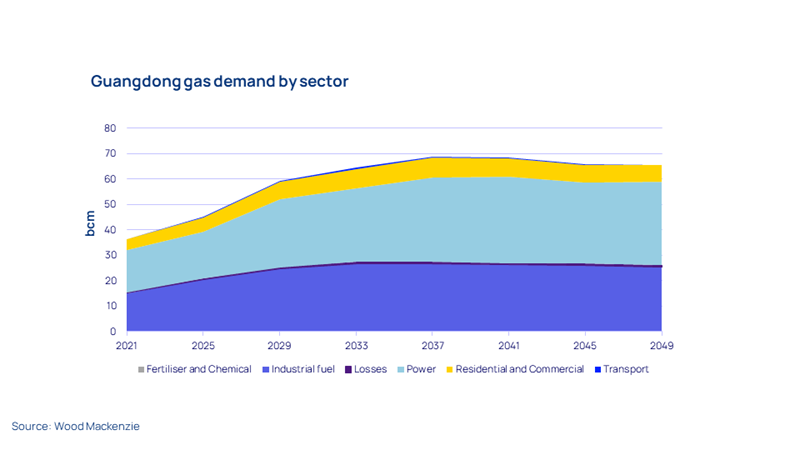

View Miaoru Huang's full profileGas plays an important part in Guangdong’s goal to achieve carbon peak by acting as a transitional fuel. The province is China’s largest gas-consumer and LNG importer with 39 billion cubic metres (bcm) and 21 million tonnes (Mt) coming into the province in 2023. As the leading economy of all China’s provinces, the potential of its gas demand is considerable.

Much of this is owing to the gas demand growth in industrial and power sectors. The provincial policies also support gas industry expansion by encouraging supply source diversifications, consumption expansion, pipeline penetration and tariff reductions. All of which favour every player in the gas market.

The following extract is from our Guangdong LNG potential and opportunities report. You can purchase this report here.

Planning for growth

Driven by expanding infrastructure and energy demands, Guangdong's LNG market is set for significant growth. With an extensive intra-provincial pipeline network now covering all 21 cities, the province's gas demand is set to rise.

The network is operated by PipeChina Guangdong Company and ensures equal access for all market players. As they shift towards higher value-added manufacturing and household incomes increase, the province is better positioned to absorb potential price hikes through cost pass-through mechanisms.

Investment in expanding regasification capacity, offshore pipelines and LNG output connections, will be crucial for meeting the growing demand and maintaining supply stability in the future.

Gas demand driver

Guangdong’s gas demand will jump from 39 bcm in 2023 to 62 bcm in 2030. Economic growth, new grid connections and power demand growth drive this 6.9% year-on-year increase. The power and industrial sectors account for more than 85% of total gas demand throughout the forecast and are also the main growth drivers.

Industrial gas demand will grow at an average annual rate of 5.7% until 2031 when it is projected to peak. This growth reflects the province's strong industrial base and the increasing need for reliable energy sources to support manufacturing and other energy-intensive activities.

Gas power is another significant driver of Guangdong's LNG demand, playing a critical role in ensuring the resilience and flexibility of the province's power system. Although Guangdong aims to grow its offshore wind and solar energy, the intermittency of these renewable sources requires a substantial increase in gas-fired power capacity. The province's gas power capacity was 38.7 GW in 2023 but is expected to reach over 80 GW by the late 2030s.

The size of LNG opportunity

With a relatively stabliised pipeline flow from neighbouring provinces and the offshore production supplying Guangdong to decline from mid-2030s, continued reliance on LNG for meeting this demand is projected to rise from 64% to 80% by 2050. LNG volumes are expected to double from 20 mmtpa to 40 mmtpa by the late 2030s, stabilising around this level through 2050, signalling a 20 mt demand growth potential.

NOCs are building their own regas terminals to take advantage of this opportunity. However, their combined regas capacity, plus PipeChina’s regas capacity, can only fulfil 22 out of the 40 mmtpa demand. The rest 18 mmtpa LNG from provincial energy companies and IOCs is needed to fill the demand gap. Even with potential new supply sources from Power of Siberia 2 and Central Asia Line D pipelines to China, this LNG demand opportunity to Guangdong will not change too much.

The time window for new LNG contracts with provincial energy companies is in the next decade when Central Asia gas delivered to Guangdong is expected to be more expensive than spot LNG.

Access to opportunities

IOCs and LNG sellers have numerous opportunities to contract LNG with provincial energy companies in Guangdong. By leveraging the open access to regasification terminals and provincial pipelines, IOCs can also expand their presence in city gas markets.

NOCs, on the other hand, can not only grow their user bases but also use their gas and LNG portfolios and regas terminals for seasonal arbitrage and swaps.

For provincial energy companies, the current landscape of rising Central Asian gas prices and decreasing LNG prices presents a timely opportunity to secure new LNG contracts and gaining competitiveness over others.

Private companies must focus on solidifying their user bases to survive the growing competition.

China’s Regional Gas Model delivers granular insight into the country’s LNG-importing provinces. It simulates the pipeline gas and LNG flows to each region using least cost linear programming techniques. A brief introduction to the model is available along with the full report here.