Powering down: lithium battery supply exceeds demand

With ongoing oversupply issues, the battery market is in flux. As lithium-ion production continues to grow around the world, can demand keep up?

4 minute read

Jiayue Zheng

Senior Research Analyst, Energy Storage Supply Chain

Jiayue Zheng

Senior Research Analyst, Energy Storage Supply Chain

Jiayue is a consultant in Wood Mackenzie’s Power and Renewables team, focusing on the energy storage supply chain.

Latest articles by Jiayue

-

Opinion

China’s solar & storage exports achieve record growth with more than 40% surge

-

Opinion

Powering down: lithium battery supply exceeds demand

-

Opinion

Energy storage technology: three trends to watch

Demand is growing for lithium-ion batteries to serve electric vehicles and stationary energy storage systems. However, thanks to aggressive manufacturing expansion in recent years, the global battery supply is expected to outstrip this demand for some years to come. Supply will grow by 45% in 2023 alone, amounting to an excess of 1,380 GWh, and while demand will also increase somewhat, the oversupply issue is expected to persist.

This has had a predictable impact on value: raw material prices have been slashed. The spot price of lithium carbonate, for example, dropped by around 50% during the first half of 2023. This unsettling volatility seems to be fostering a wait-and-see sentiment in the market.

Based on data from over 500 battery manufacturing facilities, our research looks at the global supply forecast from 2023 to 2032. Fill in the form on the right to download an extract from our 'Global lithium-ion battery supply and demand update H1 2023', which explores key manufacturing capacity trends through the supply chain and our predictions for battery components, including cells, cathodes, electrolytes and separators, as well as the capacity investment dynamics of global battery manufacturers by region, in the first quarter of 2023.

Read on for a summary of just a few of the report's key points.

A growing but slowing market

Regional market demand, government subsidies and restriction and unit capital cost are crucial to capacity investment, and all of these factors are currently impacting the industry. Global battery manufacturers pulled back significantly in the first half of 2023, with construction falling by around 50%. Although our research suggests demand will grow (reaching an estimated 1,080 GWh this year), the gap is set to widen in the coming years.

Our base case scenario suggests that supply will be sufficient to meet demand in 2032, however in our highest supply scenario, it could outstrip demand by 66%. Should all projects move ahead, oversupply could exceed 2,400 GWh by 2032. Even today, China’s supply gap stands at 558 GWh. As supply consistently keeps pace with, or exceeds demand over the next decade, investment cancellations seem likely. We expect demand for batteries to more than double by 2032, with electric vehicles taking an even larger share of the market than they do today – 84%, compared to 79%.

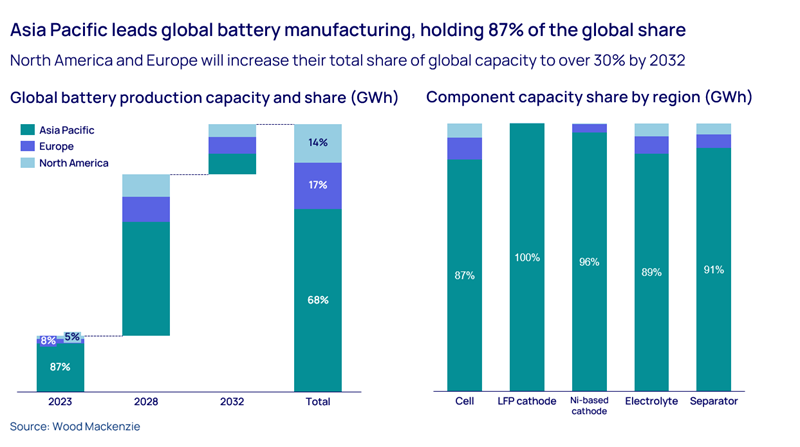

Eastern regions still dominate

Asia Pacific leads the world in battery manufacturing, holding about 87% of all key components, and the region is making determined strides in the global market. China’s lithium ion battery export revenue is particularly strong – up 80% year-on-year in the first quarter of 2023 – and the country will continue to control the supply chain for the next decade, maintaining more than 80% of LFP cathodes, electrolytes and separators to 2032 and beyond.

We are beginning to see changes, however. Localisation policies in the US are starting to make a dent on Asia’s dominance in some areas, and will cause China and South Korea’s share of Ni-based cathode production capacity to fall to 53% and 14% by 2032, respectively.

The US and Europe encroach

North America is accelerating local capacity under the Inflation Reduction Act, catching up with China as it curbs local investment. The US announced a capacity of over 350 GWh in the first half of 2023, almost equal to the whole of last year’s capacity. Remarkably, over 50% of the investment are from joint ventures in which Chinese and South Korean manufacturers participate. It’s clear that North America and Europe will pose a credible challenge to Asia Pacific in the coming years, as they boost their combined share of global battery production capacity to over 30% by 2032.

ESS and lithium lead the charge

Production of Stationary Energy Storage System (ESS) – batteries often used for renewable energy – is also set to increase. Capacity will exceed 700 GWh by 2032, sufficient to meet all ESS demand, and once again China will overwhelmingly take the market share, accounting for 89% of capacity. Solar manufacturers in China are actively developing storage businesses and investing in battery production and system integration. Chinese manufacturers have launched 300 Ah-320 Ah prismatic battery cells for grid-scale storage and having signed a long-term agreement of over 100 GWh in H1, especially with overseas clients, their dominance in this market looks secure for some time.

The market share of lithium iron phosphate (LFP) batteries which are preferred in China ESS market is supercharged, reaching 28% in 2023, and expected to surpass nickel-based batteries in 2030. Production of non-lithium-ion batteries is also scaling up, yet they will not exceed 3% of the market by 2032.

Learn more

To learn more about the battery market’s supply and demand trends, fill out the form at the top of the page to download a free extract from our 'Global lithium-ion battery supply and demand update H1 2023' report.

When you download the report extract, you’ll also get access to our charts tracking key metrics such as capacity investment by region and global battery market share rankings by shipment.