Stellar growth for global energy storage

Demand for energy storage will expand nearly nine-fold over the next decade, supported by the rise of renewables

1 minute read

The global energy storage market continues to grow at a staggering pace. The increasing acceptance of energy storage as a mainstream power technology and the growing focus on net zero targets have driven the burgeoning industry’s stellar growth.

Despite risks from the pandemic and headwinds from higher commodity costs, global demand in 2022 is expected to double year-on-year. The strong growth trajectory is set to continue over the next decade, when the market will expand by as much as nine times the current demand volume.

The drop in battery pack costs and the increasing adoption of renewables will continue to support the need for flexible storage resources.

Drawing insight from our Energy Storage Service, Wood Mackenzie’s latest Global energy storage outlook has all the key facts and figures about top trends over the next decade, providing insight into market drivers, policy and regulation for top global markets. Complete the form to receive a complimentary extract and read on for some highlights.

China and the US set the pace for energy storage growth; upside opportunity in emerging markets

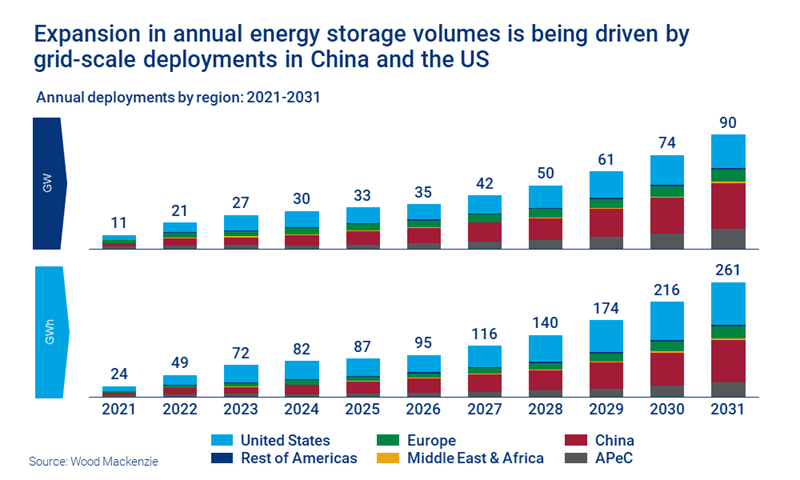

Robust market growth delivers 460 GW/1292 GWh of new deployments over the next 10 years. China and the US will set the pace. Together, they represent 75% of total demand for the outlook period, with grid-scale growth in these countries driving the bulk of the volume.

The global market is highly consolidated, with over 90% of total demand driven by only 10 countries. If supportive policies emerge in smaller markets, there is major upside potential for expansion.

The rest of the Americas lag behind the US in energy storage additions

The US market is forecast to expand as much as seven times to reach 26 GW, or 103 GWh, by 2031. That equates to a 627% increase in gigawatt capacity.

Although home to only 30% of the entire population of the Americas, the US takes pole position, and will add 93% of the total capacity in the region for the next decade.

Where the US benefits from state-level storage targets and the inclusion of storage in regional planning and integrated resource plans, volumes in other areas have been limited by a lack of power market access and fewer national incentives.

However, the US demand case is still dependent on the renewal of the Investment Tax Credit. We expect steady growth, despite 2021 project delays as a result of supply chain pressures and rising capex costs.

Europe’s rapid growth in energy storage capacity boosted by drive to drop Russian gas

Europe has set some of the world’s most ambitious decarbonisation targets, such as the European Commission’s RePowerEU plan to cut dependency on Russian gas before 2030.

The continent is set to double its share of variable renewables in power generation, which will increase intermittency. The demand for energy storage assets and other flexible power solutions will increase in order to accommodate higher renewables penetration, and, as a result, total energy storage capacity will increase 14-fold to reach 67 GW/147 GWh by 2031.

“Renewables are a cheap, clean, and potentially endless source of energy and instead of funding the fossil fuel industry elsewhere, they create jobs here. Putin's war in Ukraine demonstrates the urgency of accelerating our clean energy transition.”

Frans Timmermans, Executive Vice-President for the European Green Deal

The pace of growth varies considerably across European markets. An over 300% increase in power prices in the last two years in the UK, Europe’s market leader, has boosted the business case for storage. Increased revenue stacking opportunities will also drive further investment in the UK’s grid scale energy storage segment. Meanwhile, Germany’s 100% renewable power by 2035 target – driven by its ‘traffic light’ coalition – will mean that the country remains the residential storage market leader, as rooftop solar becomes mandatory for all new commercial and private buildings.

Gain further insights on major European markets including France, Italy and Ireland in the full report. Fill in the form for a complimentary extract.

China supported by government policies; economic incentives remain low

China’s growth will be driven primarily by government policy support, as well as the decreasing cost of batteries.

In order to boost grid-scale demand, solar and wind developers are obligated to invest in one to two hours of storage capacity, equivalent to between five and 20% of the renewable generation capacity of the project. In addition, ancillary service regulations in 16 provinces and regions enable the participation of energy storage.

Chinese state-owned generators are the leading investors in storage capacity and have established high levels of market share in the grid-scale segment. However, storage projects still have a profitability problem, which threatens sustainable development. Selling power at on-grid regulated prices does not bring additional value for storage. Instead, it only creates additional costs for developers.

Get a closer look at the global energy storage picture

This article draws on Wood Mackenzie’s latest Global energy storage outlook. The full report explores the ten-year deployment forecast for 29 key country markets, broken down by grid-scale, residential, community, commercial and industrial market segments.