The global electric vehicle race is heating up

Who will lead the EV charge?

1 minute read

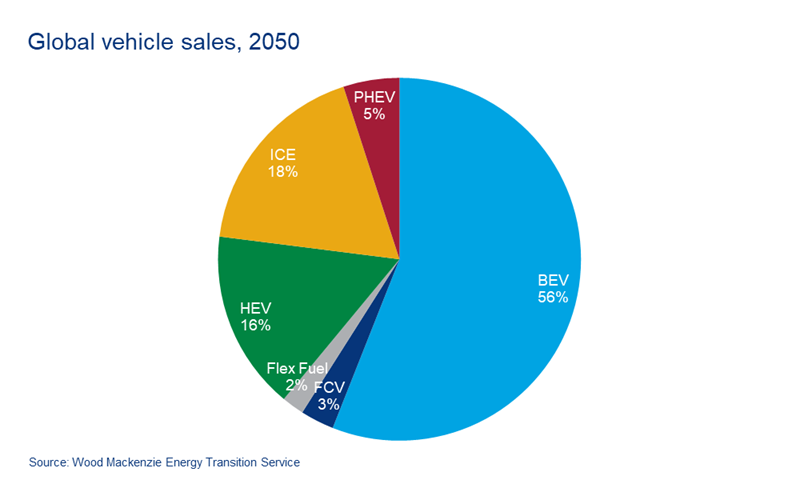

Battery electric vehicles will be the dominant form of road transport by 2050, accounting for 56% of all vehicle sales that year. Our research indicates that in 2050, we will see 875 million electric passenger vehicles, 70 million electric commercial vehicles and 5 million fuel cell vehicles on the roads. This brings the grand total of zero-emissions vehicles in operation to 950 million by mid-century.

Additionally, more than three out of every five vehicles on the roads will be electric vehicles in China, Europe and the US by 2050. Almost one in two commercial vehicles will be electric by the same date in those regions.

The projected growth in electric vehicle sales spells bad news for internal combustion engine (ICE) vehicles. Sales of ICE vehicles, including micro/mild hybrids, will fall to under 20% of all global sales by 2050. Almost half of the remaining ICE stock will reside in Africa, the Middle East, Latin America, and Russia and Caspian regions, despite those markets only possessing a combined 18% of global vehicle stock that year.

What's driving the race to electrification?

Net zero policies are transforming the global landscape. Transport is one of the largest contributors to emissions, as well as one of the low-hanging fruits. Countries accounting for over 50% of global car sales and automakers representing 80% of global sales have expressed a desire to be carbon neutral, and many have laid out concrete plans to do so.

With new supply chains and new dependencies, traditional OEMs are innovating their business models. The stage seems to be set for an overhaul of road transport, but with OEMs making flashy electric vehicle announcements frequently, the question of how, when, where and who is a subject of frequent debate.

Who's leading the EV charge?

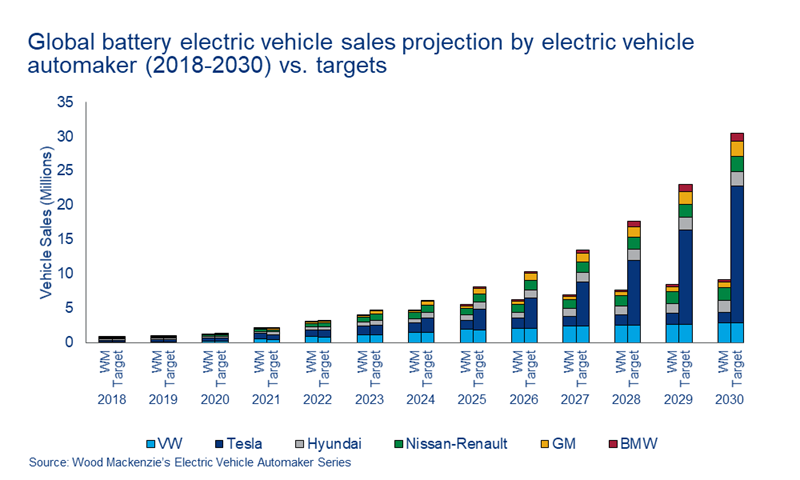

The top five Wood Mackenzie projected electric vehicle automakers – Tesla, Volkswagen, General Motors, Nissan-Renault and Hyundai – have committed to a combined 8.9 million in annual sales of battery electric vehicles by 2030, nearly 50% of our projected global battery electric vehicle sales. The companies will hit 39% of their target by this date, with Tesla’s ambition of 20 million annual sales by 2030 heavily skewing the success rate. Without Tesla, the other four automakers would hit 79% of their 2030 target sales.

Even though Tesla is currently ahead with just over half a million electric vehicle models sold in 2020, competition from OEMs, and particularly Volkswagen, is heating up.

According to Wood Mackenzie’s analysis, Volkswagen will surpass Tesla by the mid-2020s to be the leading electric vehicle automaker, selling close to 3 million electric vehicles annually by 2030. Tesla will lag behind by nearly 1.5 million vehicles. Nissan-Renault and Hyundai will also surpass Tesla in annual sales by the end of this decade. General Motor’s absence from Europe will be significant over the next decade and will see the company place fifth on the leader board for global sales.

What are the barriers to success?

A lack of electric vehicle charging infrastructure and the high price of electric cars have been widely cited as barriers to widespread electric vehicle adoption. However, we see progress on both fronts.

The projected price of battery packs used in electric vehicles continues to drop. We expect the US$100/KWh threshold to be breached by 2024, one year earlier than our previous projections.

Cumulative residential and public charging points are projected to grow to 58 million and 6 million outlets, respectively, by 2030. The sector is expected to have a cumulative investment value of US$57 billion and US$111 billion, respectively, between 2020 and 2030.

Consumers, too, have a close eye on the economics. And while most are in no small part driven by climate concerns, the financial benefits of switching to zero emission, plug-in hybrids, and battery electric vehicles is also a factor. Price parity with ICE vehicles at point of sale has been achieved in the luxury sedan segment and will extend beyond that niche ahead of original projections – a change that will really see electric vehicle adoption accelerate.

What does the future hold?

The rapidly evolving transportation landscape is beckoning new strategies. As traditional automakers enter the electric vehicle race, they are expanding their role from just car producers by investing in cell and battery manufacturing, mines, and charging infrastructure. Vertical integration will be key to keep costs down and ensure material availability to support growth.

This article was first published in PV Magazine.

Interested in electric vehicles?

We explored this topic in detail in a recent webinar, The top 5 EV automakers race to electrification. Fill in the form at the top of the page for a complimentary replay.