What does the Chevron-Hess deal mean for oil and gas?

The creation of a second Mega Major hot on the heels of ExxonMobil-Pioneer has big implications for the sector

3 minute read

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Global upstream update: diverging development strategies in Latin America, investment at risk in Africa, and Kazakhstan supply tensions explained

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

David Clark

Vice President, Corporate Research

Greig Aitken

Director, Corporate Research

Greig Aitken

Director, Corporate Research

With over 12 years of experience, Greig brings a holistic view of corporate activity to the upstream M&A research team.

Latest articles by Greig

-

The Edge

Majors' capital allocation in a stuttering energy transition

-

Featured

Upstream M&A 2025 outlook

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Featured

Upstream M&A 2024 outlook

-

Opinion

What does the Chevron-Hess deal mean for oil and gas?

-

The Edge

Big Oil: upstream M&A gets serious

Alex Beeker

Research Director, Corporate Research

Alex Beeker

Research Director, Corporate Research

Alex is a research director on our Corporate Research team, focused on the Majors and US Independents.

Latest articles by Alex

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

Chesapeake-Southwestern Energy deal: ten key takeaways

-

Opinion

What does the Chevron-Hess deal mean for oil and gas?

-

The Edge

Big Oil: upstream M&A gets serious

The announcement on Monday 23rd October that Chevron is to acquire Hess Corporation is the second huge oil and gas industry deal in less than a month. Coming hot on the heels of ExxonMobil’s acquisition of Pioneer, Chevron-Hess is a big deal in every sense. So, what are the implications for the company, but also for the wider sector?

1) How will Hess change Chevron’s portfolio?

Like ExxonMobil’s acquisition of Pioneer, the Chevron-Hess deal is not an opportunistic play but a strategic decision.

Until the announcement of the ExxonMobil-Pioneer deal, Chevron was the leading Major in the Permian Basin but was underweight in deepwater assets and faced rising concern over portfolio concentration risk. Our Portfolio Concentration Index metric indicates that the deal addresses Chevron’s concentration concerns, putting it roughly on a par with BP in terms of upstream portfolio diversification. It will also become the leading international oil company (IOC) in deepwater and ultra-deepwater, overtaking Shell in terms of value held.

In Hess, Chevron accrues a material 30% interest in Guyana, one of the world’s hottest growth plays. The ExxonMobil-operated Stabroek Block offers attractive fiscal terms, low Scope 1 and 2 emissions intensity, and highly competitive breakeven costs. It also offers abundant exploration and development potential, adding scale and longevity to Chevron’s deepwater portfolio.

2) Where does this leave the Euro Majors?

The Chevron and ExxonMobil deals emphasise an increasing divergence in strategy between US Majors and the Euro Majors.

Despite recently signalling that their involvement in oil and gas will last longer than previously expected, the Euro Majors remain committed to broader energy strategies. Stakeholder alignment concerns and lower valuation multiples would make deals of this size and structure very challenging.

In contrast, with these major acquisitions the US Majors have underlined their belief in a robust outlook for oil and gas and have so far avoided investing at utility-scale in wind and solar. Instead they are focused on meeting the world’s growing energy needs via their traditional businesses, while reducing Scope 1 and 2 emissions and investing in low carbon solutions, including CCUS, biofuels and hydrogen.

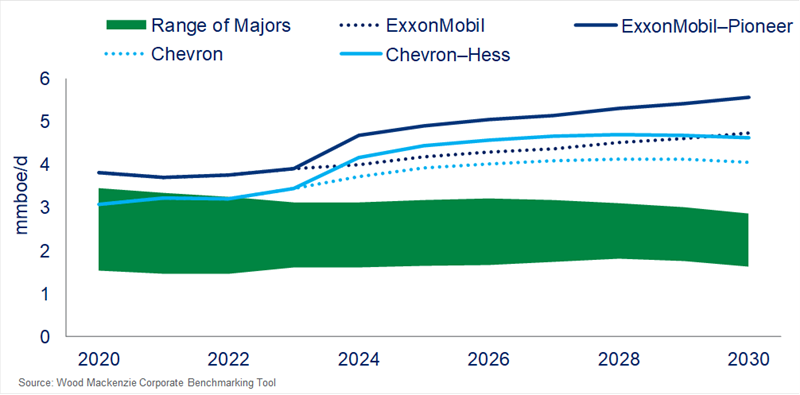

Post-acquisition, Chevron can expect to produce around 4.5 million barrels of oil equivalent per day (boe/d), while ExxonMobil’s production levels will be around 5 million boe/d.

3) What does it mean for remaining independent producers?

The news of two significant takeover deals in the space of three weeks is likely to give other independent producers pause for thought.

Both Pioneer and Hess hold high-quality, low-emissions portfolios. But like many other Independents, they face strategic diversification dilemmas as they grow. With prices robust, both companies may have considered the valuation attractive on a risk-adjusted basis when considering the uncertainties created by the energy transition.

The all-equity deal structure for both the ExxonMobil and Chevron deals suggests Pioneer’s and Hess’ owners still have confidence in the future of oil and gas – so long as producers have the scale and level of diversification necessary to thrive. Faced with future uncertainty, other Independents with assets of potential interest to Big Oil may be tempted to follow the same path.

4) What does this mean for the wider oil & gas sector?

While lots of large deals have gone ‘unanswered’ in the past, the scope and implications of these acquisitions will reverberate across the industry.

Both US Majors have committed to the theory that (even) bigger is better. Meanwhile, two of the largest and highest quality Independents have decided their future is not independent.

While we don’t see a flood of further deals as inevitable, there can be little doubt that other Mid-Cap and Large-Cap producers will be considering their options. With Pioneer and Hess already taken, the highest quality companies will seek to attract an increasing scarcity premium.

If nothing else, with valuations looking extremely healthy and transition risk growing, it’s fair to assume that board room conversations in the sector have been enlivened by the events of the last two weeks. Is the sector at the beginning of a wave of consolidation? Fill in the form to get our latest upstream insights, straight to your inbox.