1 minute read

Rory Mccarthy

Director, Power & Renewables Consulting EMEA

Rory Mccarthy

Director, Power & Renewables Consulting EMEA

Rory is a Director in the Power & Renewables Consulting division for Europe, the Middle East and African markets.

Latest articles by Rory

-

The Edge

Re-thinking energy transition supply chains

-

Opinion

Not made in China: the US$6 trillion cost of shifting the world’s clean-tech manufacturing hub

-

Opinion

2023: the year the European renewables bubble burst

-

Opinion

Will renewable auctions underpin Europe’s net zero ambitions?

-

Featured

Will 2021 be a record-breaking year for renewables auctions in Europe?

-

Opinion

Three reasons why Europe is set to lose the energy storage race

After a tumultuous 2020, European power markets could be set for a more optimistic 2021. A new year in which policymakers and market participants will refocus on initial, substantive steps towards the delivery of net-zero objectives under the light of the EU Green Deal.

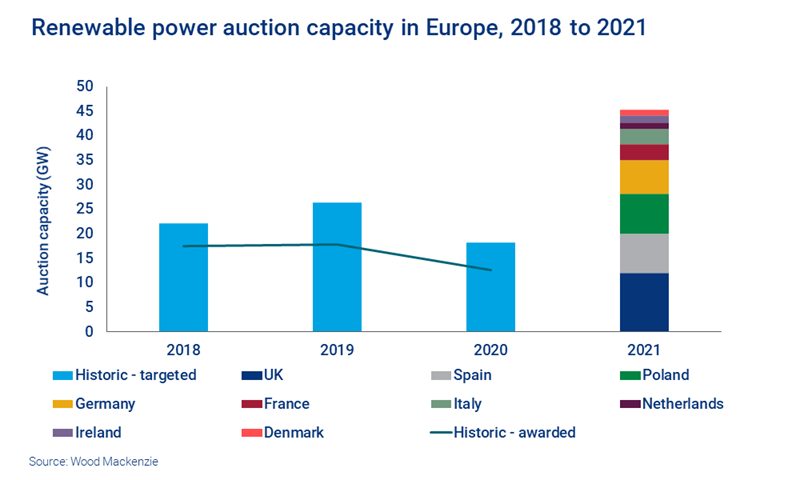

And as the race to meet increasingly ambitious 2030 targets begins, 2021 is set to be a record-breaker for renewable auctions in Europe.

What’s the scale of the renewables auction pipeline?

A mammoth 45 GW of capacity is in the pipeline, a significantly higher total than in recent years. The total consists of 17 GW of wind and 6 GW of solar PV, with the remaining auctions being either technology-neutral or applying to several sources.

Will targeted volumes be achieved?

Previous auction outcomes indicate that there is no guarantee that the targeted volumes will be achieved. But over the past three years, European auctions have seen an average award rate of 70%. If this same level of success is achieved in 2021, we could see upwards of 30 GW of capacity awarded.

What are the pipeline highlights?

The UK is targeting 12 GW from the fourth allocation round of its Contract for Difference (CfD) scheme. The round will include three technology pots with onshore wind and solar PV being readmitted to the scheme.

In Spain, a roll-over of the delayed 2020 auction will combine with the expected 5 GW annual target of the recent renewable energy auction decree. We expect to see around 8 GW targeted.

Poland has a similar ambition, with its first offshore wind auction of 5.9 GW combining with onshore wind and solar PV auctions indicating a total of 8 GW.

What will this activity mean for prices?

Clearly, wind and solar PV will represent a vast majority of capacity procured in 2021. Whilst delivering low-cost, low-carbon power in abundance, their non-dispatchable nature presents a flexibility challenge to power systems. This has already begun to manifest in several markets across Europe, with record negative day-ahead and intra-day power prices occurring in 2020 during periods of high non-dispatchable renewable generation and low demand.

Coronavirus-related demand issues aside, expect the frequency of negative prices to increase.

Are policymakers tackling the flexibility challenge ahead? When do we expect power demand to recover from its coronavirus-led decline? Will this recovery support higher prices? And how will the supply balance change?