Will coronavirus change the course of plastic circularity?

Demand for recycled PET is holding up during the pandemic – but there are headwinds

1 minute read

Andrew Brown

Director, Head of Demand and Scenarios

Andrew Brown

Director, Head of Demand and Scenarios

Andrew is responsible for aligning our consumption views across commodities.

Latest articles by Andrew

-

Opinion

Can imports solve the plastic recycling challenge?

-

Opinion

Bottle battle: the fight for recycled plastic supply is on

-

Opinion

Closing the loop on plastic packaging

-

Opinion

Can the plastics industry decarbonise?

-

Opinion

Will coronavirus change the course of plastic circularity?

The versatility of plastic means it is exposed to demand shock from the coronavirus outbreak through many applications and sectors. In this article, I'll look at the impact on PET and recycled PET (RPET) – and how it might affect plastic circularity.

How much demand destruction does PET resin face?

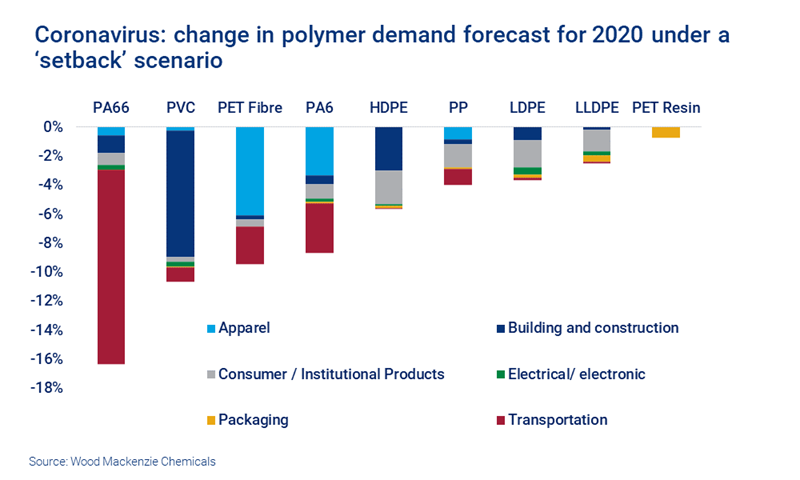

The coronavirus outbreak will see demand fall across all chemical value chains. Our coronavirus demand model has highlighted two scenarios: setback and shock. Under a setback scenario, the total demand lost across all polymers will be equivalent to about 5.9% of pre-virus forecasts. But different polymers will see different levels of destruction.

In our analysis, durable goods are most at risk. Transportation has been hit hard by lockdown restrictions, leaving some polymers exposed to a stalling automotive sector. Other durables exposed include building and construction – and while the impact there is less immediate the recovery may be slower.

The packaging sector is in a very different position, as lockdown measures drove up home consumption to provide a demand boost. PET resin’s prominence within this sector makes it the polymer least at risk of demand destruction from the coronavirus outbreak.

Does the coronavirus crisis threaten RPET demand?

2019 was an important year for the plastic circularity debate. The continued war against plastics and plastic pollution drove an unprecedented level of interest in RPET, and a significant momentum behind collection and recycling commitments. Consumer brands continued to make ambitious pledges to deliver more sustainable value chains.

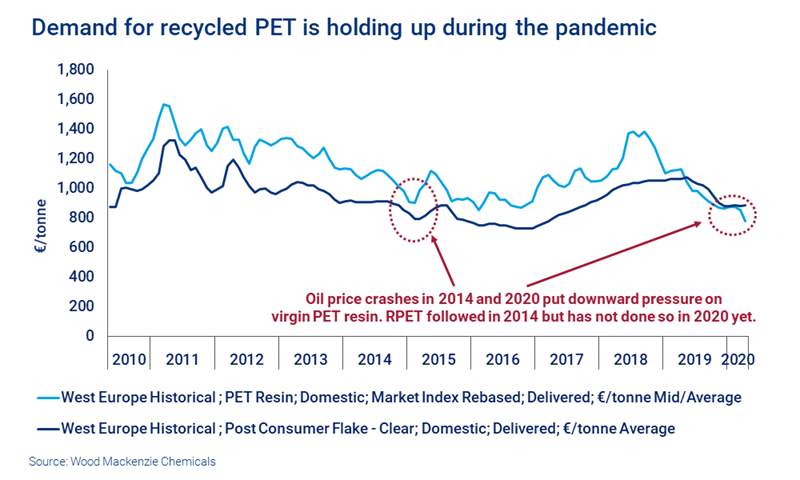

This led to an economically important switch, as RPET – typically sourced from recycled plastic bottles – began trading at a premium to PET resin made from petrochemical feedstocks.

But how has the coronavirus outbreak altered the picture? The full impact of the ongoing crisis remains to be seen – but two key themes have emerged.

1. The pandemic has paused the shift away from single-use plastics

As unpopular as single-use plastics had become, they are a cost-effective, quick-to-produce means of providing hygienic barriers in the food and medical sectors. This has led to temporary demand boost, and delays to some planned measures to curb the use of these disposable items.

In the US, legislation to reduce plastic bag use in New York and Maine was specifically delayed as part of the virus control response. In the UK, a ban on single-use plastic straws, stirrers and cotton buds has also been postponed, and the consultation period for a new plastic packaging tax has been extended by three months. The Italian government is postponing its plastic tax from 1 July 2020 to 2021, and this could be followed by other EU member states. And European Plastics Converters’ open letter to the European Commission has advocated for postponing the implementation of the Single-Use Plastics Directive.

Right now, priorities lie with the fight against coronavirus and will continue to do so until the pandemic is under control. It is clear that brands are keen to stick to sustainability goals, but if regulations are delayed it is possible that they will follow suit, delaying commitments or falling short of targets – with the caveat that the current situation has caused disruption and affected investments.

This does add more nuance to some aspects of the debate around plastics. But, longer-term, it does not change the need to drastically improve the collection and processing of plastic waste to tackle the pollution problem.

2. The oil price crash will put RPET economics to the test

In a low oil price environment, with falling petrochemical feedstock prices, plastic converters would historically switch to cheap virgin feedstocks. But early signs suggest that brands are continuing to source premium recycled materials – perhaps unsurprising, given their investment in addressing plastic waste. This commitment is sustaining the price of recyclate in the face of falling feedstock prices.

However, a sustained period of lower oil prices will test the economics of the waste management and reclaimer industry. That pressure could be amplified by delays to new plastic taxes. And an economic crash could blunt the large-scale investment the sector needs to meet brand demand and legislative requirements.

Nonetheless, the cultural and political will to maintain the war on plastic has not disappeared – and will remain a powerful force in RPET’s favour.

Read more on the latest RPET market developments

Fill in the form at the top of this page for a complimentary extract from our RPET Global Monthly Market Overview. The extract includes:

- World market overview

- Coronavirus market impacts in the Americas, Europe and Asia

- Preview of the full May 2020 report.