1 minute read

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus leads our benchmark analysis of global Pre-FID delays, and deep water developments.

Latest articles by Angus

-

Opinion

Asia Pacific upstream: 5 things to look for in 2024

-

Opinion

Can Australia create energy super basins?

-

Opinion

Japan pulls no punches on risks to Australian LNG exports

-

Opinion

Global deepwater production to increase 60%

-

Opinion

Can Asia avert a gas supply crisis?

-

Opinion

COP26: the future of upstream is in governments' hands

Japanese E&Ps are at a crossroads. They are a material, often unheralded, part of the upstream industry. Collectively, they produce 1.6 million boe/d. But the energy transition has forced companies to review their upstream strategies. A gap is emerging between those that want to grow and those that might exit the sector entirely. What does the road ahead look like for Japanese E&Ps?

Changing priorities force a rethink

For many Japanese firms invested in upstream, it’s not their core business: most are already diversified across chemicals, mining, renewables, power and hydrogen.

Energy security has long been a key historical driver for investing overseas. But Japan’s ageing population, the growth of nuclear power and renewables, and fuel efficiency improvements have reduced energy demand. As a result, Japanese firms are diversifying across the energy spectrum and upstream is struggling to compete for capital. At the same time, upstream revenues have a key role to play in funding the transition to new energies.

What are the options for growth?

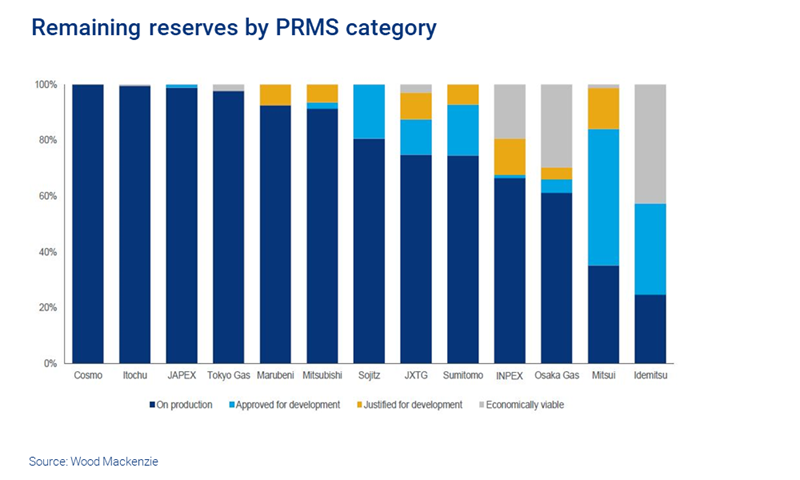

Short-term production metrics are generally encouraging. However, the longer-term growth outlook is challenged by mature portfolios and a lack of new development assets.

Historically, Japan’s resource base has focused on small equity stakes in large, long-life LNG and oil projects. Many of Japan’s E&Ps lack exposure to global growth themes, such as deepwater.

It’s a buyers’ market

International oil companies continue to have large and ambitious divestment programmes. As asset valuations have fallen over the last year, it has very much become a buyers’ M&A market. This leaves the ‘big three’ – INPEX, Mitsui and Mitsubishi – in a good position to be able to leverage their balance sheets to acquire undervalued assets as IOCs sell up. Meanwhile, smaller players need to be nimble and leverage their strengths. Those that choose to exit the market will need to weigh up whether it is the right time to sell.

Tough choices ahead

Japan’s E&Ps face some difficult choices. But they must face them, along with their IOC peers.

How do the priorities of Japan’s trading houses differ from the priorities of integrated players? Our insight uses Wood Mackenzie Lens® data to benchmark the options for four distinct groups of Japanese E&Ps in the face of the energy transition. Fill in the form on this page to receive three charts built with Lens data showing net production, capital spend and remaining net upstream asset portfolio commercial value.