1 minute read

As market share for renewables gains momentum, key players are entering the scene across Latin America. With Mexico's Energy Reform enabling solar and wind capacity to grow, Brazil making a comeback in wind power and Argentina emerging as the fastest-growing regional market for renewable energy, it's clear that these countries will continue to dominate the spotlight.

To look more deeply into the dynamics of these markets, we have launched a Mexico Gas, Power and Renewables Service as well as a Southern Cone Gas, Power and Renewables Service covering Brazil, Argentina, Bolivia and Chile. These research services offer short- and long-term outlooks across two years and 20 years in addition to historical commercial data, timely market insights, and access to the analysts who author them.

Mexico's power sector: vanguard of the renewables market

While Mexico's shallow and deepwater licensing rounds have made waves at energy news desks, its power market is also shifting due to the quick pace of reform and rapid adoption of renewables. Day-ahead energy markets have been in place for two years, and we've now seen three highly successful long-term auctions that have cleared nearly 7 GW of installed capacity at record-low prices. Despite some risk in project delivery, Mexico seems to be on the leading edge of the Age of Renewables.

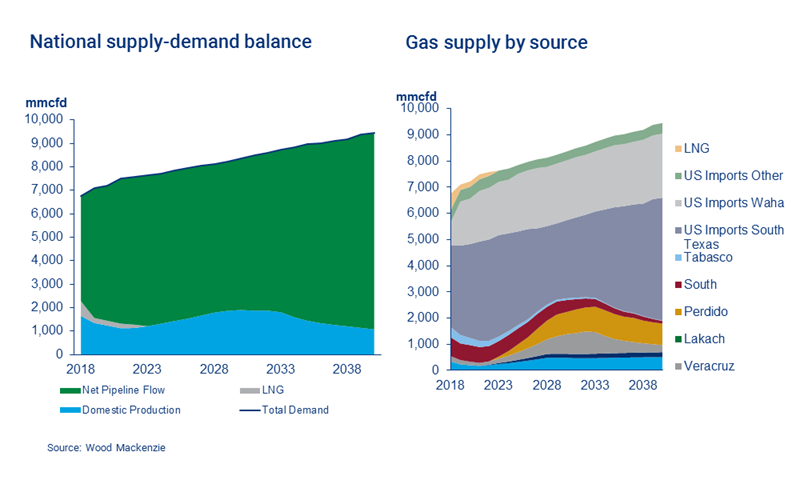

Domestic gas production, however, has declined 49% since its peak in 2010, and critical pipeline infrastructure to import low-cost US gas remains incomplete, forcing Mexico to rely on expensive fuel oil and LNG. Completions in Waha and Sur de Texas-Tuxpan pipelines across 2018 and 2019 should bring some price relief via cheaper piped gas.

We expect the development of shale plays in northern and eastern Mexico, along with associated gas from deepwater production. While this domestic rebound will compete with volumes out of South Texas, US imports will keep the lion's share over the long term and continue to serve a steady demand growth at 2%.

Southern Cone: revitalizing gas markets

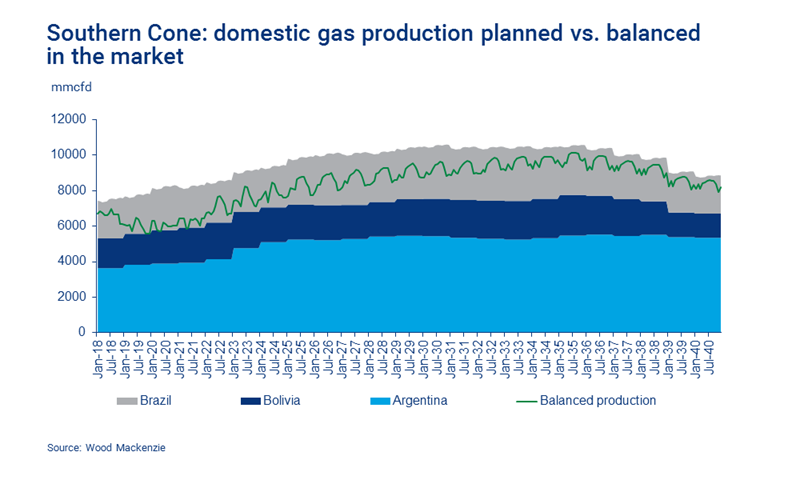

Two plays in the Southern Cone are now responsible for unparalleled gas resources and renewed interest worldwide in its regional gas markets: Vaca Muerta in Argentina, and Brazil's pre-salt. The playing field has become more competitive, with major companies such as Shell, Statoil, Total and Chevron in the mix, strengthening local players such as Tecpetrol, PAE and Pluspetrol, as well as NOCs YPF and Petrobras.

With LNG marketing on the rise in Latin America and a growing global interest in renewables potentially challenging gas demand growth, our analysis suggest the Southern Cone could be poised for gas oversupply post-2019.

An oversupply scenario could mean upstream investors seeking cost reductions to stay competitive, more urgency for LNG sellers to secure long-term deals, and plentiful opportunities for investment in infrastructure, pipeline expansions and intensive gas consumer industries.

Overall, Latin America's gas and power markets are promising for new capex investments — but how long will it last? And which countries hold the most promise, or the greatest risk?

Our new research from the dedicated Mexico Gas, Power and Renewables Service and Southern Cone Gas, Power and Renewables Service can offer you:

- Detailed modelling including 87 gas hubs (50 in Mexico and 37 in the Southern Cone) and 62 power zones (45 in Mexico and 17 in the Southern Cone).

- Commodity pricing, international and domestic flows, and supply and demand balances

- Generic infrastructure needs to serve market demand

- Two- and 20-year outlooks dedicated to each region

- Regulatory, economic and technological analysis

- Regional gas and power market dynamics

- Access to our regional experts

- Scenario analysis to analyse how changes in selected drivers affect results

Staying local to the Mexico and Southern Cone markets we cover

Our experts discuss our new gas, power and renewables coverage for Latin America

Register your interest today and learn more about this first-of-its-kind offering through upcoming dedicated webinars on our Mexico coverage and Southern Cone coverage.