Decarbonising metals and mining: three key strategies to win the emissions battle

What will decide whether the sector can achieve net zero emissions while delivering the raw materials vital to the energy transition?

6 minute read

Anthony Knutson

Global Head, Thermal Coal Markets

Anthony Knutson

Global Head, Thermal Coal Markets

Anthony is the global head of our thermal coal markets research for the Metals and Mining group.

Latest articles by Anthony

-

Opinion

Harris v Trump: A fork in the road for US energy

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

Decarbonising metals and mining: three key strategies to win the emissions battle

-

The Edge

Resource nationalism and energy transition metals

-

Opinion

Golden opportunities to drive down mining and metals carbon emissions

-

Opinion

Battery raw materials: tracking key market dynamics

The metals and mining industry is responsible for approximately 15% of annual global emissions. As the world increasingly focuses on net zero, the metals and mining industry finds itself in a dichotomy. On the one hand, its products, from aluminium and copper to lithium, nickel and zinc, are essential for the energy transition. But on the other hand, mining, smelting and refining these metals can be highly polluting activities in themselves. So, how does the sector plan to address its own emissions?

We recently presented our analysis of the outlook for decarbonising metals and mining at the LME Forum 2023. Fill out the form on the right to download a detailed extract from that presentation, or read on for a quick summary of three of our key findings:

1. Technology and innovation will be vital weapons

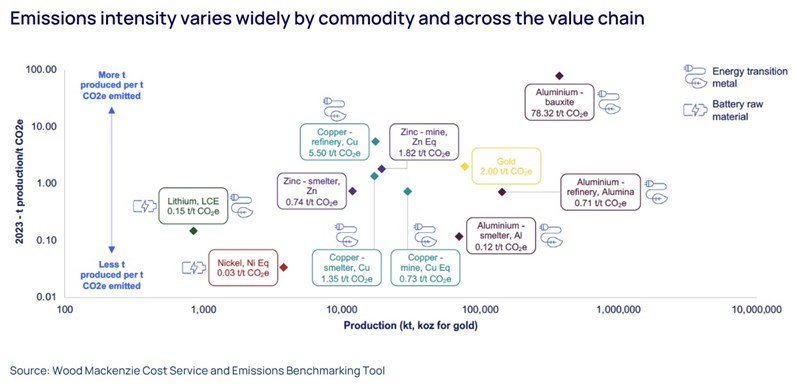

The metals and mining emissions battlespace is asymmetric across different commodities and parts of the value chain (see chart below).

Deeper regional reconnaissance and benchmarking reveal commodity specific emission source and scope hurdles where carbon is particularly embedded.

However, common to all is the need to continue building solid foundations now for ultimate net zero victory. This will require a total rethink of what the mining and metals space is and where it needs to be. Looking at mining, the industry will re-evaluate itself, how mining is done and how much it costs. Traditional approaches to design and operation will need to be challenged on every level, exploiting all opportunities to reduce emissions ranging from improving efficiencies to how we power equipment and processes.

Most importantly in building the foundation, effective decarbonisation of the sector will stand or fall on the provision of adequate renewable power sources for mining, smelting and refining. The industry needs to be confident that green power will be available as and when it’s needed, delivered via a strong transmission infrastructure. Success is not solely reliant on the miner or processor and requires strong collaboration with power providers, government regulators and financiers to name a few.

Yet power supply requirements are only part of the mine electrification puzzle; another critical element will be the replacement of diesel haulage fleets with combinations of electric and fuel cell alternatives. The first full battery electric vehicle (BEV) mine haul trucks are expected to arrive in force later this decade. In the meantime, intermediate technology will be needed to bridge the gap. Options include trolley assist, in which power is supplied to hybrid diesel-electric or diesel-battery trucks via overhead wires, along with alternative fuels such as liquefied natural gas (LNG), hydrogen and renewable alternatives to diesel (e-fuels). Beyond the truck and power variables, the “devil in the detail” as companies put this puzzle together – wires, substations, new operating procedures – to facilitate this mining paradigm shift.

At the same time, mines will need to embrace the efficiency offered by autonomous fleets and artificial intelligence, while addressing labour requirements and expectations in the face of an unprecedented skills shortage in the industry.

And while primary production will remain king for the foreseeable future, establishing strong secondary markets and processes for recycling metals will be imperative to reducing commodity emissions profiles in the longer term.

2. The full arsenal of policy measures will be needed

Prudent policy will be a critical ally in promoting the decarbonisation of metals and mining, acting as both a carrot and a stick to mobilise public and private capital and promote lower carbon options.

Major government policies spurring investment include the Inflation Reduction Act and Infrastructure and Jobs Act in the US; the European Green Deal and Climate Pact; and Japan’s ‘GX’ Green Transformation Program. The financial magnitude and game changing impact of these policies speak to the role governments must play in creating an environment of change.

On the flipside, carbon schemes including taxes and emissions trading systems will provide the stick, pushing miners to decarbonise their activities or risk margin erosion. Canada’s Greenhouse Gas Pollution Pricing Act is already in force, as are the European Union Emissions Trading System (EU-ETS) and Australia’s Safeguard Mechanism, which requires large industrial facilities to keep their emissions below set limits. Miners will face mounting pressures as the roll out of industry specific carbon schemes at the country and provincial/state levels continue to gain momentum. Stricter guidelines and requirements for emissions reporting and compliance will go hand in hand with carbon scheme adoption. Though by opening the carbon books and having a decarbonisation plan, we expect companies gain critical access to green funding options.

From a global perspective, the introduction of an international carbon border adjustment mechanism (CBAM), like the one introduced this year as part of the European Green Deal, will be key. This initiative aims to address carbon leakage whereby polluting activities are simply moved to regions with less stringent regulations. It does this by placing a tariff on imported goods to equalise the carbon price paid by domestic and imported products. Wider adoption of CBAM measures will be discussed at COP28 in Dubai in December. Other policy weapons in the arsenal include national critical mineral lists which help to prioritise metals vital to the energy transition and direct government investment similar to the US Department of Energy offer of capital for lithium project investments.

3. The majors are spearheading the attack, but need support

Across the resource space, the mining majors and large commodity specific mid-tiers have been at the vanguard of the climate fight, leading the charge towards decarbonising the industry. Despite being under the emissions microscope, susceptible to public and shareholder pressure, the big miners are willing to invest and be judged against aggressive reduction targets. Arguable, they are setting the standards for how the wider industry operates now and out towards 2050. In their corner, they have support from the C-suite, access to cheap capital, economies of scale, and presence across the commodity value chain to lead by example and blaze the trail.

In isolation, efforts by major and mid-tier producers alone will not be enough to address the many obstacles to decarbonising the sector. While the energy transition desperately needs more metals, local voices and international resistance to mining and processing plus government red tape remains a deterrent to investment. At the same time, practical challenges add to the industry’s consternations; timely and adequate access to renewable grid power, supply chain bottlenecks for key equipment, and a lack of supportive policy in some jurisdictions are beyond the direct control of mining firms.

Ultimately, achieving net zero for the sector will require the combined efforts of producers, governments, financiers, customers, power providers, equipment suppliers and research entities. These groups are all allies in the campaign against carbon in the mining and metals space. Through collaboration and alignment, the next decade offers an important opportunity to compound progress already made and create firm foundations for a net zero victory.

Learn more

Fill in the form at the top of the page to download an extract from our full presentation. This includes our verdict on the achievability of near-term emissions targets, decarbonisation trends to 2035, a timeline of carbon target development, breakdowns of emissions by business unit for majors and mid-tier producers, and spot analysis of power supply requirements for electrifying mine haulage.