Electric vehicle infrastructure investment trends to watch

From increasing diversification to the rise of SPAC mergers

1 minute read

The electric vehicle (EV) revolution is well underway, with 950 million projected to be on the road by 2050. And just as EV sales are accelerating, so too must the development of supporting infrastructure. So, how has infrastructure investment activity evolved over the last decade – and what could that mean for the future?

We explored this topic in a new report: A decade of corporate activity in the EV infrastructure space. Fill in the form for a complimentary extract and read on for a brief introduction.

Infrastructure investment is diversifying as the EV market matures

We’ve tracked more than US$18 billion of venture capital (VC) investments and 409 mergers and acquisitions (M&A) between 2010-2020 in our Grid Edge Database. What’s clear is that grid edge VC and M&A activity over the last decade shows a trend towards flexibility and electrification – in fact, energy storage, EV charging infrastructure and customer energy management make up over two-thirds of disclosed VC funding and just over half of completed M&A deals.

Zeroing in on the EV charging infrastructure market, more than 65 vendors have raised a cumulative total of US$2.7 billion across 165 investment rounds and completed 35 M&A deals since 2010. In the early years of the decade, when passenger EV adoption was at 0.01% of global vehicle stock, investments were focused in submarkets that increased access to chargers. This included vertically integrated vendors (vendors that both produce and operate chargers), EV charger manufacturers and network operators (vendors that operate chargers but do not manufacture their own chargers). Around the middle of the decade, investments in EV infrastructure submarkets started to diversify in order to meet the changing needs of a more mature EV market. Investors began to allocate larger funds into consumer software and services like:

- charging navigation and management operations

- ancillary equipment, such as electric and hybrid conversion products

- smart charging software, including network optimisation.

By 2020 the global EV stock had reached 1% of total passenger vehicle stock – and continues to increase. Download the complimentary extract to see charts on passenger EV growth, and charging outlet stock.

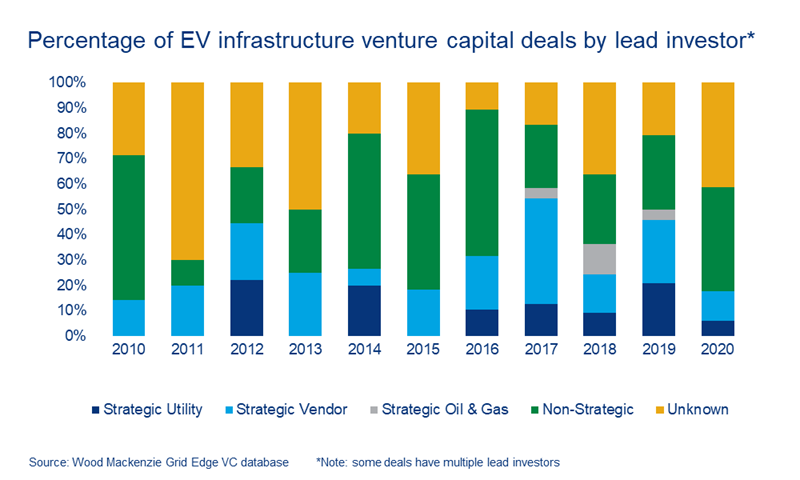

Vendors and utilities have been the most active strategic investors in EV infrastructure companies

Strategic vendors have led 21% of EV infrastructure VC rounds and completed 60% of EV infrastructure M&A deals since 2010. Strategic vendors invest in vendors providing products and services that complement their own or improve the customer experience.

Automakers were the largest type of strategic vendor investor. Instead of creating their own charging network or manufacturing their own chargers, automakers partner with and invest in these vendors to give their customers these products and services.

Utility investments in EV infrastructure companies reflect two recent trends: the role utilities play in deploying and operating charging infrastructure, and the changing utility business model. Utilities did not have a significant role in the early days of EV adoption, but now play a more active role in not only deploying chargers but also owning and operating them, depending on the geography and regulatory environment.

One of the main challenges utilities will have to overcome with growing EV adoption is minimising impacts to the grid, through capital and non-capital investments. Capital investments include direct investments or acquisitions in smart charging and vehicle to grid (V2G) companies, or investments as limited partners in venture funds. Non-capital investments include non-wires alternatives, incentive programmes and EV-specific electricity tariffs. Smart charging and V2G companies that provide hardware and software to control charging or enable bidirectional grid services were the second largest submarket utilities invested in since 2010.

The EV SPAC craze has gathered momentum

At least 33 EV charging infrastructure and related companies have gone public through a special purpose acquisition company (SPAC) merger since the beginning of 2020. Investors put money into a SPAC, which goes public via an initial public offering (IPO). It then has two years to find and acquire a target company.

EV companies made up about half of the clean energy SPAC mergers tracked, while charging infrastructure companies made up a fourth. Electric transportation companies are attractive for SPACs for several reasons. EV and charging markets are emerging markets, meaning that while they may have accrued revenue and customers, much of their potential has yet to materialise.

EV and charging companies are also in the growth stage, seeking a new influx of capital in order to enter new markets and develop new products. And as hardware-centric companies are very capital intensive they may have exhausted other fundraising avenues.

Only time will tell whether these companies will survive the public markets. A few have come under scrutiny from the Securities and Exchange Commission for potentially misleading investors. But while there may be some causalities from the SPAC craze, many of these companies will survive and thrive because they lie at the convergence of two markets with enormous potential: transportation and electricity.

The full report explores this infrastructure investment trends in more detail. Fill in the form at the top of the page for a complimentary extract that includes:

- Snapshot of the EV charging market

- EV infrastructure M&A activity highlights

- SPAC mergers overview