Go for gold: increased exploration is vital for future supply

The resurgent gold price has sparked a renewed sense of optimism in the industry, but there's a supply challenge ahead.

1 minute read

There is a fresh lustre on gold. Economic headwinds and geopolitical tensions set the scene for safe-haven assets. And as central banks adopted a more dovish tone and the FED cut interest rates the gold price has risen, boosting optimism in the industry.

The resurgent gold price may have put gold back in the spotlight, but a challenge lies ahead. The lack of exploration spend in recent years means the industry faces a period of secular decline in the long term.

However, these three factors could help to arrest a fall in gold supply.

1. Miners firing up their drill rigs

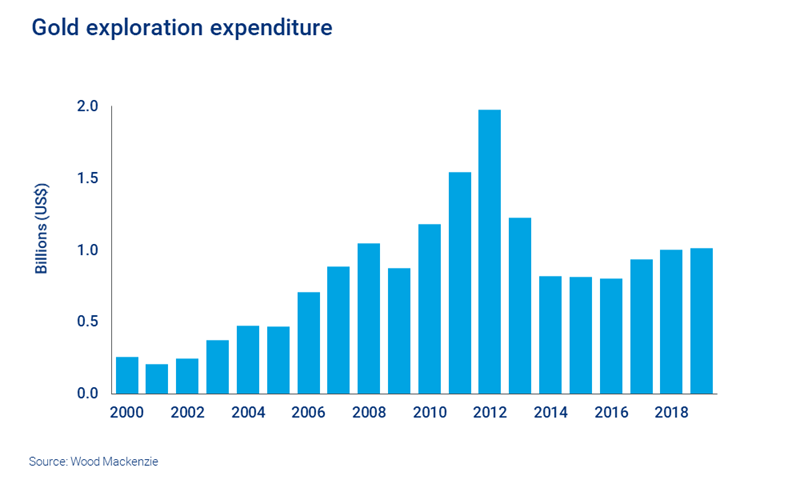

Exploration budgets were slashed following the fall in the gold price from the highs reached in 2011/2012. And they have since failed to recover.

We have seen a slight rebound in exploration spend over the past couple of years, largely focused on brownfield projects and near-mine development. This has not been enough to replenish mined ounces, and as a result peak gold supply is now a very real possibility.

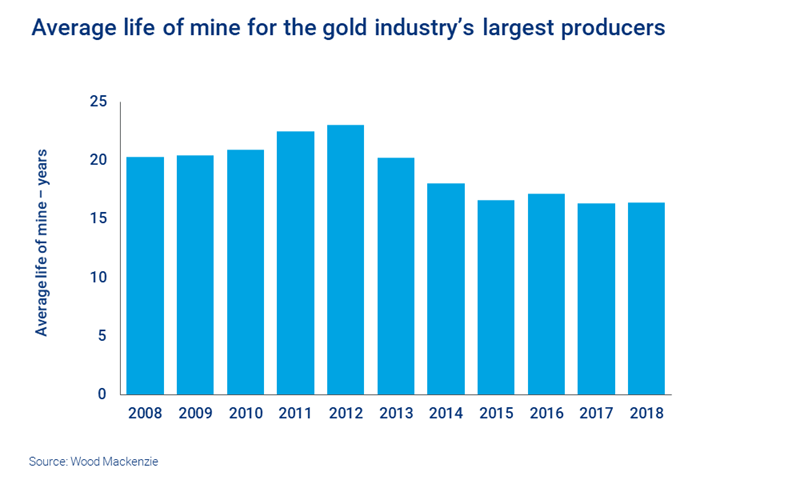

Insufficient exploration spend has seen gold reserves depleted significantly. According to our Gold Research Suite, the global average mine life has fallen from 16 years in 2012 down to an estimated 11 years in 2018. However, as the largest producers’ collective average mine life is still over 16 years they can arguably afford a more calculated approach to replenishing reserves.

With gold breaking through the $1,500/oz marker we are seeing some signs that exploration activity could be turning a corner. You can read more about this in the full version of this insight, available via the form on this page.

2. Majors backing juniors

The gold price resurgence has led to speculation about how miners will respond. The mantra currently appears to be cost control, portfolio management and capital discipline.

We have seen heightened M&A activity and miners focusing on their core assets. This may help to bolster balance sheets, through improved operational performance and realised synergies, but it does little to address the challenge the industry faces to sustain current production levels.

In recent months we have noticed an uptick in some majors opting to increase their footholds in a select few juniors, with promising exploration opportunities. Agnico Eagle, AngloGold Ashanti, Kinross and Newcrest are actively investing in, or entering into joint ventures with junior gold companies to create long-term value. To read more on this, download the full insight via the form on this page.

3. Price predictions are bullish

Buoyed appetite for gold does present an opportunity for miners to expand their reserve base.

The gold price remains volatile, buffeted by geopolitical sentiment and macroeconomic data, and that does create uncertainty. However, numerous industry participants are calling for $2,000/oz next year – and some are offering even more bullish predictions. This could encourage miners to factor higher prices into long-term price assumptions.

Will the trend in declining reserves be reversed this year?

Compared to 2012, proposed exploration budgets for the largest producers remain conservative. But will there be a knee-jerk reaction to increased prices?