Discuss your challenges with our solutions experts

How are chemicals companies responding to the coronavirus blow?

Capex cuts, deferred projects and new partnerships are a feature of the new industry landscape

1 minute read

Coronavirus, supply disruptions, muted demand and the oil price plunge have sent shockwaves across the petrochemical industry. Year-on-year profits have been considerably reduced. So how is the industry handling the blow, and what does it mean for balance sheets, budgets and planned projects?

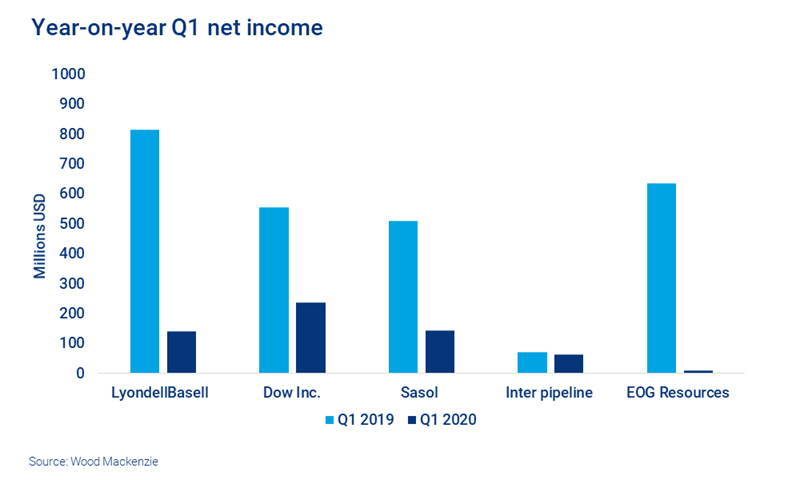

Profit margins have been squeezed

Coronavirus has stalled economic activity around the world. Consumer expenditure for petrochemical derivatives dropped sharply, narrowing producers’ profit margins considerably. Many companies’ Q1 income took a hard hit.

The drop in demand has forced rapid supply adjustments, with utilisation rates substantially reduced. In the US, chemical production dropped 5% in April from March. A recent Wood Mackenzie insight explored how coronavirus is reshaping the global olefins industry – including cuts in operating rates in the face of an oversupplied market. And as the pandemic story is still unfolding, ‘new normal’ demand levels are yet to be defined.

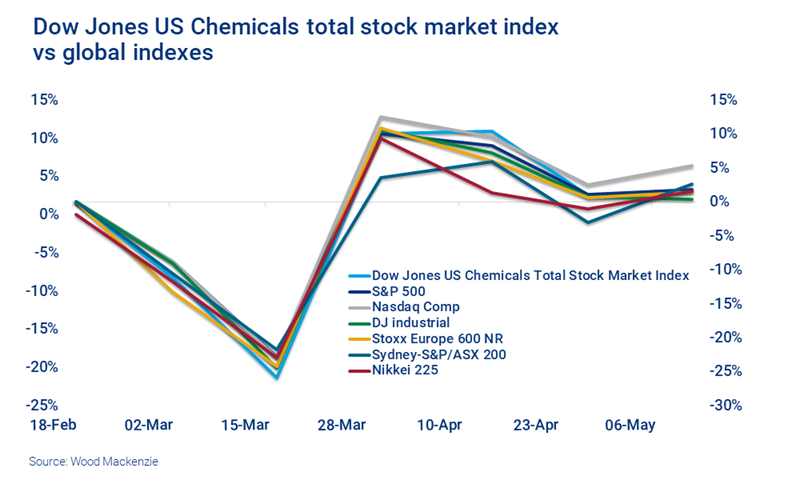

Stock prices took a tumble

What is already clear is that the pandemic has had a devastating impact on global markets. March marked the end of a 10-year “bull era” for the US stock market, and several publicly-traded chemical companies saw their stock prices fall as much as 40% in a matter of weeks.

Government stimulus in advanced economies, the gradual re-opening of economies and news of a possible vaccine have all helped to stabilise global markets, and chemical company share prices.

The oil price crash added pressure

Oil prices further dented the industry as Brent and WTI reached unprecedented lows in Q1. Historically low prices were seen in various NGL, olefin, and aromatic value chains around the world.

The mix of price volatility, demand disruptions and muted demand are creating challenging and unusual market dynamics. US producers, for example, began to favour naphtha over ethane as the most cost-effective ethylene steam cracker feedstock.

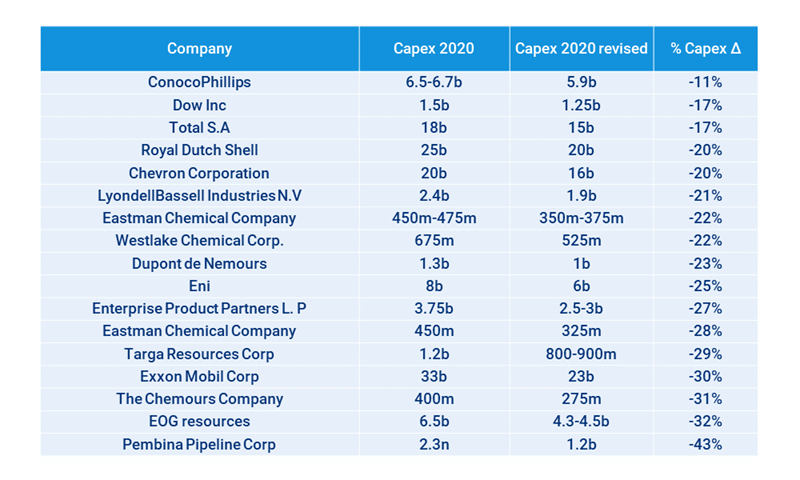

Chemical producers responded with capex cuts

As Q1 profit margins fell, chemical producers quickly adjusted by minimising operating expenses and substantially decreasing 2020 capital expenditures.

Paused projects and partnerships may be a feature of more risk-averse strategies

Capex cuts, reduced operating expenses and declining global demand for chemical derivatives will affect many upcoming petrochemical projects. We’re seeing postponed start-up dates, revised estimated project costs and delayed final investment decisions (FIDs).

Enterprise, for example, is delaying the start-up date of their 750 ktpa PDH2 in Texas from Q1 2023 to Q2 2023. BP and SOCAR have postponed construction and FID on the Mercury Complex in Turkey. And in China, Sinochem Quanzhou’s 1000 ktpa cracker, Heilongjiang Longyou’s 400 ktpa cracker, and Ningbo Huatai Shengfu’s 600 ktpa cracker have all announced delays.

Some companies are tackling uncertainty by leaning into partnerships and joint venture (JV) activities. LyondellBasell and Bora have signed definitive agreements to form a JV on an ethylene cracker project in China, for example. More recently, CNOOC and Shell signed a cooperation agreement to expand their existing JV in Guangdong province.

Does deeper deterioration lie ahead?

Companies across all chemical value chains are adjusting to the impact of coronavirus on balance sheets and operations. And while the worst of the pandemic may be behind us, the full extent of the damage to the industry remains to be seen. We do expect to see a deeper deterioration in Q2 earnings as a result of muted demand.

How will companies respond if the challenge intensifies? What strategies might come into play? And what are the challenges – and opportunities – for investors and creditors? Our experts can help you stay ahead of a rapidly-changing industry. Visit the store to browse our latest chemicals industry reports.

Evaluating investor opportunity

The coronavirus crisis is like nothing markets have ever seen – corporates, their investors and creditors are operating without a playbook. Discover our latest analysis of the impact on commodities markets and the energy and natural resources sector – and how we can help investors evaluate opportunities.