How will the EU’s CBAM impact global iron and steel?

The Carbon Border Adjustment Mechanism has big implications for international trade patterns

5 minute read

Nuomin Han

Principal Analyst, Head of Carbon Markets

Nuomin Han

Principal Analyst, Head of Carbon Markets

Nuomin provides clients with insights into emissions and climate-related development.

View Nuomin Han's full profileWhile it’s an EU regulation, the Carbon Border Adjustment Mechanism (CBAM) aims to encourage decarbonisation at a global level. As the new rules will affect anyone who exports to the EU, it promises to have significant consequences for international trade.

In our latest insight, our metals and mining sector analysts set out the details of the Carbon Border Adjustment Mechanism and assess its implications for the iron and steel sector, which is the largest by import value of the six sectors covered by the first phase of the scheme.

Fill out the form to download a free extract from the report, or read on for an overview that touches on the implications for other commodities.

What is the Carbon Border Adjustment Mechanism?

The CBAM aims to address the issue of so-called ‘carbon leakage’. The EU defines carbon leakage as ‘the situation that may occur if, for reasons of costs related to climate policies, businesses were to transfer production to other countries with laxer emission constraints’.1 The EU looks to address the risk of carbon leakage by taxing imports to equalise the carbon price paid by EU and non-EU products.

What sectors does it cover?

Initially, the CBAM will cover six sectors, with a focus on carbon-intensive and trade-exposed industries that are at the high risk of carbon leakage. These are electricity, hydrogen, cement, fertilisers, aluminium, and iron and steel. Later it will be extended to all sectors covered by the EU’s Emissions Trading System (ETS) by 2030. The bloc will also assess whether to extend the mechanism to organic chemicals and polymers by the end of the transition period, and will look at the potential to cover indirect emissions for more sectors and a wider range of downstream products.

When does it come into effect?

- October 2023 – Transitional period: Importers of products covered by the initial scope only have reporting obligations for the purpose of the CBAM

- January 2026 – Financial obligations commence: Importers will face financial obligations of surrendering CBAM certificates, which will ramp up progressively. Free allowances for CBAM-targeted sectors under the EU ETS will start to phase out.

- On or before 2030 – Extension: Regulations will be widened to all sectors covered by the EU ETS

- By 2034 – Full implementation: The CBAM will reach full effect for the initial batch of sectors and allowances will be all allocated via auctions for these sectors under the EU ETS

How will it work?

Until now, industrial installations within the EU considered to be at significant risk of carbon leakage have been receiving free allowances under the EU ETS to support their competitiveness. The CBAM will replace these free allocation, which will be phased out between 2026 and 2034 at the same pace as the CBAM is phased in.

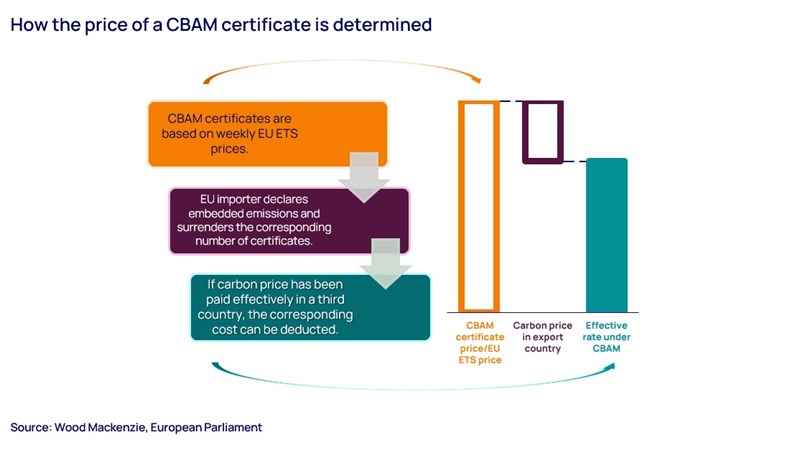

CBAM financial obligations will be determined by the embedded emissions of imported goods and the price of the CBAM certificate, which is based on the EU ETS price. Carbon price effectively paid in the export country can be deducted (see diagram below).

Why has iron and steel been chosen?

The iron and steel sector is large, trade exposed and emissions intensive, making it a prime candidate for inclusion in the CBAM. European producers face significant competition, with 30% of EU demand for steel basic materials and key intermediates met by foreign supply. Price is a major factor, with EU steel producers facing higher production costs than their foreign competitors. As the energy transition progresses, higher carbon prices will further corrode their competitiveness.

Emissions from crude steel production in most of the bloc’s major steel trade partners, including China, India and Russia, are notably higher than the EU average, yet none of these countries places a carbon price as high as the EU’s. The CBAM is intended to address this discrepancy and create a level playing field for domestic production. The mechanism will cover CO2 emissions from a range of imported products, including pig iron, semi-finished and finished steel, some fabricated steel, and downstream items like nuts, bolts and screws.

What will the impacts of the CBAM be?

In the long term, the CBAM could lead to global decarbonisation of affected sectors and downstream consumption. However, collateral damage should also be expected.

Cost growth will be moderate in the first few years of the CBAM payment. During this period, exporters to the EU could reorganise their production and sales to direct lower-emissions products to the European market as a short-term fix. However, they may simply avoid the higher cost of operating in the EU market, creating supply shortages. Meanwhile, carbon costs will rise for EU producers as free allowances are phased out.

In the longer term, however, carbon will become an increasingly important cost component to consider. This will eventually impact steel trading patterns and encourage exporters to the EU to invest in emissions reduction technology. At the same time, the bloc’s trading partners will be incentivised to introduce or raise their own domestic carbon prices to prevent revenue leakage (although it should be noted that they are likely to remain structurally weaker than the EU’s).

On the downside, higher carbon costs and disrupted supplies will impact downstream manufacturing, leading almost inevitably to price increases for both domestic and foreign products. Steel is also widely used for renewable energy applications such as wind turbines and electric vehicles; higher prices and added strain on the supply chain could, therefore, make the energy transition more expensive in the EU than elsewhere.

Learn more

The full report draws extensively on our industry-leading research and analysis. It includes assessments of the CBAM’s specific impact on the iron and steel sector in China, India, Russia, Turkey and the US as well as the EU, along with a detailed breakdown of obligations during the transition period. You can find out more about our Steel Research Suite on our website.

Don’t forget to fill out the form at the top of the page to download your complimentary extract from the insight, which contains more detailed analysis, plus supporting charts and data.