Discuss your challenges with our solutions experts

Norway’s upstream sector will prosper — but can the UK rally?

1 minute read

Malcolm Dickson

Research Director, Europe Upstream Oil and Gas

Malcolm Dickson

Research Director, Europe Upstream Oil and Gas

Malcolm leads our research coverage of the European Upstream sector.

Latest articles by Malcolm

View Malcolm Dickson's full profileThe oil price took its toll on both the UK and Norwegian sectors in 2016, with capex dropping, exploration curtailed and only small new projects getting the go ahead. In Norway, there was a sense that this is simply a dip and interest in the sector is still high — as strong M&A activity attested. But in the UK, the lowest number of exploration wells for 50 years, and another 20% drop in capex pointed to a deeper malaise.

Some brightness amid the gloom for the UK

High investment up to the end of 2014 has rallied UK production and it continued to grow in 2016. Also — crucially for a sector beset with high costs, swingeing operating costs reductions were realised across the basin — which will be absolutely key to prolonging the life of mature fields. Opex/boe has been halved since the crazy days of 2014, when it had reached US$30/bbl. We also saw M&A activity picking up in the second half of the year, with private equity leading the way — hinting at what we can expect early in 2017. Finally, the UK government recognised the precarious state of the industry, and cut the marginal tax rate to a very competitive 40%.

A fork in the road — what will 2017 bring for the UK and Norway?

Norway is heading for a more prosperous year. The proof is in the numbers:

- Capex of US$14.5 billion for Norway versus only US$6.9 billion for the UK

- 35 exploration wells playing 15 wells

- And the story is replicated across FIDs, production and M&A

The UK will need to work hard to maintain the impressive production of the past couple of years. We still expect it to rise again in 2017, but beyond 2018, more sources of output will be required. Of the 14 fields expected to come onstream — which is impressive — many have already had sizeable delays.

With few wells expected in 2017, it’s hard to see those barrels coming from exploration. That said, contrary to the past two years there are a number of exciting wells to be drilled, and notably by the Majors. Statoil will drill three wells to watch. Plus high pressure /high temperature (HP/HT) is back on the agenda, with Total, Nexen, and ConocoPhillips all set to spin the bit. So perhaps it’s not all doom and gloom.

Norway’s glamourous Arctic

Norway’s exploration will stand out on a global scale. It’s a return to elephant hunting, and in the Arctic no less. With up to 15 wells expected there, including the massive Korpfjell in the formerly disputed zone bordering Russia, the headlines are sure to be big. Among the Barents hopefuls are exploration specialists Lundin, Norwegian stalwarts Statoil and Arctic pioneers Eni.

Only three Norwegian fields are expected onstream, which will just about be enough to keep production flat. With big fields like Johan Sverdrup and Aasta Hansteen coming up in the next few years, there’s no need to panic. The same can be said for investment, which despite a 4% fall into 2017 will grow again from 2019.

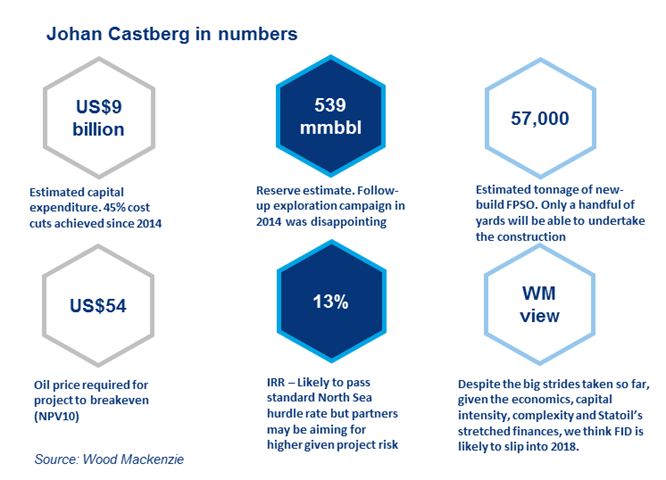

One big project to watch which could shift the needle for Norwegian production and spending is Johan Castberg, in the Western Barents. FID is slated for 2017, but we believe that more cost cuts are desirable for the 540 mmboe FPSO project and it could slip to 2018. The FIDs we expect to happen are incremental Statoil projects: Njord Future (including nearby Snilehorn) and Snorre Expansion.

Is the decommissioning glut finally about to happen?

We couldn’t talk about the UK sector without addressing decommissioning. With US$66 billion to be spent on abandoning the sector over the coming decades, many are wondering when the big spend will arrive. The UK industry is working hard to delay this spending and to maximise economic recovery from the sector, but decommissioning itself will also offer its share of jobs and investment for the UK sector.

As much as US$20 billion could be spent over the next five years as tens of fields cease production. 2017 will see a 60% increase in spend as it ramps up to around US$2.1 billion, with the Majors paying most of the bill.

Want more on the year ahead? Read our global upstream outlook to 2017