Can green hydrogen compete on cost?

Cost reductions for low-carbon hydrogen are critical to enable a swift energy transition

1 minute read

Bridget van Dorsten

Principal Analyst, Hydrogen

Bridget van Dorsten

Principal Analyst, Hydrogen

Bridget is a hydrogen-focused principal analyst on our Energy Transition Practice.

View Bridget van Dorsten's full profileThe hydrogen boom is well underway, but not all hydrogen is created equal. A spectrum of hydrogen colours are in play – but the real gamechanger will come when low-carbon green hydrogen costs become competitive in major markets.

We explored the economics of green, grey, brown and blue hydrogen in Hydrogen costs to 2050: getting ready to scale. Fill in the form for a complimentary extract and read on for an introduction.

Green hydrogen has some catching up to do – but the project pipeline is gathering pace

Green hydrogen – hydrogen created from the electrolysis of water using renewable energy – has a tiny share of the global energy market today. It is currently still largely uncompetitive against fossil-fuelled alternatives. However, the momentum behind net zero ambitions means that investors are betting on its long-term potential.

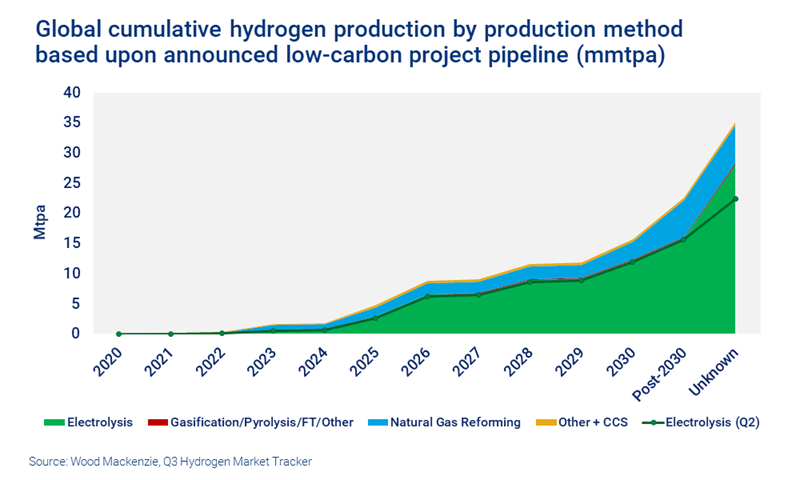

As a result, the hydrogen project pipeline has grown seven-fold since December 2020. We’re tracking more than 560 low-carbon projects in our database with a minimum of 180 GW total electrolyser capacity designation. Most projects are still at early development stage, with the bulk of new projects advanced through Q2 this year.

Hydrogen manufacturing companies are scaling up

Until 2019, global estimated electrolyser manufacturing capacity was just 200 MW. By the midway point of 2021 that had jumped to 6.3 GW of announced capacity, with 1.3 GW added in Q1 alone.

Now, as we reach the end of Q4, electrolyser manufacturers are dramatically expanding plans for gigawatt scale factories. In recent weeks, Ohmium, Clean Power Hydrogen, Green Hydrogen Systems, Sunfire and FFI have all announced large-scale factories, joining Cummins, Haldor Topsoe, ITM, Nel, McPhy, Siemens, Thyssenkrupp and Plug Power.

Electrolyser capex is falling fast

We expect a significant drop in electrolyser capex by 2025. Costs are being driven down by a range of factors including economies of scale, new entrants to the market, greater automation and increased modularity.

Cost drivers differ for different electrolyser types. Reductions for solid oxide electrolysers are set to be the most dramatic in the next 6-8 years; but alkaline and polymer electrolyser membrane (PEM) costs are forecast to fall 35-50% by 2025.

Capex reduction will help drive down the levelised cost of hydrogen production (LCOH). Combined with cheap renewable PPAs and good renewable utilisation in many markets, the potential for competitive green electrolysis-based hydrogen really starts to grow. At the same time, as the world adjusts to high commodity prices while demand bounces back from Covid-19 lows, the economics of blue, grey and brown hydrogen have become less favourable than they were a year ago. (Though the world of blue hydrogen – which pairs natural gas reforming with carbon capture and storage (CCS) – is also expanding with a rapidly increasing project pipeline for CCS projects linked to hydrogen.)

This combination of forces means that we believe green hydrogen will be competitive in 12 markets – those with the highest utilisation rates and lowest renewable electricity prices – by 2030. Brazil and Chile are amongst the front-runners of harnessing cheap renewables to produce green hydrogen off-grid. And by 2050, 20 of the 24 countries in our analysis see very competitive green hydrogen costs.

Hydrogen costs to 2050: getting ready to scale includes a country-by-country breakdown of LCOH forecasts for green, blue, grey and brown hydrogen. To find out more fill in the form at the top of the page to download a complimentary extract.