与我们分析师联系

Enterprise targets a second PDH unit in the US

How much capacity will the new plant add – and what’s driving the need for new on-purpose production?

1 minute read

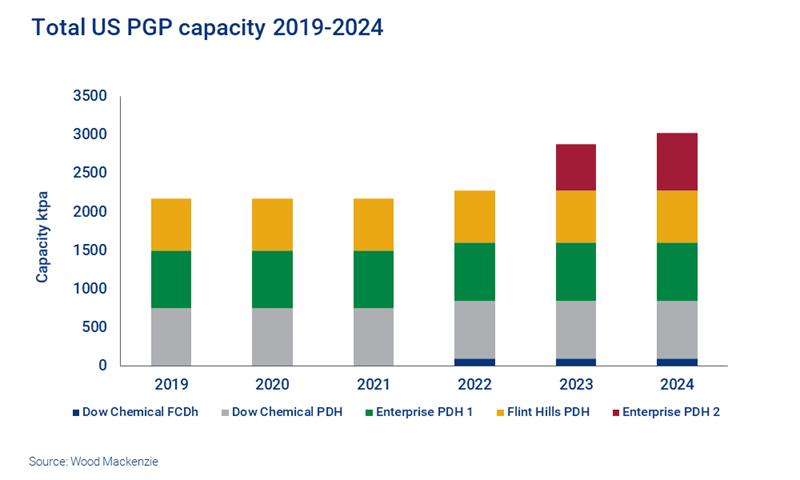

At the end of September 2019, Enterprise – a key player in the US polymer-grade propylene (PGP) market – confirmed plans to construct a second propane dehydrogenation (PDH) plant. The announcement is positive news for the US market, meeting a structural need for propylene demand growth to be met by on-purpose production.

For some time now our supply and demand forecasts have highlighted the need for a new PDH unit, based on increasing domestic demand for derivatives such as polypropylene, propylene oxide, and acrylonitrile. Enterprise’s PDH 2 unit is scheduled to start production in 2023 – we expect that this capacity will help to meet demand for approximately 2,300 kta of PGP from PDH units by that time.

Driving the need for on-purpose production

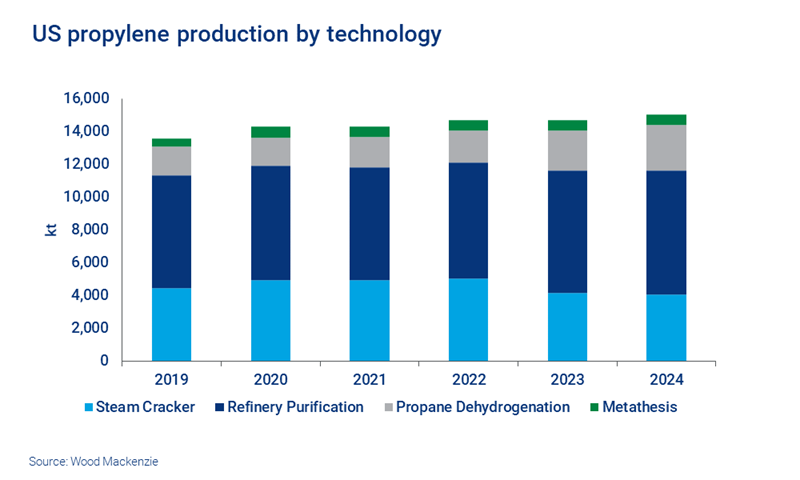

Explosive ethane growth in the US set the scene for this investment. Over the past decade, ethylene steam crackers have adjusted by lightening their feed slates, gaining more efficient economics for production. One side effect is fewer by-products, including propylene, from the steam cracking process. Given the high cost of establishing new refineries, new PDH capacity is by far the most logical and cost-effective way to replace this lost supply.

The new PDH 2 facility will be located at Enterprise’s complex in Mont Belvieu, Texas, and will have the capacity to produce 750 ktpa of PGP using UOP’s Oleflex Technology. It will bolster Enterprise’s already strong position in the US propylene market, increasing a network of assets that already includes a PDH, refinery grade propylene purification capacity, more than 300 miles of pipelines with 26 PGP connections, and over five million barrels of storage capacity.

Is further investment likely?

The US markets are delicately balanced. While we have seen investment in the ethylene chain, fuelled by the current economics of ethane, there has been much less activity on the propylene side.

Rather than investing in capacity, it’s often more cost-effective for feedstock – propane – to be exported for conversion by overseas PDH units. Other countries are building PDH capacity to meet their own demand, and in many developing economies the pace of demand growth is much faster than in the US, which has begun to level off.

In the US, we anticipate an additional PDH unit every two to three years to meet local demand, rather than a wave of investment.

This article is part of The Chemical Reaction, a regular content series that brings together news and views from our chemicals experts around the globe.

Recent topics have included:

- ‘Monster’ MEG plants on the horizon

- Alpart alumina refinery outage dampens caustic soda market sentiment

- 2020 European steam cracker outages review