Has Covid-19 left the apparel industry hanging by a thread?

Apparel consumption has collapsed, and the pain is being felt along the value chain

1 minute read

Bruna Angel

Principal Analyst, Fibres

Bruna Angel

Principal Analyst, Fibres

Latest articles by Bruna

-

Opinion

Bottle battle: the fight for recycled plastic supply is on

-

Opinion

Tackling the textile industry’s carbon footprint

-

Opinion

Has Covid-19 left the apparel industry hanging by a thread?

Fibres markets have had a tough time during the coronavirus pandemic. The stalled automotive sector took its toll, as demand for fibres going into carpets, seat covers, airbags, insulation and tyre cord evaporated. But the apparel sector – where 55% of total fibre volume was consumed in 2019 – is where the value chain has been most exposed.

This article is an extract from our latest coronavirus and polymers update. Fill in the form for a complimentary copy of the full insight. Or read on for three key themes – and three of the most pressing questions the crisis has raised for the apparel industry.

Apparel consumption has collapsed around the world

The impact of the coronavirus pandemic on apparel has been swift and dramatic. Around the world, lockdown measures saw stores shuttered and discretionary spending fall. Large sections of the global population were suddenly working from home with restricted leisure activities – and little impetus to shop for new clothes.

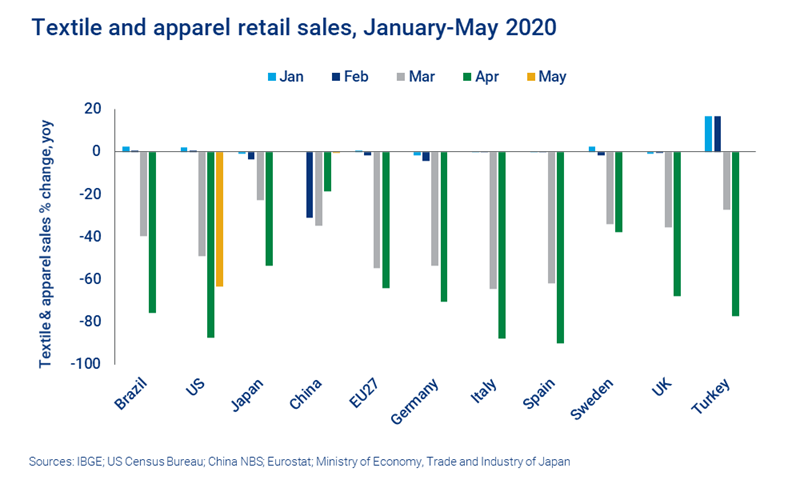

Retail sales plummeted. In the US, sales at apparel and apparel accessory stores in May were down 63% year-on-year, following an 87% decline in April. In the EU27, retail sales at specialist textile, apparel, footwear and leather goods stores fell 55% and 64% in March and April, year-on-year. In Spain, which imposed one of the strictest lockdowns, the April decline in sales was 90%. Even in Sweden, where there was no strict lockdown, sales fell 38% in April.

May retail sales data is also likely to show substantial year-on-year reductions as the slow transition from lockdown to the ‘new normal’ is still underway. And the pandemic is far from over – we’re currently seeing a resurgence of cases in parts of the US, for example.

Plummeting sales have already hit retailers hard. In the US, five national companies with revenues in excess of US$22bn in 2019 filed for Chapter 11 bankruptcy by the end of May. And global brands such as Gap (-US$1.2bn) and Inditex (-€409m) reported significant operating losses in Q1.

The trend towards online retail has accelerated

The pandemic may prove to be an inflection point for the apparel sector. In many countries, a general trend towards greater market share for online retailers has accelerated – and if that continues it will affect the whole value chain.

This has created opportunities as well as challenges. Some nimble digital players offering low cost, ‘fast fashion’ on a 1-2 week cycle were able to adjust their offer rapidly. They’ve been able to take advantage of the challenges faced by bricks and mortar operators by buying their stock or operations from administration.

We expect to see continued restructuring of the retail segment before the pandemic is over. Brands and retailers are redoubling their efforts to boost their digital presence, and this is likely to lead to the closure of some physical stores. This will herald change for the rest of the value chain – online-focused operators tend to reduce inventory, and often near-shore supply of their products so they can respond quickly to demand.

The pain is being passed up the value chain

The global pandemic hit brands and retailers at such velocity at that the impact was soon felt up the value chain.

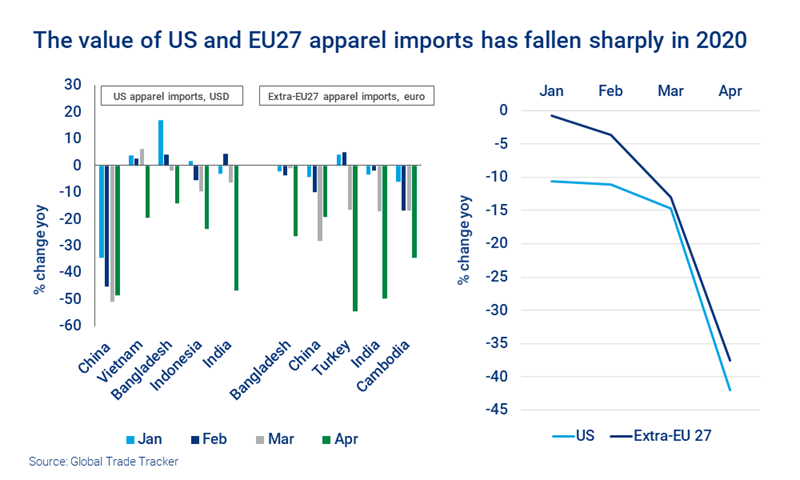

The USD value of apparel imports into the US was down 19% in the four months to April, year-on-year, and a massive 42% in April alone. The situation is very similar in Europe, where the euro value of extra-EU27 apparel imports dropped by around 13% in the first four months of the year, compared with the same period in 2019. In April alone, the decline was 38% year-on-year.

Fibres facility operating rates have collapsed with this sharp reduction in demand. Lockdown policies led to some total stops, and in June – as restrictions generally receded – operating rates of less than 50% could be seen in markets as diverse as India, the US and Taiwan. Textile plants are now holding plenty of unsold stock that can’t be countered even with heavy price discounting.

The combination of a crushing demand shock, with gradually rising raw materials prices (albeit from a low start) is now causing acute financial distress across the value chain.

Pressing questions for the apparel industry

The global pandemic is still an evolving story. But it’s already clear that the apparel industry faces an existential crisis.

The full insight considers pressing questions, including:

- Do unsustainable finances rule out sustainable behaviour? The apparel industry’s commitment to sustainable practices is being sorely tested. How are brands responding?

- When will consumer habits begin to return to ‘normal’? Is consumer confidence recovering in China, and what could that mean for the rest of the world?

- When will fibres demand recover? Our current projection for global all fibres demand in 2020 is a decline of around 8% compared with 2019. When will volumes return to 2019 levels?

Fill in the form at the top of the page to read this complimentary insight in full.