Discuss your challenges with our solutions experts

Nuclear’s massive net zero growth opportunity

How the SMR pipeline is shaping up after NuScale’s cancellation

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

David Brown

Director, Energy Transition Practice

David Brown

Director, Energy Transition Practice

David is a key author of our Energy Transition Outlook and Accelerated Energy Transition Scenarios.

Latest articles by David

-

Opinion

Energy priorities of House Republicans come out in full force

-

Opinion

The new landscape for gas-fired power: turbocharged or turbo lag?

-

The Edge

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Americas

-

Opinion

The federal government steps up support for nuclear power

-

Opinion

The impact of Republican control on US energy policy and the IRA

Small modular nuclear reactors (SMRs) should play a key role in achieving net zero by 2050. Yet the cancellation in November 2023 of NuScale’s Carbon Free Power Project bore many of the hallmarks of failed large-scale nuclear plants of recent decades, not least rising costs. Is it a killer blow to this nascent energy segment or merely a road bump? I asked David Brown, Director, Energy Transition Service, who tracks the progress of SMR projects globally.

Was the cancellation a mortal blow to SMRs?

Far from it – the SMR pipeline continues to grow, reaching 22 GW in Q1 2024, up 65%, or 8.9 GW, since 2021 and signalling global investment close to US$176 billion. While NuScale’s Clean Power Project cancellation sent shockwaves through the SMR industry, the sector is still very much in the mix as one of the emerging technologies the world needs to realise net zero.

In fact, not long after NuScale cancelled its Utah project, at COP28 in the UAE, 22 countries agreed to triple nuclear capacity by 2050, from around 400 GW to 1,200 GW. And, in WoodMac’s net zero scenario, SMRs account for almost half the 770 GW increase in total nuclear capacity, implying a fifteen-fold increase in the pipeline – a massive growth opportunity for developers to seize. We expect SMRs to begin contributing to the energy mix by the mid-2030s.

Who is leading the SMR charge?

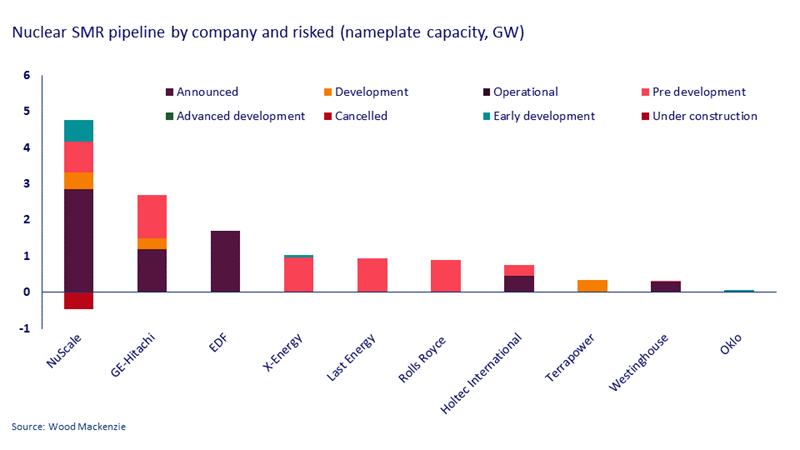

The US has more than twice as many projects as any other market, a 30% share of the global risked pipeline. Poland, Canada, the UK and South Korea round out the top five. Among developers, NuScale is by a distance the biggest, with 4.7 GW of projects, mostly US-based. GE-Hitachi and EDF sit second and third, with pipelines less than half of NuScale’s.

The quality of the pipeline also matters. GE-Hitachi has the largest pre-development pipeline globally, centred on its projects with Ontario Power Generation in Canada and the Tennessee Valley Authority in the US. SMR project developers X-Energy, Last Energy, Rolls Royce and TerraPower are other significant players active in North America or Europe.

What’s driving demand for nuclear output, including SMRs?

One big dynamic is customers requiring zero emissions and 24/7 power, both of which SMRs are designed to deliver. After flatlining for 15 years, power demand growth is surging in some US locations, driven by data centres, transport electrification and manufacturing expansion. Amazon has purchased a data centre powered by conventional nuclear, a positive sign for SMRs in the technology sector. That SMRs can be built in stages as demand expands is an added boost. In the industrial sector, Dow is exploring a reactor design with X-Energy in Texas to provide stable baseload power and zero-carbon industrial heat.

Timing matters, too. Utilities that have announced net zero goals have to start making investment plans soon – many are already behind schedule. With coal phase-outs looming large, PacificCorp is one utility to watch as it considers TerraPower’s SMR design.

Where will SMR growth take off?

The US will continue to be a key growth market, with projects supported by the investment tax credits and production tax credits enshrined in the Inflation Reduction Act. The EU Net Zero Industry Act, proposed last year, includes nuclear power in the region's strategy framework to achieve net zero. We expect further pipeline announcements on SMR projects from Westinghouse, Rolls Royce and EDF, all of whose portfolios are underweight in Europe.

Similarly, Asia’s SMR pipeline is small and needs to build momentum in the next 10 to 15 years. We estimate 180 GW of SMR capacity is required to put Asia on a net zero pathway. With Japan’s commitment to nuclear uncertain, much depends on policy decisions in China and South Korea.

What’s the biggest challenge for SMRs?

The cloud perennially hanging over developers and investors is costs. The hope is that SMRs break the mould of conventional nuclear projects of the last two decades and developers deliver a product with more controllable and predictable costs. We expect first-of-a-kind SMRs to cost around US$180/MWh, falling by 40% to US$100/MWh by 2030, driven by innovation and scaling up.

There are four must-haves for SMRs. First, investors will need to have a multi-decade time horizon as cost savings will come through over time. Second, government support needs to focus on tax breaks, faster-permitting timelines and government-backed offtake. Third, governments need to ensure investment in uranium supply and enrichment capacity. The wild price swings in the uranium market over the last 12 months are a risk to SMR project development. Lastly, and critically, customers will need to be realistic about the cost of 24/7, zero-emissions power.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.