Hydrogen: the outlook to 2050

Drawing from our strategic planning outlook, we offer five key things to know about how the market will develop for this versatile gas

2 minute read

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray is responsible for Wood Mackenzie’s global coverage across the hydrogen value chain.

Latest articles by Murray

-

Featured

Hydrogen: 5 things to look for in 2026

-

Opinion

eBook | Overcoming the challenges around hydrogen deployment

-

The Edge

Securing offtake for green hydrogen

-

Opinion

Hydrogen: the outlook to 2050

-

Opinion

Our top takeaways from the World Hydrogen Summit

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what utilities and developers need to know

Monica Trilho

Research Analyst – Hydrogen & Derivatives

Monica Trilho

Research Analyst – Hydrogen & Derivatives

Mónica is a hydrogen-focused research analyst for the Power & Renewables department.

Latest articles by Monica

-

Opinion

Enforcement and investment: how RED III is shaping the hydrogen market in the EU

-

Opinion

Hydrogen: the outlook to 2050

-

Opinion

Our top takeaways from the World Hydrogen Summit

-

Opinion

Hydrogen conference 2024: our biggest takeaways

-

Opinion

Our key takeaways from the Lisbon Energy Summit 2024

-

Opinion

Hydrogen costs in 2024: what you need to know

Tommaso Pellegrinelli

Senior Research Analyst, Hydrogen & Derivatives

Tommaso Pellegrinelli

Senior Research Analyst, Hydrogen & Derivatives

Tommaso provides long-term demand and supply outlooks, price forecasts, policy analysis and market tracking.

View Tommaso Pellegrinelli's full profileAlready an essential element of processes across a wide range of industries, hydrogen has immense potential as a tool to help decarbonise hard-to-abate sectors. But as a delayed transition scenario becomes more likely, what are the implications in terms of how the market will develop for this versatile gas?

In a recent webinar, we drew on our strategic planning outlook to present our views on the future for hydrogen and its derivatives, both in existing applications and new use cases. Fill out the form at the top of the page to access an extract from the webinar presentation – or read on for an overview of the themes covered.

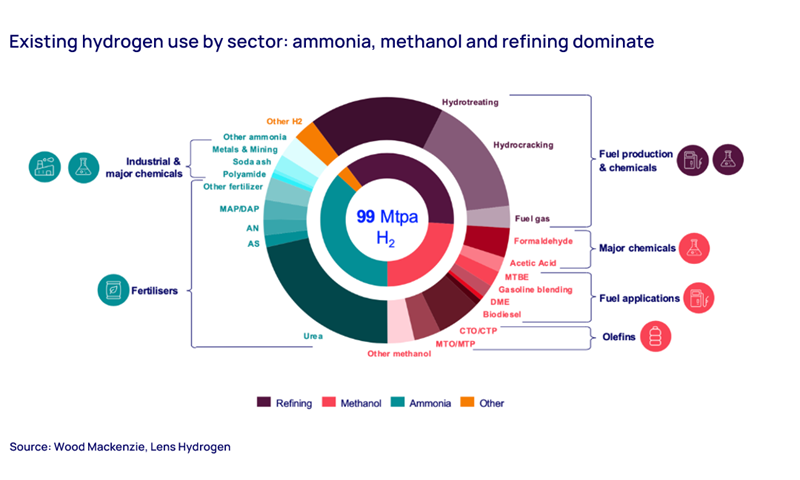

1. Hydrogen demand is currently dominated by three sectors

In today’s industry, hydrogen is mainly produced by reforming natural gas or by coal gasification. Wood Mackenzie’s Lens Hydrogen platform currently holds data on almost 1,400 carbon-intensive hydrogen production plants across the world, and our long-term outlooks cover 12 sectors that use it. However, existing demand is strongly focused on three key sectors.

In the refining sector, which accounts for around 36% of demand, hydrogen is used for sulphur removal and for cracking crude oil into lighter, more useful products. The second major current use case is for ammonia, which is mainly employed in making fertiliser such as urea, as well as in the production of textiles and explosives. The third main driver of hydrogen demand is methanol, which is a base ingredient in a wide range of chemicals and is also used to make polymers and as a fuel additive.

2. A third of traditional applications will use low-carbon hydrogen by 2050

Based on levels of progress with the energy transition globally, our long-term outlook for hydrogen demand has seen ongoing reductions over the past three years. We also have a bearish view on the potential of hydrogen penetration into some sectors, such as residential and some forms of transport, where we consider the use case to be relatively poor. However, we don’t forecast significant changes and declines in the potential of low-carbon hydrogen in the most relevant sectors, but rather a delay in volumes materialising. Our current view is that by 2050, 33% of traditional carbon-intensive hydrogen applications will have shifted to low-carbon supply.

3. New energy sectors will take up more than half of global hydrogen demand by 2050

Despite the potential for a slower-than-hoped-for energy transition, new low-carbon end-use sectors in energy are set to be a major source of future hydrogen demand. Our current analysis indicates that new energy sectors’ share of global hydrogen demand will rise from 5% in 2030 to 54% by 2050, as policy across different regions strongly supports the case for their decarbonisation.

Power generation will be the largest end-use sector for low-carbon hydrogen, accounting for 25% of new energy sectors demand. A range of policies including production and investment tax credits and tenders for contracts for difference are being introduced to help drive adoption. Incentives are already in place in several countries, including contracts for difference in Japan, South Korean auctions, the UK’s H2P (Hydrogen to Power) initiative and Germany’s 12 five-gigawatt hydrogen-ready gas turbine power plants.

Learn more

Don’t forget to fill in the form at the top of the page to learn the rest of the five key things to know about future hydrogen market developments, and to download your complimentary extract from the webinar presentation.