Get this complimentary article series in your inbox

1 minute read

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Latest articles by Julian

-

Opinion

Metals investment: the darkest hour is just before the dawn

-

Opinion

Ebook | How can the Super Region enable the energy transition?

-

The Edge

Can battery innovation accelerate the energy transition?

-

Featured

Have miners missed the boat to invest and get ahead of the energy transition?

-

Featured

Why the energy transition will be powered by metals

-

Featured

Could Big Energy and miners join forces to deliver a faster transition?

The Ukraine conflict has focused politicians’ minds on the need to reduce reliance on Russian hydrocarbon supply and ensure greater energy security. This goes hand-in-hand with an acceleration of the build-out of renewables and electrification of transport – both of which call for ready availability of energy transition metals.

But producers are finding themselves in between a rock and a hard place. On the one hand there is an acute awareness of the challenges and extended lead times of supply development. On the other, an acceleration of capital deployment is hampered by investor reticence and a focus on maximising dividend distribution.

Miners are currently unable to deliver the metal for a faster transition

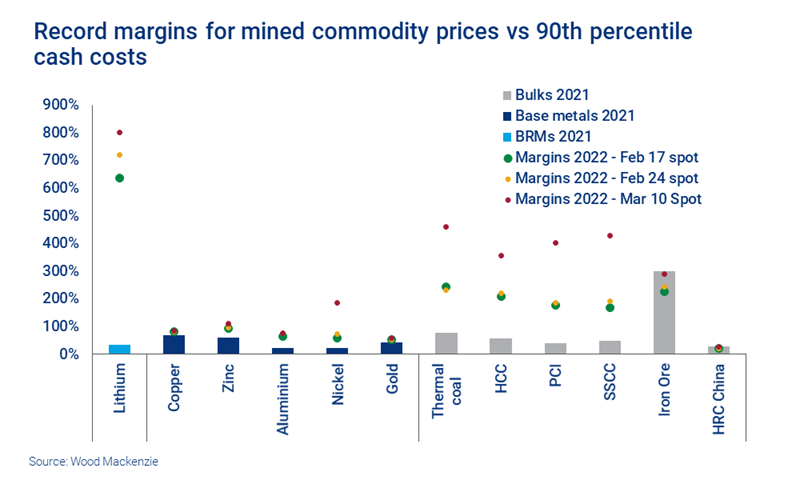

By any measure 2021 was a good year for miners, evidenced by strong market fundamentals and sharply higher prices. This fed through to record free cashflow generation and dividend distribution. But capex was constrained and well below levels needed to deliver a global warming pathway consistent with Paris goals.

So how might miners pull the rabbit out of the hat and tilt their businesses to energy transition growth while also delivering shareholder returns? One argument is that the only solution to the challenge of higher capital deployment is higher prices, to give miners the ability to maintain dividend distribution and increase capital deployment.

However, the evidence of 2021 stands contrary to this thesis. Miners are still not delivering growth to match needs, and nowhere near enough to deliver an accelerated transition. Higher prices are also feeding through to inflation and operating costs are on the rise, which will limit margin expansion. The key question is whether cost drag, cost inflation that lags that of prices, ensures that higher prices feed through to higher margins. The answer looks to be no: at the top of the cost curve we’re seeing smelters in Europe, for example, exposed to spot energy inputs curtail output, despite record prices.

The question of whether dividend distribution remains a fixed percentage of free cashflow also needs to be addressed. Many miners are distributing around 60% to shareholders with 40% for sustaining and growing the business. If the percentage remains fixed, then free cashflow will have to expand massively to allow capex to rise substantially. My suspicion is that this is unlikely. Shareholders would have to agree to cap their take to allow the business to fund faster capex deployment.

More carrot needed to drive decarbonisation

For miners, the decarbonisation journey has so far been defined by a big stick approach: the imposition or threat of carbon taxes, emissions caps and emissions trading schemes (ETS). The reward for decarbonising the value chain comes from regulatory compliance, ESG-focused shareholders and lenders that link decarbonisation to terms because they have made the same commitments.

Given that the energy transition cannot be delivered without metals, I wonder whether there is a large carrot that could be applied, rather than just a big stick. This carrot could take the form of credits (perhaps tax credits) mandated by government to reflect the decarbonisation that is enabled by the deployment of metals in low carbon power generation, storage, transmission and use. This would require an assessment of the carbon saving associated with the deployment of an individual commodity over its lifetime.

This Scope 4 emissions analysis would need to be certified and warranted, and assessed in addition to Scope 1-3. Patently, a structure where operators could forego decarbonisation of their supply chain because the Scope 4 benefit dwarfed Scope 1-3 reductions would be unpalatable. But I believe that providing investors and their companies with a financial credit for enabling the acceleration of the energy transition is necessary. It could be the mechanism that will enable miners to deploy the capital required.

Get unique views on metals and mining

This article is part of a regular series exploring opportunities and challenges in the world of metals and mining. To make sure you don't miss out, fill in the form at the top of the page to get this complimentary series in your inbox.