Oil and gas: a risky business

How can investors evaluate the changing oil and gas risk landscape? And what does it mean for valuations? We outline a differentiated approach that evolves as the industry adapts to a zero-carbon reality

1 minute read

Ian Thom

Research Director, Upstream

Ian Thom

Research Director, Upstream

Ian brings 18 years of experience to his role as head of regional analysis for Europe, Russian, Caspian and Africa

Latest articles by Ian

-

Opinion

Video | Lens Emissions: Africa’s oil – legacy fields vs low-carbon future

-

Opinion

Namibia faces setback as Shell downgrades oil discoveries

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

ADNOC acquires stake in Rovuma LNG from Galp

-

Opinion

Global upstream: the biggest topics

-

Opinion

Africa’s Energy Hotspots – three trends that will shape the next decade of African energy

Oil and gas faces an existential crisis as global efforts to reduce carbon emissions gather strength and pace. In this new paradigm, definition and assessment of risk is critical.

Risk has been inherent in oil and gas investment since the first wells were drilled. But the risks facing the industry are in many ways greater now than ever before as carbon risk and expectations of peak demand become critical.

Across the world, policies and regulations for development, operations and financing are becoming increasingly hostile to fossil fuels. That’s while renewable energy is becoming seriously competitive and scalable.

In this new paradigm, it’s critical to accurately define and measure risk.

Oil and gas has unique risks as a resource-producing capital-intensive industry

For investors, risk and return are two sides of the same coin. An asset with a stable, predictable cash flow requires a lower return than a riskier asset.

But there are big differences in risk profile between different hydrocarbon assets. Not all oil and gas projects are the same.

A more nuanced method should be applied as the industry adapts to a new reality

There are various ways to evaluate risks, and each has a different effect on valuation.

For example, discounted cash flow valuations often use a standard discount rate of 10%. For benchmarking purposes, 10% has stood the test of time in upstream oil and gas.

While discounting all assets at that rate is ideal for benchmarking, it struggles to communicate the true value of assets with very different risk profiles. And asset risk can easily become disconnected from a standard rate.

That’s where risk-adjusted discount rates – where a premium is applied to reflect additional asset risk – come in. When it comes to the valuation of risky assets, this method has real advantages.

How could a differentiated approach affect asset and company valuations? Our insight considers four main scenarios where markets could start to take a more nuanced view of oil and gas risks. We also track the potential impact of those scenarios on the Majors’ portfolios. Fill in the form to read the full report.

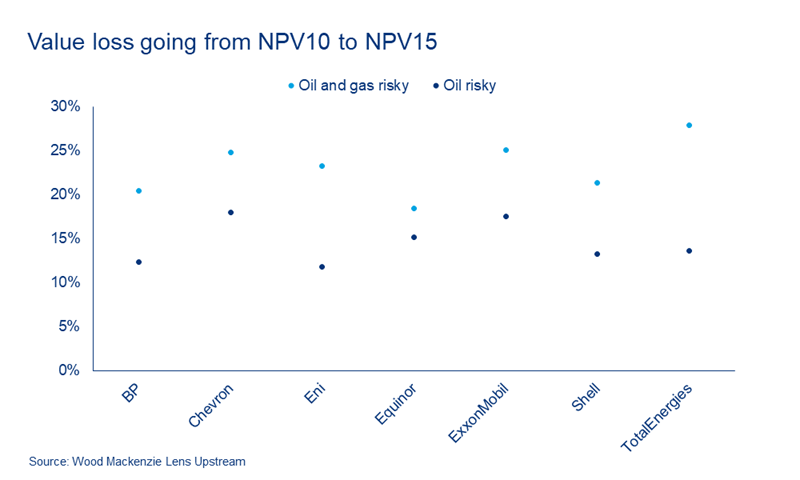

Weighing oil versus gas risk

One scenario we consider is if oil is deemed riskier than gas, which is viewed as a critical fuel for the energy transition.

Assuming gas has a safer outlook with a strong market growth and less pricing downside, oil assets could be discounted at 15%; gas at 10%.

Fill in the form to access the insight for more on which of the Majors’ portfolios are weighted in favour of gas and how that impacts risk.

Factoring in the energy transition

Country risk adjusted discount rates are often applied in valuation: for example, Norway is treated as lower risk than Nigeria.

However, the reality is more complex. Emerging risks around carbon policy and climate litigation complicate matters. Risks in traditionally low political risk countries are growing.

And as the energy transition progresses, fiscal and regulatory change will materially influence corporate success.

Better valuations for investments

When it comes to valuing risky assets for transactions, it makes sense for the valuation to reflect specific risks, especially as scarce investment seeks out the most advantaged resources.

Investors don’t expect the same return for a producing asset with a strong market position in a stable political environment as they do for an undeveloped high-carbon asset in a risky province.

Advantaged assets should command a premium. A differentiated approach to measuring risk will help to achieve that.

Fill in the form at the top of the page to download the full insight, where we discuss:

- Why risk adjusted discount rates are useful for investors

- Does the tried and tested 10% discount rate work in all scenarios?

- Which Major is best placed for the risky outlook?