Prices, FIDs and the energy transition: three key factors for global LNG

1 minute read

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo brings extensive knowledge of the entire gas industry value chain to his role leading gas and LNG consulting.

Latest articles by Massimo

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Gas, LNG & The Future of Energy: investment momentum builds in a volatile market

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Upside pressure mounts on US gas prices

-

Opinion

Video | Lens Gas & LNG: Will Russian gas and LNG come back?

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

The gas and LNG industry is navigating through strong prices following the record lows through the pandemic. But there is uncertainty about the future. How long will strong prices last for? What is the outlook for LNG final investment decisions (FIDs)? How resilient is gas and LNG demand through the energy transition?

Read on for our view on these three key questions following the publication of our latest global gas outlook to 2050 forecast using our proprietary Global Gas Model Next Generation. To access a complimentary copy of the outlook report extract, fill out the form on the right.

Stronger for longer mid-term prices

The price recovery we forecasted in previous updates has accelerated, pointing towards stronger for longer LNG prices. The market was always going to rebalance. Limited LNG investments between 2015 and 2017 combined with increasing Asian LNG demand was set to reduce LNG availability to Europe, particularly around 2024. But three elements have contrived to create a structurally tighter market through to 2025 than we previously anticipated.

Firstly, there is going to be even less LNG supply growth than we previously forecast. LNG projects under construction, including Shell’s LNG Canada and BP’s Tortue, had already signaled delays last year because of the Coronavirus. But the insurgency in Mozambique affecting TotalEnergies’ Area1 project, has compounded the issue. This means that several of the major projects which were sanctioned in 2018 and 2019 are now expected to come online after 2025.

Secondly, Asian LNG demand growth has accelerated. Access to new infrastructure and anti-pollution policies are providing increased support for LNG demand growth. China in particular stands out; the 14th Five-year Plan provides clearer scope for gas demand growth. With regasification capacity expected to double by 2025, we now forecast LNG demand to be almost 100 mmtpa by 2025, some 8 mmtpa more than our previous update.

Thirdly, booming coal and European carbon prices have shifted up the range in which European gas prices trade by US$4/mmbtu since the start of 2021. Coal prices might well come down from today’s highs, but carbon prices will increase further, sustaining gas prices at higher levels than our previous update.

The potential for more FIDs on new LNG supply

45 mmtpa of new LNG capacity has already taken FID in 2021, following investment decisions in Qatar (North Field East) and Russia (Baltic LNG). With much of the LNG sanctioned in 2018 and 2019 now expected post 2025, there is more LNG supply coming to market in the 2026-28 period than what might be required, setting the scene for renewed price pressure.

But the scale and timing of supply coming to market post 2025 remains unclear, given uncertainty around developments in Mozambique and timing of Baltic LNG, creating a window of opportunity for new LNG supply projects. US LNG developers have a clear advantage against competitors. It’s fast to market, some projects can deliver supply to market in under 30 months from sanctioning and their commercial structures are best suited to capitalise on high spot LNG prices. Picking winners remains difficult and as always will depend on projects’ ability to attract sponsors which will underpin financing.

Brownfield projects, including Freeport Train 4, Cameron LNG Train 4 and Corpus Christi Stage 3 (recently boosted by Cheniere’s GSA with Torumaline) remain attractive options, but are still finalising engineering studies. In contracts, shovel-ready greenfield projects, like Venture Global’s Plaquemines and Tellurian’s Driftwood LNG have had recent commercial success, positioning themselves as frontrunners.

The market will be watching whether Venture Global can deliver its first project, Calcasieu Pass, on schedule and whether the new commercial innovations proposed by Tellurian can be both attractive to customers and bankable. We expect between 20-30 mmtpa of new US LNG projects to take FID in the next two years.

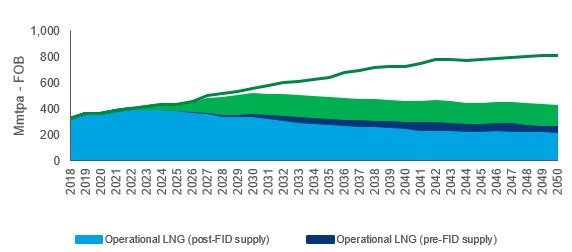

In the long term, investment opportunities in new LNG supply projects remain robust and Qatar and Russia are already talking about FID on their next development projects. Recent investment decisions might have well limited the market space for new LNG in the 2026-28 period and set the scene for renewed price pressure. But with global LNG demand expected to double over the next 20 years, and with LNG supply from some legacy projects continuing to decline, we anticipate the market will require more than 250 mmtpa of investments in new LNG supply by 2040.

The resilience of LNG demand through the energy transition

LNG demand in our base case view results in CO2 emissions consistent with temperature rise above 2.5 °C. We have also developed an alternative scenario considering an accelerated energy transition resulting in temperature rise of 2 °C, in line with the Paris Agreement.

Under our scenario, LNG demand remains resilient. A stronger push to reduce CO2 emissions globally accelerates reduction in gas demand in Japan and results in lower gas demand growth in South Korea and China, with demand peaking around 2035. However, scope for reducing reliance on coal continues to provide headroom for gas demand to increase in developing markets in south and southeast Asia, even as renewables investments ramp up.

Our view of global LNG demand in the AET-2 scenario is some 100 mmtpa lower than our base case by 2040, but one that still requires investments for 150 mmtpa of new LNG supply.

The outlook for LNG investments post 2040 looks less robust both in our base case and the AET-2 scenario. As scope for coal to gas switching reduces, renewable investments scale up and electrification and green hydrogen challenge the role of natural gas in industry and heating, there is limited scope for gas demand increase. Our view of LNG demand in the base case is one that grows by 1.2% only, limiting requirements of new LNG supply to 110 mmtpa between 2040 and 2050. Under our AET-2 scenario, LNG demand remains flat between 2040 and 2050, negating the need for new LNG supply developments altogether. The next 20 years continue to look bright for LNG investments, but post 2040 clouds are starting to mount.

Find out more information on our global gas outlook to 2050 using Global Gas Model Next Generation, and view the key takeaways by filling out the form at the top of this page to access the report extract.