与我们分析师联系

The making of a Megamajor – ExxonMobil acquires Pioneer Natural Resources

Our experts discuss what this means for ExxonMobil and other key takeaways from the deal

4 minute read

Tom Ellacott

Senior Vice President, Corporate Research

Tom Ellacott

Senior Vice President, Corporate Research

Tom leads our corporate thought leadership, drawing on more than 20 years' industry knowledge.

Latest articles by Tom

-

The Edge

Majors' capital allocation in a stuttering energy transition

-

Featured

Corporate oil & gas 2025 outlook

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

Can ExxonMobil make attractive returns from its US CCUS portfolio?

-

Opinion

How do integrated companies position themselves in the changing downstream landscape?

Robert Clarke

Vice President, Upstream Research

Robert Clarke

Vice President, Upstream Research

Robert leads our US onshore research, with a particular focus on the evolution of the tight oil sector.

Latest articles by Robert

-

The Edge

US Lower 48 upstream: the US Majors’ long-term strategic advantage

-

Opinion

Video | Tariff turmoil: how big a cost hit will US oil and gas operators take?

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

Global upstream update: oil supply questions and portfolio resets

-

The Edge

Three factors driving US liquids production to new heights

-

Opinion

What's new in global upstream

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Global upstream update: diverging development strategies in Latin America, investment at risk in Africa, and Kazakhstan supply tensions explained

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

David Clark

Vice President, Corporate Research

David Clark

Vice President, Corporate Research

Latest articles by David

-

The Edge

What comes after the Permian for IOCs?

-

Opinion

What does the Chevron-Hess deal mean for oil and gas?

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

The making of a Megamajor – ExxonMobil acquires Pioneer Natural Resources

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

-

Editorial

US Independents: cash is king in “stay flat” mode

Matt Woodson

Principal Analyst, US Lower 48

Matt Woodson

Principal Analyst, US Lower 48

Matt works on the US Upstream research team with a focus on company asset modelling.

Latest articles by Matt

-

Opinion

US Lower 48: 4 things to look for in 2024

-

Opinion

The making of a Megamajor – ExxonMobil acquires Pioneer Natural Resources

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

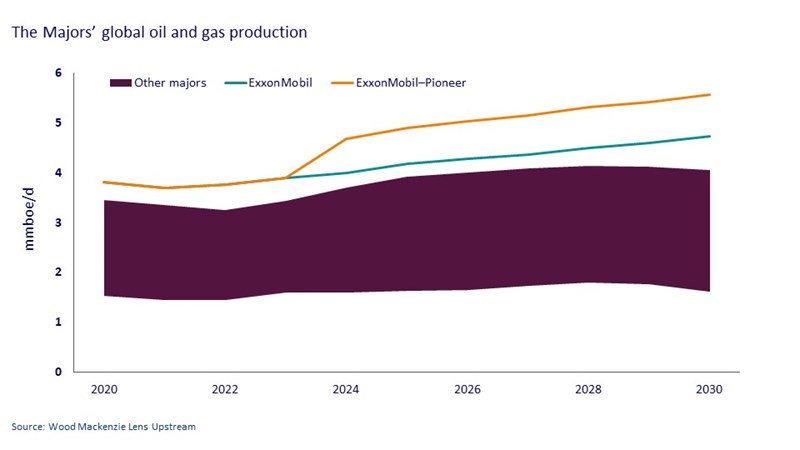

We predicted several years ago that Big Oil would get bigger, highlighting ExxonMobil as a likely aggregator in US tight oil. Yesterday, the company announced the acquisition of Permian powerhouse Pioneer Natural Resources for US$64.5 billion. This is the largest upstream deal, in nominal terms, since Shell acquired BG for US$82 billion in 2015.

With one swoop of equity, ExxonMobil gains over 700,000 boe/d of Midland Basin production, adds US$5 billion of annual free cash flow, establishes a Permian resource base of over 16 billion boe and creates the world’s largest tight oil player, leapfrogging the leadership Chevron gained when it added PDC.

This landmark move is far from counter-cyclical and is something very few of ExxonMobil’s peers could do. A massive oil deal that demonstrates oil demand and price bullishness, the company will now be in a peer group of one: the industry’s first Megamajor.

ExxonMobil secures decades of supply for its growing integrated full value-chain infrastructure that stretches from the Permian to the Gulf Coast – including midstream, refining, petrochemicals, carbon management, LNG and commodity exports.

It is also a deal done from a position of strength – an acquisition of choice rather than of necessity. ExxonMobil already has one of the strongest oil and gas production growth outlooks this decade, supported by an opportunity-rich upstream portfolio.

On the day of the announcement, our Corporate, M&A, and Lower 48 Upstream teams published a 'Top 10 takeaways' Inform to our customers. Continue reading below for a summary of a few of those key takeaways.

1. Driving portfolio improvement across the board through advantaged barrels

Pioneer’s upstream operating cash margins over the next five years are 20% higher than ExxonMobil’s global upstream average. Wells payback in less than 24 months, driving stellar returns and some of the lowest breakevens in the sector. Pioneer’s Scope 1 and 2 emissions intensity is also 75% lower than ExxonMobil’s global upstream average over the next five years in our Emissions Benchmarking Tool.

ExxonMobil estimates the acquisition will increase its exposure to short-cycle barrels from 28% to over 40%. This step-change in flexibility will help the company manage future volatility in what’s sure to be a bumpy ride through the energy transition. Domestic, short payback assets are also one of the best tools to manage heightened geopolitical risk.

2. Increasing upstream portfolio concentration around the Permian

This deal will meaningfully increase ExxonMobil’s upstream portfolio concentration. The Permian would move from roughly 30% of the company’s total upstream value to over 40%. Assuming a 1 January 2024 deal close, we estimate that the basin will account for about approximately 37% of ExxonMobil’s upstream operating cash flow in 2024. That is higher than Chevron (28%) and only a bit below ConocoPhillips (41%).

ExxonMobil had one of the most diversified upstream profiles prior to the deal. With this acquisition, the company’s asset-level upstream operating cash flow concentration exceeds Chevron's. But the scale of the company's other businesses across the value chain (midstream, refining, marketing, petrochemicals, low carbon) provide substantial diversification ballast, which differentiates it from its US peer.

3. Global tight oil leadership

ExxonMobil favours peer-leading scale in important basins, and with this move it locks-up a dominant position in the Permian with more than 1.4 million mostly contiguous acres and associated infrastructure. The blocky leases will be the size other shale players can only dream of.

The combined portfolio has enough duration for ExxonMobil to be a standout leader in global tight oil. Pro-forma, over the next decade, it could produce over 10% of global tight oil on a boe basis.

4. Ripple effects – the return of Permania?

This deal has implications for both the shale sector and the Majors. US Independents will face some big strategic decisions. Selling out is one way of solving the portfolio challenges the US Independents face. And if the leader of the pack decides to sell up rather than consolidate, what does that mean for other players with weaker portfolios and market ratings?

The market may rerate other Large Caps with Permian inventory and leading capital efficiency metrics. E&Ps like Diamondback, Permian Resources and Matador are now hotter acquisition targets. Demand for short-cycle resource brings EOG, Devon, and Marathon into play as well, especially considering the premium ExxonMobil is paying.

Chevron and ConocoPhillips may respond – for the right price. But the European Majors have much less room to manoeuvre due to discounted equity and stakeholder pressure to decarbonise. BP could be a wildcard, with BPX's refreshed growth strategy part of BP's pullback from shrinking its upstream business. Shell is also leaning back into upstream, which would suggest the Majors' strategies are aligning again. But does ExxonMobil's landmark transaction mark a new phase of increasing strategic differentiation between the US and European Majors? We think so.

If you have questions for our industry experts or would like to know more about our upstream M&A solutions, get in touch using the form at the top of the page.