Tracking the hydrogen market: from policy to project pipeline

A slowdown in the hydrogen project pipeline at the end of 2022 was counterbalanced by record electrolyser manufacturing announcements

4 minute read

Flor Lucia De la Cruz

Principal Consultant, Asia Pacific Power and Renewables Consulting

Flor Lucia De la Cruz

Principal Consultant, Asia Pacific Power and Renewables Consulting

Flor is a subject matter expert in hydrogen and emerging technologies, working for our Energy Transition Practice.

Latest articles by Flor Lucia

-

The Edge

Hydrogen: how carbon intensity rules can muddy the waters

-

Opinion

Australia’s energy revolution: the promise of battery storage and hydrogen

-

Opinion

Tracking the hydrogen market: from policy to project pipeline

-

Opinion

Decoding the hydrogen rainbow

-

Opinion

Hydrogen: the US$600 billion investment opportunity

-

Featured

Will CCUS and hydrogen live up to the hype in 2022? | 2022 Outlook

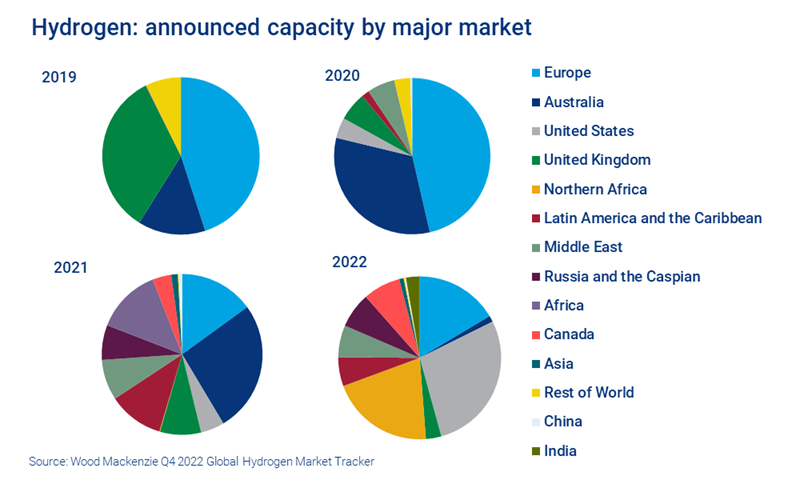

Low-carbon hydrogen project capacity announcements continued to grow in scale and geographical diversity in 2022. After a record 12 Mtpa of project capacity announcements in Q1, total announced capacity reached 71.4 Mpta in 2022. However, a sluggish Q4 meant that 2022 fell just 3 Mtpa short of becoming a record year.

The year was marked by the energy crisis and a slew of policy announcements, leading to a plunge in the number of project announcements. Only 19 low-carbon projects were announced in the last quarter of 2022, with a total of 0.96 Mtpa in hydrogen production – the fewest since mid-2020. No mega projects were announced from October to December either.

But, of course, hydrogen is one of the hottest topics in the energy transition space – broader momentum continued to build as existing projects took major steps.

This article draws on our Q4 2022 Global Hydrogen Market Tracker, available via our Energy Transition Service.

Not quite a record year for hydrogen

The US led project announcements in 2022 with a total of 7.17 Mtpa. Underpinned by COP27, which was held in Sharm El Sheikh, and eyeing export opportunities to Europe, Egypt announced 5.62 Mtpa, 70% of it for green ammonia production.

Green ammonia emerged as the derivative of choice last year, capturing 27% of announcements.

On the project front, the construction of Shell’s Holland Hydrogen I (200 MWe) began in July, while OCI Blue Ammonia began in December. BP purchased a majority stake in the US$70 bn Asian Renewable Energy Hub. In the US, the first mega-projects were announced with GHI announcing Hydrogen City (3 Mtpa) and SoCalGas announcing Angeles Link (around 20 GWe).

Despite uncertainty around government support, developers sought offtake and financing to de-risk their projects. NEOM, for instance, announced that it had secured financing from the Saudi Industrial Development Fund (SIDF) and National Infrastructure Fund (NIF). The project targets financial close in early 2023.

Electrolyser manufacturing to the rescue

The slowdown in project announcements was counterbalanced by record electrolyser manufacturing announcements.

A year ago, electrolyser manufacturing looked like a bottleneck. That no longer seems to be the case, with a record 45 GWe announced in 2022. Interestingly, while 95% of operational manufacturing capacity is in Europe, China and the US, 41% of announcements are heading to Africa.

At COP27, DSE – a consortium of 22 European companies focused on hydrogen project development in Africa – announced plans for the largest gigafactory to date. The consortium plans to produce 30 GWe per year in electrolysis capacity in Namibia by 2030. DSE said it was finalising an initial investment contract worth US$2.5 billion with the government for a gigafactory to be developed in several phases. It will manufacture both polymer electrolyte membrane (PEM) and alkaline electrolysers.

However, the split between alkaline and PEM has not been disclosed nor has the electrolyser OEM or the names of the companies making up the consortium. The plans are very ambitious and the lack of concrete details makes the facility highly speculative.

John Cockerill, meanwhile, announced ambitious plans to produce 8 GWe around the world by 2025 and plans to produce up to 14 GWe of its high-pressure alkaline electrolysers in Morocco. Battolyser Systems announced a 1 GWe factory to produce its unique battery-electrolyser system.

Policy changes shift the hydrogen landscape

Policy-wise, hydrogen strategies continued to evolve and adapt to the market in 2022.

In May, the EU launched RePowerEU, setting more aggressive targets for 2030. The bloc aims to import 10 Mtpa of hydrogen, 4 Mtpa of that as ammonia. It also doubled its domestic hydrogen production to 10 Mtpa.

In July, the UK doubled its 2030 ambition to 10 GW and, for the first time, declared that at least half would come from electrolytic projects. In December, the Scottish Government published its Hydrogen Action Plan to support its ambitious target of 5 GW of hydrogen production by 2030 (about 0.45 Mtpa), growing to 25 GW by 2045.

Notably, Scotland is also targeting export opportunities to the rest of the UK and other European markets.

The Inflation Reduction Act has prompted some markets to develop similar incentives in an effort to remain competitive, and others to object.

Flor Lucia De la Cruz

Principal Consultant, Asia Pacific Power and Renewables Consulting

Flor is a subject matter expert in hydrogen and emerging technologies, working for our Energy Transition Practice.

Latest articles by Flor Lucia

-

The Edge

Hydrogen: how carbon intensity rules can muddy the waters

-

Opinion

Australia’s energy revolution: the promise of battery storage and hydrogen

-

Opinion

Tracking the hydrogen market: from policy to project pipeline

-

Opinion

Decoding the hydrogen rainbow

-

Opinion

Hydrogen: the US$600 billion investment opportunity

-

Featured

Will CCUS and hydrogen live up to the hype in 2022? | 2022 Outlook

The US passed the Inflation Reduction Act in August, announcing a 45V production tax credit (PTC). Qualifying hydrogen facilities can obtain a 10-year PTC of up to US$3/kg, the most generous tax incentive to date. The move has prompted some markets to develop similar incentives in an effort to remain competitive, and others to object.

Canada plans to develop a similar subsidy scheme with up to 40% in tax credits. The EU, in contrast, launched the US EU Task Force on the Inflation Reduction Act in October and has submitted an official response requesting a modification to the PTC to limit its potential effects on EU projects.

India’s National Hydrogen Mission set out the government's specific strategies for the short term (to 2030) and broad-strokes principles for the long term (10 years and beyond) for green hydrogen production. However, the government has scaled back the specific targets for refiners and fertiliser companies and instead created the Empowered Group (EG) to define new targets, to be notified in 2023-2024. The initial financial outlay for incentivising green hydrogen and green ammonia production is in the final stage of approval.

Keep track of the hydrogen market

For more on low-carbon hydrogen developments around the world, the Q4 2022 Global Hydrogen Market Tracker is available via our Energy Transition Service.

To receive future complimentary articles on this topic – and more – in your inbox, sign up for The Inside Track, our weekly round-up of news and views from our global teams.