Decoding the hydrogen rainbow

Do you know your green hydrogen from your blue, grey, black, brown, yellow, turquoise, white and pink?

Bridget van Dorsten

Principal Analyst, Hydrogen

Bridget van Dorsten

Principal Analyst, Hydrogen

Bridget is a hydrogen-focused principal analyst on our Energy Transition Practice.

Latest articles by Bridget

-

Opinion

Our top takeaways from the World Hydrogen Summit

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what utilities and developers need to know

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what industrial players need to know

-

Opinion

eBook | Investing in hydrogen from now to 2050: what you need to know

-

Opinion

European power in 2025: the pace, opportunities and challenges of the transition

-

Featured

Hydrogen 2025 outlook

Flor Lucia De la Cruz

Principal Consultant, Asia Pacific Power and Renewables Consulting

Flor Lucia De la Cruz

Principal Consultant, Asia Pacific Power and Renewables Consulting

Flor is a subject matter expert in hydrogen and emerging technologies, working for our Energy Transition Practice.

Latest articles by Flor Lucia

-

The Edge

Hydrogen: how carbon intensity rules can muddy the waters

-

Opinion

Australia’s energy revolution: the promise of battery storage and hydrogen

-

Opinion

Tracking the hydrogen market: from policy to project pipeline

-

Opinion

Decoding the hydrogen rainbow

-

Opinion

Hydrogen: the US$600 billion investment opportunity

-

Featured

Will CCUS and hydrogen live up to the hype in 2022? | 2022 Outlook

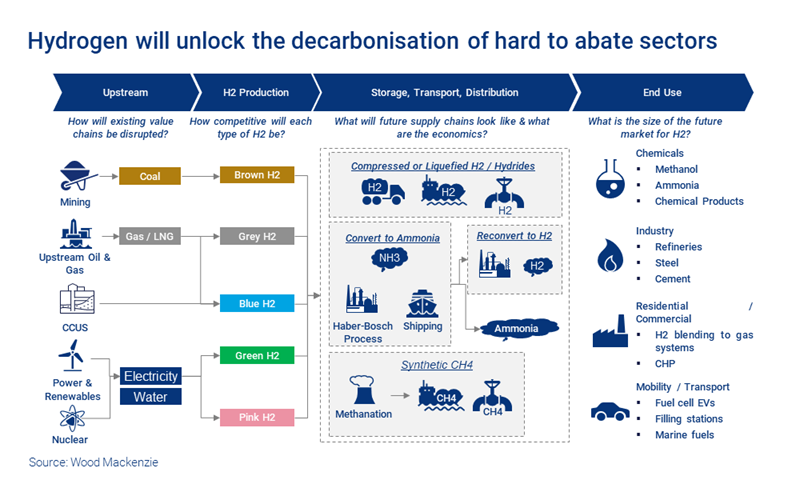

Hydrogen has huge potential as a fuel to help achieve a net zero future. It does not emit carbon when burned and offers a cleaner substitute to fossil fuels for power generation and heating. It’s a particularly attractive alternative for hard-to-decarbonise sectors, where replacements for fossil fuels are few and far between.

Hydrogen’s high energy density means it has huge potential to displace coal for greener steel production, for example. In the transport sector, it looks set for adoption in heavy-duty trucking, shipping and aviation, possibly through conversion into a synthetic fuel. It also has immense potential as a long-duration energy storage medium.

We forecast global demand for hydrogen to increase two- to sixfold between now and 2050. Under our Accelerated Energy Transition (AET-1.5) scenario, low-carbon hydrogen demand reaches as much as 649 million tonnes (Mt) by 2050, with almost 150 Mt of that traded on the seaborne market. That’s a massive opportunity.

But not all hydrogen is created equal – there is a veritable rainbow of variety. So, what type of hydrogen might you want to invest in? How do you tell your green hydrogen from your blue? What makes hydrogen grey? And what’s all this about pink, yellow and turquoise? Read our brief guide to decoding the hydrogen rainbow for an introduction.

Green hydrogen

Green hydrogen is the holy grail of the hydrogen world. It’s hydrogen produced using renewable energy and electrolysis, which means it does not produce any harmful emissions.

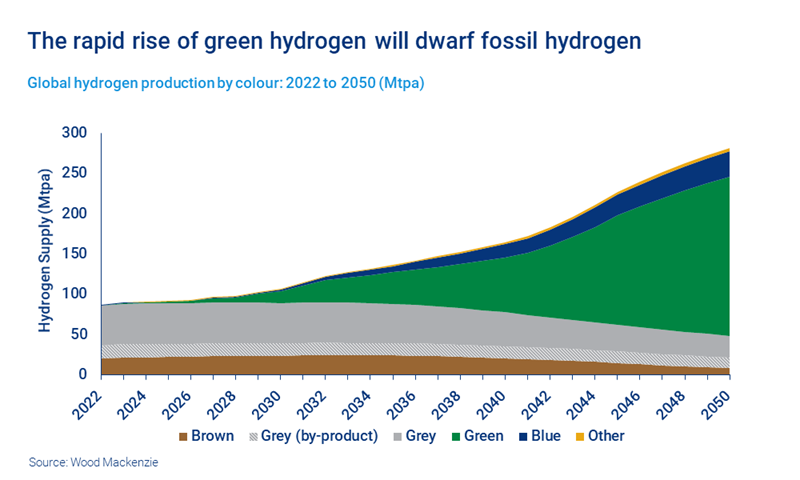

Of course, it’s not easy being green – production is currently expensive, but it will get easier as renewables prices fall and renewable power sources become more widespread. We expect the green hydrogen market to dwarf all others, so that they account for less than 20% of the total hydrogen market by 2050.

Blue hydrogen

Blue hydrogen is mainly produced from natural gas in a process called steam reforming (where gas meets steam and creates hydrogen). This process does also create carbon dioxide, which is what sets it apart from green hydrogen.

As blue hydrogen is merely a ‘low-carbon’ hydrogen, carbon capture and storage (CCS) is essential. Blue hydrogen is considerably cheaper to produce than green in countries like the US and Canada, which have cheap natural gas at the moment, though this is expected to change as renewable prices continue to come down.

Grey hydrogen

Grey hydrogen is hydrogen produced from steam methane reformers (SMRs) in the ammonia, refining and methanol sectors.

As a by-product, grey hydrogen isn’t produced from scratch and cannot be entirely substituted with low-carbon hydrogen. The 13 Mt of hydrogen currently produced by refineries will decline to about 11 Mt by 2050. This is due to shrinking oil demand and the evolution of more integrated refineries that consume more by-product hydrogen.

Black hydrogen

Black hydrogen is produced using black, bituminous coal – it’s the polar opposite of green hydrogen in terms of carbon emissions.

Brown hydrogen

A first cousin of black hydrogen, brown hydrogen is produced using brown coal, or lignite. It also releases significant carbon emissions. Indeed, so similar are the gaseous emissions of brown hydrogen to those of black hydrogen that the terms are sometimes used interchangeably to describe any hydrogen produced using fossil fuels.

Yellow hydrogen

Yellow hydrogen is the term used to describe hydrogen produced by electrolysis, fuelled by solar power. It’s up there with green hydrogen on the carbon-credential front – and indeed it could be argued that yellow is a shade of green on the hydrogen colour spectrum.

Countries such as Australia, with vast tracts of sun-drenched land and a proven track record in bringing complex energy projects to market, have massive potential for solar-powered hydrogen production.

Turquoise hydrogen

Turquoise hydrogen is the new kid on the block, created in a process called methane pyrolysis, which also creates solid carbon. Unlike blue hydrogen, therefore, there is no need for CCS to capture the resulting carbon, which can be used to make other products, such as fertiliser.

The process is still in the experimental stage and has yet to be proven at scale, though.

Pink hydrogen

Pink hydrogen, like green, is created by electrolysis, but powered by nuclear energy rather than renewables. Just to confuse things, it’s sometimes referred to as purple or red hydrogen.

White or gold hydrogen

Despite its colourful reputation, naturally-occurring hydrogen is actually colourless. Geological hydrogen, known as white or sometimes gold hydrogen, is produced in the earth’s crust and found in underground deposits, often through fracking. There is currently no large-scale strategy out there for tapping into this resource.

Time to ditch the rainbow?

The hydrogen rainbow is useful, up to a point, in facilitating conversations about the future of the industry. But is it time to ditch the rainbow and focus instead on carbon intensity? What happens with hydrogen produced via electrolysis but connected to the grid? If the grid is in Poland, which relies heavily on coal, or in Brazil, where there is a high renewables penetration, what is the carbon intensity of the hydrogen in each case?

There are different emissions associated with each grid, and those differences are becoming increasingly important in the way hydrogen is categorised. The Green Hydrogen Organisation launched its Green Hydrogen Standard in May 2022, for example. It requires projects to operate at <= 1 kg CO2e per kg H2 for a project to be certified under the scheme. The EU’s CertifHy is more lenient, with a 4.4 kgCO2e/kg H2 threshhold. However, the European Commission’s RePowerEU plan and associated delegated acts are likely to impact the current threshold under CertifHy, potentially lowering it in the future. Other countries are following this route and establishing hydrogen pathway emissions calculators and thresholds for ‘low-carbon’ or ‘clean’ hydrogen.

This focus on carbon intensity will continue to evolve. Emissions associated with conversion of hydrogen, transportation and re-conversion back to hydrogen should also be considered as part of a wider discussion about what truly ‘green’ hydrogen really looks like.

Keep pace with the evolution of hydrogen

Download our additonal insight from our global experts by filling in the form at the top of the page.