Sign up today to get the best of our expert insight in your inbox.

Gastech 2025: when will the music stop for US LNG?

Growth in LNG supply running up against concerns over Chinese demand

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

India’s energy challenge

-

The Edge

Is there still life in decarbonising hard-to-abate sectors?

-

The Edge

A wild week for gas markets

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

-

The Edge

Is Greenland Venezuela 2.0?

-

The Edge

Five themes shaping the energy world in 2026

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A wild week for gas markets

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

-

The Edge

Is Greenland Venezuela 2.0?

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Five key takeaways from COP30

-

The Edge

Can copper supply keep up with surging demand?

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo brings extensive knowledge of the entire gas industry value chain to his role leading gas and LNG consulting.

Latest articles by Massimo

-

The Edge

A wild week for gas markets

-

Featured

Gas & LNG: region-by-region predictions for 2026

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Gastech 2025: when will the music stop for US LNG?

-

Opinion

Asia’s LNG affordability challenge amid surging supply

-

The Edge

Could US LNG become a victim of its own success?

Frank Harris

Head of Global LNG Consulting

Frank Harris

Head of Global LNG Consulting

Frank is a recognised expert on the global LNG industry and leads our global consultancy practice in this area.

Latest articles by Frank

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Gastech 2025: when will the music stop for US LNG?

-

The Edge

Could US LNG become a victim of its own success?

-

The Edge

Taking the pulse of the global LNG industry

-

Opinion

Debating the future direction of the LNG market

-

The Edge

WoodMac’s Gas, LNG & Future of Energy conference – five key takeaways

Kristy Kramer

Head of LNG Strategy and Market Development

Kristy Kramer

Head of LNG Strategy and Market Development

Kristy brings over fifteen years of gas and energy industry experience to her role leading our Gas and LNG Consulting.

Latest articles by Kristy

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

Opinion

US LNG expansion: Balancing growth ambitions with oversupply risks

-

Opinion

Managing the nitrogen challenge in Permian gas

-

Opinion

How LNG and power are shaping US gas pipeline development

-

The Edge

Gastech 2025: when will the music stop for US LNG?

-

The Edge

Could US LNG become a victim of its own success?

Giles Farrer

Vice President Research, Commodities, Gas & LNG

Giles Farrer

Vice President Research, Commodities, Gas & LNG

Giles heads our LNG and gas asset research and manages our market-leading LNG Service & Tool and LNG Corporate Service.

Latest articles by Giles

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Gastech 2025: when will the music stop for US LNG?

-

Opinion

Debating the future direction of the LNG market

-

The Edge

Positioning for global LNG’s next big growth phase

-

Opinion

Third wave US LNG: a $100 billion opportunity

-

Opinion

LNG: seismic shifts as Russia/Ukraine conflict makes waves

Gastech 2025 revealed a clear consensus that gas is essential to ensuring stability in increasingly connected energy markets. The industry’s response is a seemingly unbridled investment push across the LNG value chain globally to ramp up supply and feed the predicted growth in demand over the next decade.

But the industry risks over-exuberance, particularly as the LNG ecosystem expands. Our team, just back from Gastech 2025 in Milan, shares its concerns that some cracks may be starting to show.

For US LNG developers, when will the music stop?

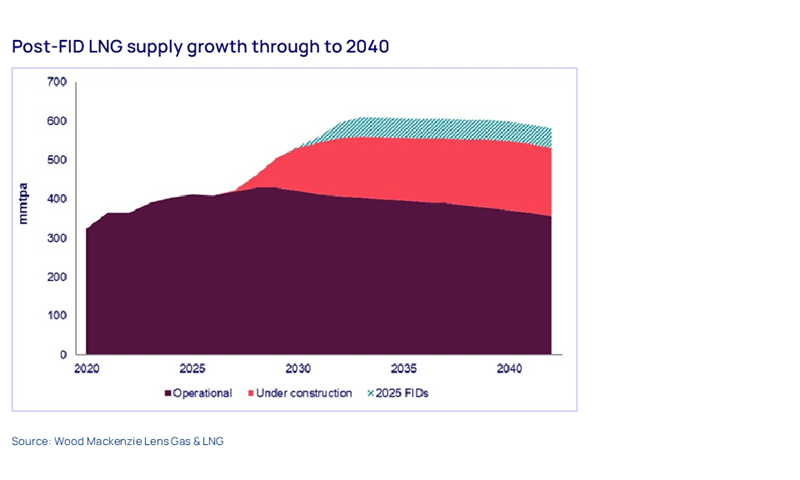

The US LNG bandwagon rolled into Milan exuding confidence, boosted by announcements both of new long-term contracts and yet more project final investment decisions. Chris Wright, the US Energy Secretary, and Doug Burgum, Secretary of the Interior, were in town to beat the drum of US energy dominance, putting LNG at the fore. Estimates of the volume of US LNG to be sanctioned this year alone have already headed higher, with more to come over the next 12 to 18 months. But the US LNG export party can’t go on forever, and the sheer volume of capacity up for sanction is starting to raise serious questions. Each project taking FID will make commercial sense in its own right, but collectively risk edging the market closer to oversupply.

Is the world’s biggest LNG market now its biggest headache?

Anticipated lower spot prices have long been expected to boost demand in Asia. Over the past two decades, China has risen to be the world’s largest LNG importer and remains the big hope to absorb much of the new LNG supply coming to market.

But worries over Chinese LNG demand are now audible. Overall energy demand in China has been weaker than expected this year, with LNG imports down 18% for the first eight months of 2025 compared to the same period last year. Looking further forward, China’s plan to construct the huge 60-GW Medog hydro project, progress towards additional Russian pipeline gas imports and its ongoing massive rollout of wind and solar capacity all pose structural risks to longer-term LNG demand growth.

Geopolitics front and centre for the LNG industry. Geopolitics and gas/LNG are increasingly interconnected. The Trump administration’s push for energy dominance is the sharp end.

As US dissatisfaction with Russia grows, we see a more determined effort by the White House to accelerate the complete shut-out of Russian gas and LNG into Europe, an outcome welcomed by European Commission President Ursula von der Leyen earlier this week. That creates more opportunity for US LNG in Europe, of course. For an administration committed to lowering prices for US consumers, targeting Russian gas and LNG exports to Europe – rather than Russian crude, which could spike oil prices – looks the more palatable option.

But geopolitics isn’t the sole domain of the US. Russia’s high-profile riposte has been twofold so far – the recent delivery of two Russian Arctic LNG-2 cargoes into China and Russia’s announcement of a binding Power of Siberia 2 ‘deal’ earlier this month. Whether US LNG or Russian pipeline gas, raised geopolitical uncertainty does little to alleviate existing concerns over supply concentration.

Identifying the winners and losers.

The numerous new entrants into LNG are creating a bigger, more diverse and more liquid market. Rapid change and increasing volatility will inevitably lead to winners and losers. US LNG offtakers could feel the pain of a future margin squeeze. At the same time, most US LNG project developers are relatively insulated, given the infrastructure-style commercial framework of US LNG liquefaction projects and fees. European consumers could be the biggest winners as prices soften after weathering the loss of further Russian imports, while Asian buyers with firm demand benefit from locking in long-term contracts at lower prices.

The huge pool of financing from both debt and equity markets also underpins confidence in the US gas and LNG story. With renewables constrained by the OBBBA and the Trump administration overtly pro-gas, debt and equity capital is lining up to support new projects. What surprised us at Gastech, however, were the first hints of scrutiny around financing new supply – debt finance looks relatively secure, but equity investors are increasingly attuned to the potential for margins to be squeezed by higher US gas prices and lower international spot prices.

Could the LNG industry benefit from a reality check?

Our numerous conversations in Milan around the emerging downside risks suggest it’s required as concerns of oversupply grow. This isn’t about bursting the LNG bubble – far from it. Rather, it’s aimed at keeping the industry match-fit to deliver the next phase of growth in an increasingly interconnected world.

Connected: Bringing predictability to the increasingly uncertain world of energy.

Diving deep into the themes of an increasingly interconnected world, we’re proud to launch Connected: Bringing predictability to the increasingly uncertain world of energy, a new book I co-authored with Wood Mackenzie CEO, Jason Liu. It brings together the ideas, challenges and solutions shaping the future of energy and captures the reality that our world and our industry are no longer siloed. Everything is connected. Markets. Commodities. Geopolitics. Data. Technology. And decision-making.

Find out more: Connected | Energy, Data & Analytics Book from WoodMac | Wood Mackenzie

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.