2019 in review: 5 trends that shook the petrochemical markets

As 2019 draws to a close we look at the trends that jolted the industry over the past year.

1 minute read

Petrochemicals has always been a cyclical industry. Participants are well accustomed to a certain amount of boom and bust. While the outlook in 2019 has been relatively upbeat there have been challenges to contend with.

On the one hand, petrochemicals remains an integral driver of future oil demand through the energy transition, with the fastest-growing share of the oil barrel. Many companies in the energy value chain have looked to increase their exposure as a result.

On the other, the war on plastic put parts of the industry in the headlines for all the wrong reasons, while more headwinds threatened its stability.

So, what shook the foundations of the petrochemical markets in 2019?

Fill in the form on this page for free access to the full insight.

Here are some of the highlights from our look at the last year in review:

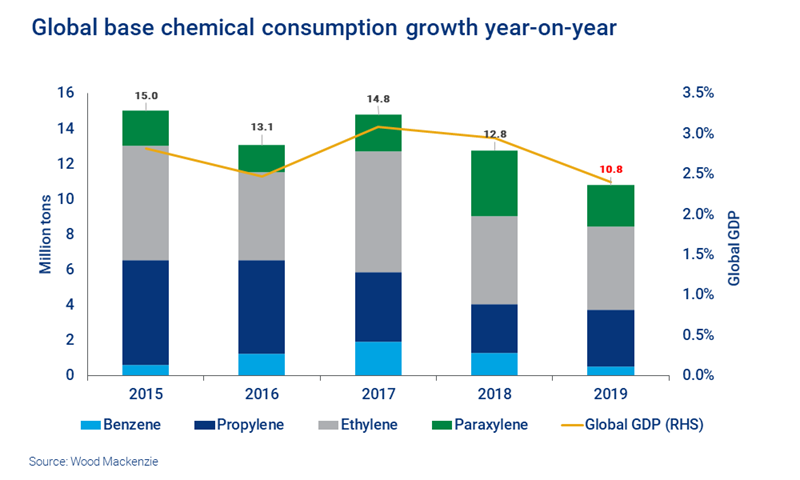

1. Global economy: lower GDP reduced petrochemicals growth

A lower GDP environment, driven partly by the US-China trade war, made its presence felt. We saw reduced consumption of base chemicals – the building blocks of the industry.

The impact varied across the value chain. However, there was a clear overall trend of lower petrochemical market growth in 2019, relative to recent history.

2. Oil and feedstock dynamics led to increased inter-competition

Crude oil prices remained within a fairly tight band of US$60-70 per barrel in 2019. Corresponding global supply-demand balances and prices for petrochemical feedstock were significantly influenced by upstream supply growth in the US and refinery operations, reflecting an increasingly interconnected global energy value chain. And competition between feedstocks grew considerably.

For example, the US steam cracking asset base has seen LPG compete with ethane into domestic production facilities. In Europe and Asia, LPG competed with naphtha in regional ethylene plants.

3. Global overcapacity: a supply-driven challenge

The global petrochemical industry is set to enter a period of overcapacity, relative to base level demand growth expectations. This will send operating rates for many base chemicals into a downturn.

This has its roots in the previous investment cycle, five to seven years ago. A period of generally rising operating rates and profitability led to top-of-cycle industry conditions. Today, the picture looks different. Ethylene, for example, is heading out of a 2017/2018 peak and we expect the downturn to persist until the middle of the next decade.

4. Plastics circularity: momentum started to build

Global pressure on use and disposal of plastic is having an unprecedented impact on the entire industry.

Much of the backlash is focused on packaging, but the long-term impact of a circular plastics economy also has real implications for the oil market. Virgin resin from petrochemical feedstock is one of the fastest-growing drivers of global oil demand.

Circular economy pledges have not yet had a major impact on virgin material consumption, but momentum is building with chemical companies and brands taking action. Shell, for example, recently announced its ambition to use a million tons of plastic waste a year in its chemical plants by 2025.

This is just the start of a growing trend. And the more plastics are reprocessed into virgin-like material, the more it will reduce the call for new production and capacity.

5. Technology evolution: two major shifts

We saw two major technology shifts in 2019, at opposite ends of the value chain.

The first was an increased focus on crude-oil-to-chemicals (COTC) technology. First generation assets traditionally convert around 15-20% of incoming crude oil into outgoing petrochemical products. Second generation assets – due soon in China – will double that. And in 2019, both Reliance and Saudi Aramco showed an active interest in third generation developments, where chemicals yield from oil could be around 70%.

The second shift centred on new technologies to tackle plastic waste. The focus moved from mechanical recycling towards more efficient chemical recycling. Several pilot plants have been developed in Europe, and while volumes are small that will change.

What's next for the global gas and LNG markets?

As the world gathers for Gastech 2023, US supply continues to play an increasing important and sometimes dynamic role in Global LNG markets. Energy security for nations both in Europe and Asia, as well as energy sufficiency to meet climate goals, both weigh on the need for continued growth of North American sourced LNG volumes – which in turn means a continued call for US Gas Production growth.

Rig counts are down. From a peak of 784 in November of 2022, latest Baker Hughes rig counts are down nearly 20% to ~630. Efficiencies continue to increase, and underlying declines also continue to flatten out. Though with gas in contango, our rig-based models forecast a return to production growth. In fact, our latest forecast of US gas production, based on this somewhat dynamic forward curve, calls for a growth to ~110 Bcfd by end of 2027, up ~9 Bcf from recent months’ production levels of ~101 Bcfd.

Want to read more? Fill in the form at the top of this page for your complimentary copy of our Gastech special gas and LNG round-up.