Energy transition metals: the ESG dilemma

Lithium, cobalt, graphite and rare earths face escalating demand – but meeting it calls for ESG quality as well as quantity

1 minute read

Suzanne Shaw

Head of Energy Transition & Battery Raw Materials

Suzanne Shaw

Head of Energy Transition & Battery Raw Materials

Suzanne specialises in commodities including cathode and precursor, lithium, cobalt, graphite, rare earths and lead.

Latest articles by Suzanne

-

Opinion

How will the new US Republican government reshape the global electric vehicle supply chain?

-

Opinion

Four key takeaways from LME 2024

-

Opinion

Three challenges to overseas expansion for the Chinese cathode sector

-

Opinion

What’s next for the EV and battery value chains?

-

Opinion

Battery raw materials: tracking key market dynamics

-

Opinion

Energy transition metals: the ESG dilemma

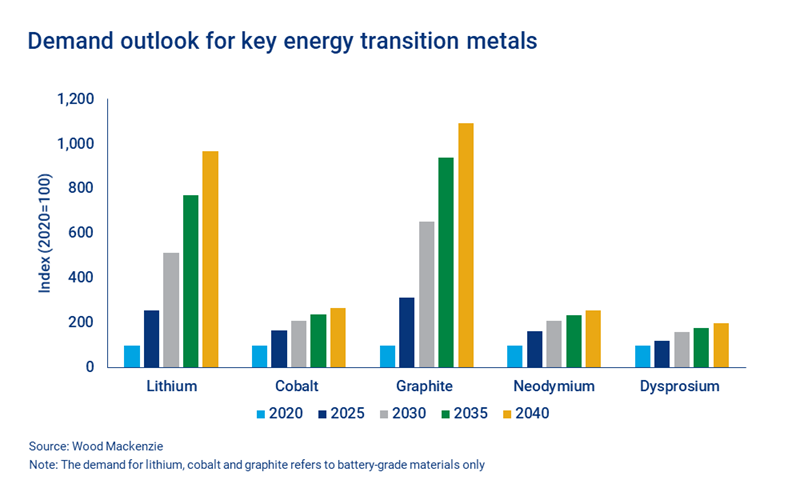

This is a time of unprecedented opportunity for energy transition metals. Lithium, cobalt, graphite and rare earths are crucial building blocks of a decarbonised world – but to move towards a truly sustainable future these sectors must tackle a significant environmental, social and governance (ESG) challenge.

The central dilemma is clear. Can vital energy transition metals markets ramp up production fast enough to satisfy demand, while also revolutionising supply chains to meet ever-more stringent ESG requirements?

In a recent webinar, we drew on insight from across our Lithium, Cobalt, Graphite and Rare Earths Research Suites to explore this topic in depth. Fill in the form to access a replay and read on for an introduction to some of the key supply chain challenges.

Graphite: hydrofluoric acid means the environmental stakes – and costs – are high

Battery anodes for electric vehicles (EVs) and energy storage systems rely on graphite for more than 90% of their raw materials. With no immediate, widescale alternative, ESG issues have come into sharper focus as consumers question the sustainability of existing supply chains.

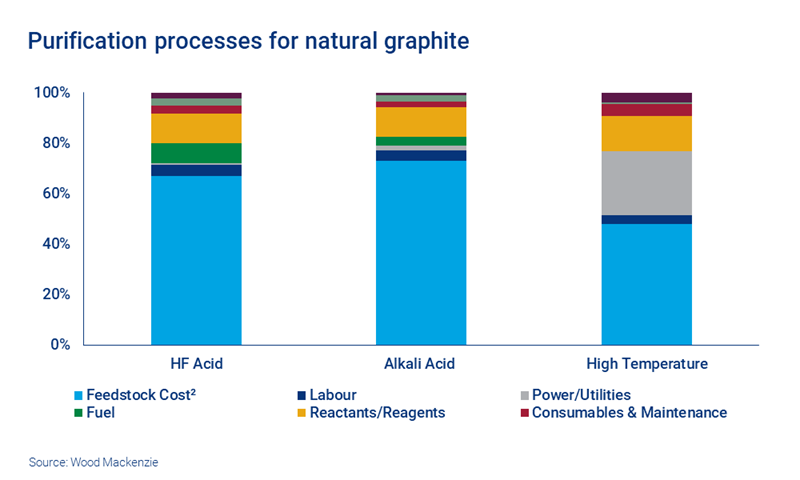

Natural graphite, mined mainly in China and, increasingly, Mozambique and Madagascar, is subject to traditional mining ESG concerns, such as water use and equipment and transport emissions. However, battery-grade graphite involves intensive purification and shaping into spherical form, which relies on large quantities of hydrofluoric acid (HF). This downstream process, currently only done in China, has much deeper ESG concerns.

With HF, the environmental stakes are high – and so are the monetary costs. It’s highly corrosive and its disposal is strictly regulated. If corners are cut, the impact can be devastating.

Graphite now appears on many countries’ official lists of critical materials due to concerns over ESG issues, as well as China’s control over supply volumes and prices.

China is working hard to improve environmental standards in the graphite industry, introducing increasingly strict regulations since the mid-2010s. However, frequent inspections have resulted in ongoing rounds of temporary capacity closures – and some permanent. This has led to supply shortages and price rises. Graphite now appears on many countries’ official lists of critical materials due to concerns over ESG, and China’s control over supply volumes and prices.

Several mine developers outside China are looking to create a new supply chain, with plants being considered in locations around the world. Most are looking to use alternative, low- or zero-HF methodologies, such as acid-alkali or thermal-only. However, the former uses a strong set of environmentally challenging reagents, while the latter entails high energy consumption and production costs. Some companies are exploring other proprietary methods, none of which have yet been proven at scale.

Natural graphite isn’t the only – or indeed the dominant – option. Synthetic graphite is a fossil fuel derivative, manufactured artificially from needle coke. It’s an extremely energy-intensive process, but does produce high purity graphite suitable for battery anodes with little further processing. While China is the largest supplier, production is much more distributed than natural graphite, with large quantities produced by Japan, the US, India and Europe.

Both natural and synthetic graphite have complex ESG issues to overcome. And, while the development of silicon anode materials and solid-state battery technologies may erode long term demand, graphite will remain a vital material for lithium-ion battery anodes for years to come.

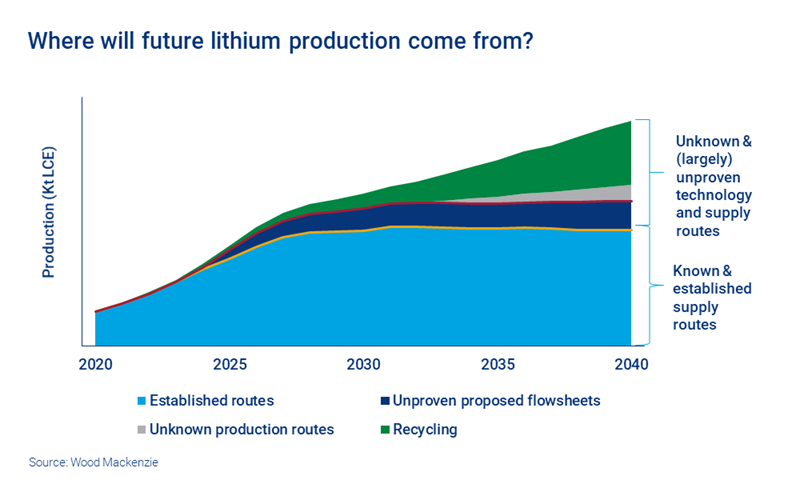

Lithium: high water consumption versus high carbon emissions?

The lithium sector faces a binary problem. Buyers – auto manufacturers, cathode manufacturers and other OEMs – must choose between two routes: brine or mineral sources. Each involves a distinct ESG challenge, centred on either water consumption or carbon emissions.

-

Brine sources:

Concerns over high water consumption at lithium brine operations have led to conflicts with local and state authorities in South America, and investigations into the efficacy of production. Plus, brine producers not only have greater water consumption rates than mineral concentrate producers, but they’re operating in some of the driest places on earth, with high levels of water risk.

-

Mineral sources:

Most lithium mineral concentrate is shipped to Chinese refineries reliant on coal power. In terms of embedded emissions per tonne of refined lithium produced, this refining stage contributes 70-90% of all carbon emissions within the mineral concentrate supply route. This doubling up effect, of high energy consumption and high emission fuel use within the mineral supply chain, makes refined lithium produced via mineral concentrate 3.5 times more CO2 intense than brine.

This creates a downstream dilemma. High embedded emissions within a value chain are a clear carbon risk. However, issues associated with high water consumption could hamper expansion plans and limit capacity.

Over the coming decades, a growing proportion of refined lithium production is likely to come from unproven routes. This includes projects aiming to use direct lithium extraction (DLE) technology and extract from unconventional mineral deposits, such as clay, sedimentary or borosilicate minerals.

These routes have potential, but there are engineering challenges. There are no successful commercial-scale lithium production routes using unconventional mineral deposits as feedstock, and limited examples of DLE technology being successfully employed at commercial scale, or achieving the necessary quality of refined lithium.

Watch the webinar replay for a closer look at the future of lithium production. Fill in the form at the top of the page for complimentary access.

Cobalt: ESG adds to the rising cost challenge

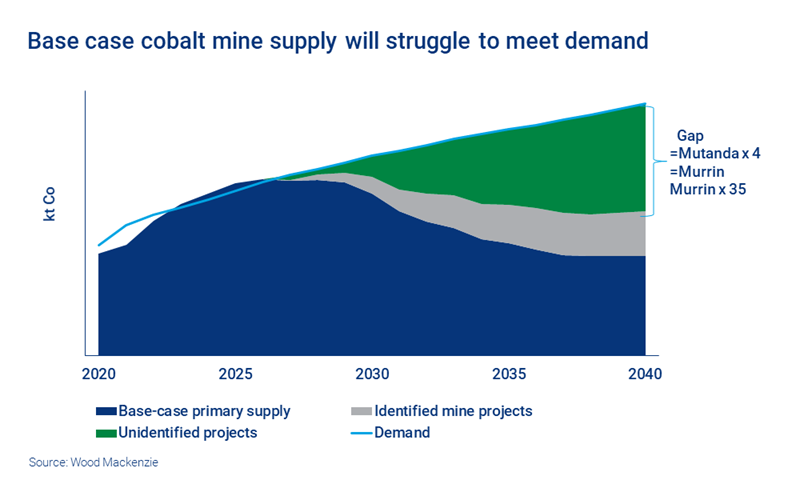

The cobalt market is forecast to double in size by 2050, underpinned by a spectrum of battery applications. But a significant supply gap lies ahead, requiring further expansions at existing mining operations and new investment.

There are several sizable obstacles. The cost of mining cobalt is on the rise, due to ore grade attrition and reserve depletion. Surging metal prices and strong EV momentum are triggering a revival of resource nationalism in key producing countries, posing a risk of supply disruption. ESG risk heightens the challenge.

Cobalt reserves and mine production are concentrated in regions and countries that exhibit significant ESG risks. The DRC and Indonesia, by far the top two cobalt reserve holders, are both categorised as high-ESG-risk countries in Verisk Maplecroft’s ESG Risk Index.

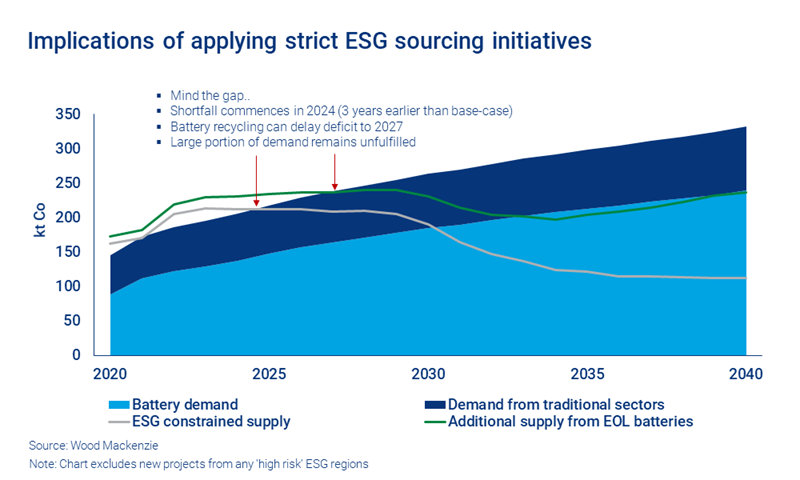

In an ‘ESG constrained supply’ scenario, a shortfall in the cobalt market can emerge as early as 2024. Battery recycling, if fully utilised, can ease the upcoming supply shortage, but it cannot fill the entire gap. This implies that virgin cobalt materials will remain critical to meet the surging demand.

To build up a more resilient supply chain, the industry must take action to address ESG issues through continuous innovation and collaboration. Advanced mining technologies can help improve mining practices, reduce costs and increase traceability of materials. For regions with limited cobalt reserves, such as Europe and North America, or for high-cost producers like Australia, government backing will be crucial to establish localised value chains. Alternative feedstock options must also be explored to mitigate the risk of supply disruption.

Rare earths: a crackdown has seen a fall in illegal and unregulated production – but challenges remain

Growth in rare earth permanent magnet demand is set to increase by 89% by 2030, primarily from automotive and renewable energy applications. China currently dominates the industry and is forecast to account for 63% of total rare earth mine production and 84% of refined output in 2022 – and more than 95% of recycled production. With supply tight, industry and governments in the rest of the world are looking to reduce dependence on China, though commissioning at many projects under development remains unlikely in the short to medium term.

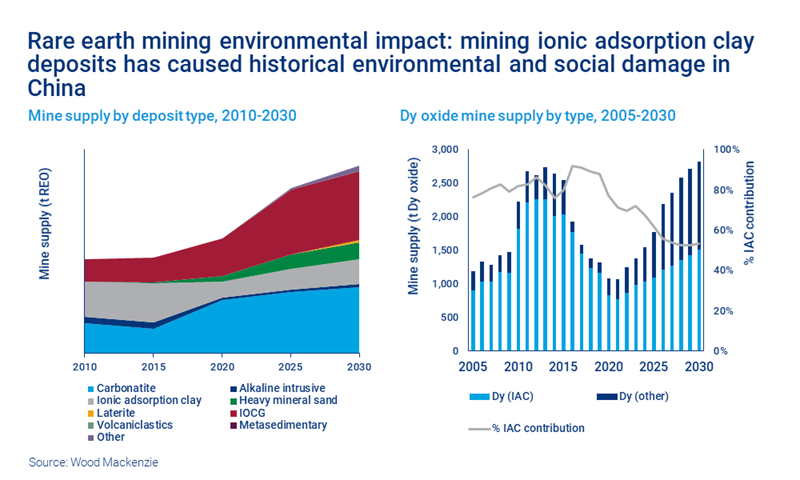

The environmental impact of rare earth mining and processing has been well documented, with production from ionic adsorption clay (IAC)-type deposits a particular issue. Deposits largely occur in remote regions, spread over large areas, making inspection and monitoring challenging. A crackdown by state governments, coupled with falling rare earth prices, did result in a sharp drop in illegal and unregulated production of rare earths from IAC-type deposits in China in 2021. This is progress, but it doesn’t resolve the issue – the crackdown has sparked the development of IAC deposits in Myanmar, and more recently in Laos.

ESG challenges related to IAC-type deposits are a key issue going forward, and innovative solutions must be found. Other methods have been trialled, though have to date proven unsuccessful alternatives to the ammonium-sulphate in-situ leaching widely used in southern China and Myanmar.

The importance of IAC-type deposits is focused on the production of the less abundant heavy rare earth elements. In 2022, such operations will provide 70% of dysprosium oxide mine supply – limited development of IAC-type deposits in the period to 2030, fuelled in good part by ESG concerns, will see this fall to 53%. As a result, other rare earth operations with much lower heavy rare earth contents will have to meet demand growth, particularly for dysprosium and terbium, in permanent magnet applications.

To find out more about the ESG implications of rare earths, along with graphite, cobalt and lithium, fill in the form at the top of the page to access the webinar replay.