What’s next for green steel technologies?

Exploring alternatives to scrap, high-grade iron ores and current steel production routes

4 minute read

Daniel Carvalho

Director, Metals & Mining Consulting

Daniel Carvalho

Director, Metals & Mining Consulting

Daniel brings over 18 years of experience as a global operations, process and technology leader.

Latest articles by Daniel

-

Featured

Metals & mining 2025 outlook

-

Opinion

Four key takeaways from LME 2024

-

Opinion

Grey area: can steel really go green?

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

What’s next for green steel technologies?

-

Featured

Metals and mining 2024 outlook

Steelmaking's transition to more sustainable processes will be crucial to driving down global emissions. However, current commercially viable technologies may require significant technological advancements if steelmaking is to play its part in meeting net-zero targets.

We recently presented a webinar on “What’s next for green steel technologies?”. Fill in the form at the top of the page to download the slides from our presentation, or read on for a quick overview.

What are the existing key steelmaking technology routes?

The blast furnace-basic oxygen furnace (BF-BOF) process currently dominates steelmaking, mainly because it is low cost and can flexibly accept a range of iron ore qualities. However, it is difficult to decarbonise, presenting a challenge for the industry as it aims to take its place in a low-carbon future.

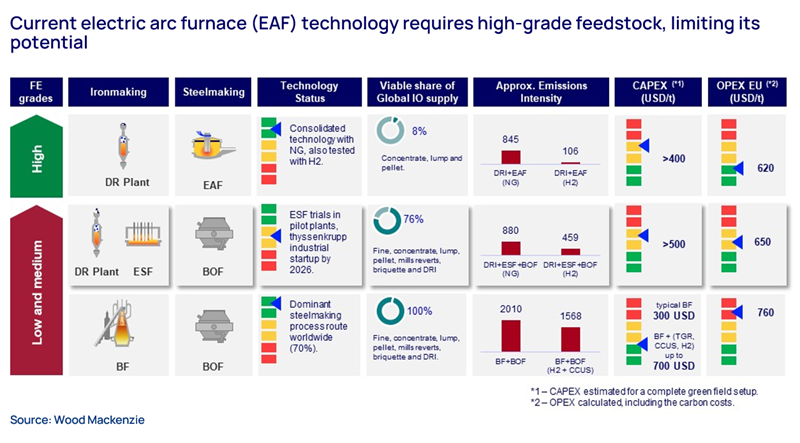

Electric arc furnace (EAF) technology produces far less emissions; as a result, it is growing rapidly in popularity and is predicted to reach near-parity with BF-BOF production by 2050. Making steel using the EAF process utilises scrap material as the primary metallic feedstock can reduce emissions by 75-80% compared to conventional BF-BOFs. However, EAFs do not directly utilize iron ore inputs, are increasingly competing for a limited global pool of scrap, and require high-quality iron ore inputs for ore-based metallics like DRI. Reducing emissions in the steel value chain is therefore likely to require a multi-technology approach which incorporates steelmaking routes beyond existing electric arc furnace production processes.

What are the potential routes to low-carbon steelmaking?

Combining green hydrogen with direct reduced iron (DRI) stands out as a preferred route to low-carbon steelmaking for many. Using green hydrogen instead of natural gas or coal to produce DRI as the metallic feedstock eliminates the sources of carbon from the steelmaking process and is the route closest to carbon neutrality. As a result, DRI’s share in the metallic mix is projected to more than double by 2050.

The current DRI landscape is predominantly gas-based (80%), with the remainder coal-based facilities largely concentrated in India and China. Any shift towards green hydrogen as a feedstock for DRI production is likely to be a gradual evolution, with natural gas bridging the gap to a green hydrogen future.

The electric smelting furnace-basic oxygen furnace (ESF-BOF) process is another potential solution that could bridge the gap between existing EAF and BF-BOF technologies. The initial ESF process utilises electricity, instead of coal/coke, as fuel like an EAF, but unlike the EAF process it can accept DRI produced with low and medium-grade iron ores as a feedstock. ESF-produced liquid hot metal can then be processed into steel in a traditional basic oxygen furnace. ESF-BOF can potentially be rolled out at BF-BOF facilities using existing BOF footprints, helping to reduce blast furnace use and cut emissions while reducing capex, operational complexity, and project execution time.

ESF technology offers steelmakers greater flexibility. They can either use their own DRI or trade all ranges of DRI products based on their value-in-use (VIU) analysis; in contrast DRI-EAF producers are technically limited to high-grade iron ore products.

Decarbonisation at what cost?

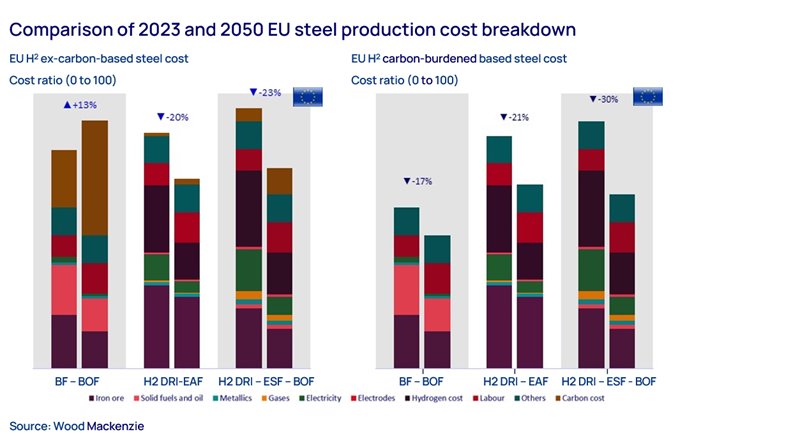

The cost competitiveness of different steelmaking processes will remain an important factor, and may ultimately depend on how carbon pricing structures evolve. Without rigorous carbon pricing, traditional BF-BOF is likely to remain the lowest-cost route for steel production across most global regions.

DRI-ESF-BOF could reach near cost parity with traditional DRI-EAF over the long-term; in some cases, it could even be cheaper, depending on regional dynamics and whether the fuel feedstock used is natural gas or hydrogen.

Hydrogen DRI costs 30% more than gas DRI and is even more expensive compared to coal DRI units in India. Economic measures and industrial ramp-ups should narrow this cost gap by 2050, but significant green incentives and stringent carbon tax policies will be essential for further cost mitigation.

Potential hubs for DRI-based steel

We foresee seven potential hubs for DRI-based steel production by 2050. Each will have a distinct technological mix and development timeline. The Middle East, China, Australia and Europe are likely to lead DRI capacity additions. The US and Brazil will see some traction, but high scrap use may dampen DRI demand. We expect India to shift from coal to gas-based DRI only gradually, limiting its potential contribution to green steel production.

Making the green steel revolution happen

Decarbonising the global steel industry is complex and will require technological innovation, policy support – including robust carbon taxation and alluring green incentives – and significant investment. The rollout of green steel will be dependent on multiple factors, including iron ore quality, hydrogen and natural gas availability, renewable energy sources, the intricacies of carbon pricing, and the legacy of existing steel frameworks.

The challenges are substantial and must not be ignored; they include limited DR-grade iron ore supply, hurdles to electrification and hydrogen production scalability, logistics concerns, and the overarching high costs of greening. However, the potential reward is significant: a cleaner, sustainable world.

Learn more

Don’t forget to fill out the form at the top of the page to download the presentation slides from our recent webinar - 'What's next for green steel technologies?' - in which we explored the technical factors, opportunities, challenges and competitive landscape for key green steelmaking technologies in more depth.

To find out what's next for steel in the near term, you can also read our 2024 outlook for steel, as well as our other metals and mining predictions for 2024.