Sign up today to get the best of our expert insight in your inbox.

Renewable developers change tack

Market challenges driving shifts in investment

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

Norman Valentine

Director Corporate Analysis, Head of Corporate Power and Renewables Research

Norman Valentine

Director Corporate Analysis, Head of Corporate Power and Renewables Research

Latest articles by Norman

-

The Edge

Renewable developers change tack

-

Opinion

Growing pains: how are corporate power and renewables strategies adapting to energy transition challenges?

-

Featured

Mixed signals for power and renewables in 2023

-

Featured

Power and renewables companies face merging headwinds in 2022 | 2022 Outlook

Akif Chaudhry

Research Director, Corporate Strategy and Analytics

Akif Chaudhry

Research Director, Corporate Strategy and Analytics

Akif focuses on strategy, benchmarking and valuation analysis related to power and renewables within company portfolios.

Latest articles by Akif

-

The Edge

Renewable developers change tack

-

Opinion

Elevated subsidies enable offshore wind to end 2023 on a high note

-

Featured

Mixed signals for power and renewables in 2023

-

Opinion

Big Oil set to cash in on the trillion-dollar offshore wind prize

-

Featured

Power and renewables companies face merging headwinds in 2022 | 2022 Outlook

-

Opinion

Natural gas: friend or foe in Europe’s 2030 emissions target?

Europe’s largest international renewable power developers have had another tough year. Worsening market conditions have reined in earnings and dented investor confidence across a sector that should be booming. Recent political change, notably in the US, adds new uncertainty and risk.

Has the shine come off renewables investment? Or can the leading global power and renewables developers recharge their strategies to capitalise on the huge market growth potential through this decade and beyond?

Gavin Thompson spoke to Norman Valentine and Akif Chaudhry from our corporate research team to hear the challenges and opportunities facing companies in the sector.

What is the investment outlook?

Recent corporate messaging hasn’t been great. Leading European players Ørsted and EDP downgraded their growth projections earlier this year. Shell and BP, which historically led the charge among the oil Majors into renewables, have more recently retrenched from the sector.

But this isn’t the full story. Most developers continue to pursue growth opportunities, primarily focused on expanding renewable generation capacity and power networks. Power demand growth remains very positive, with decarbonisation the chief driver, boosted by data centre expansion and reindustrialisation in the US.

Boards will inevitably remain cautious, given the potential impact of recent political changes on support for renewables and wider electrification. Nonetheless, we expect aggregate power and renewables budgets for the leading 16 companies we cover to edge up slightly in 2025 compared to this year.

How will companies allocate investment capital?

Priorities will shift in 2025. Power networks are the big beneficiary, reflecting the segment’s relatively low risk and increasing government recognition of the need to invest in electrification infrastructure. Enel, Iberdrola and SSE have already indicated growing spend on grids next year.

Energy storage will also attract more investment as power market variability rises. Battery storage systems are an increasing feature in company growth plans while new pumped-hydro storage schemes could also advance towards development next year.

Oil and gas companies active in the power sector will look to expand flexible generation fleets, integrating with their gas supply businesses and capitalising on growing trading and marketing opportunities. TotalEnergies is the most likely to make a material move, aligned with its integrated power strategy.

What does this mean for new spend on renewable capacity?

Budgets for renewable generation capacity growth should remain broadly flat next year, as policy uncertainty, sustained interest rates and grid connection constraints limit total investment in new wind and solar capacity.

US offshore wind will come under the most pressure as the new administration is sworn in: early-stage US projects are already being mothballed. In Europe, several recent offshore wind tenders attracted limited interest from developers against a backdrop of higher costs, supply chain constraints and limited government price support measures. The segment’s longer lead times may limit the immediate impact on 2025 budgets, but offshore wind is set to slide down the investment priority list for many diversified renewables developers next year.

How will this impact corporate renewable capacity targets?

Several leading international renewable developers have set ambitious capacity targets for the end of this decade. EDF, Engie, RWE and TotalEnergies lead the pack, with 2030 targets equivalent to around 40 GW on a net equity basis.

We expect mixed results. Some companies should hit their 2030 targets, given portfolio evolution to date and healthy renewable project development pipelines. Several others have already pared back or dropped their targets, with revised goals now looking more achievable.Bottom of the class are those companies with back-end weighted capacity growth that are at risk of falling short. Further dialling back of corporate targets in 2025 can’t be ruled out.

What are renewable developers’ financial priorities?

Managing revenue and cost risks will continue to be the top priority. Investment in regulated and contracted revenue opportunities will be prioritised to enhance future earnings predictability.

Some players will look to asset sales to balance cash flow and sustain balance sheet strength, with any slowdown in the M&A market having knock-on consequences on financial flexibility and investment. Ørsted and EDP will face the most pressure given their reliance on asset sales to balance the books. Meanwhile, another round of US offshore wind asset impairments could also hurt balance sheets next year with Ørsted at greatest risk, given its relative exposure to the sector.

Has the investment case for renewables lost its lustre?

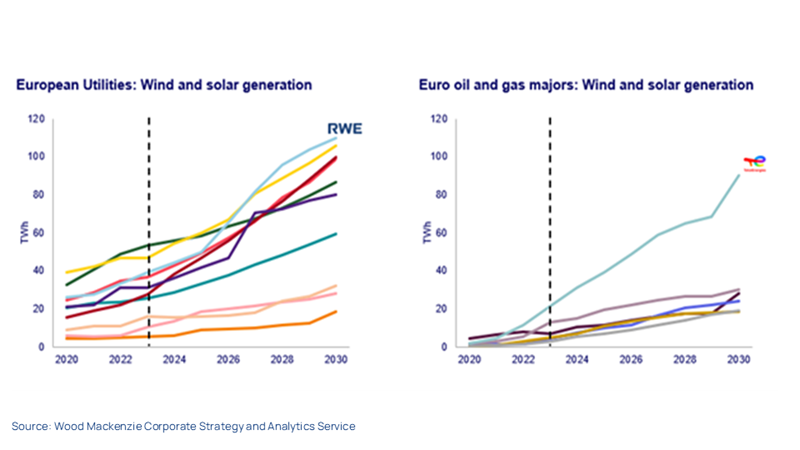

No doubt but delivering on the hype was never going to be easy. Developers and investors are now in reset mode. Despite this year’s downgrades, future drivers are undiminished. We continue to expect double-digit aggregate annual growth this decade in wind and solar output from the leading players.

Converting this growth into increasing shareholder rewards will be critical. RWE has already announced it will start a share buyback programme in 2025, reflecting a more disciplined approach to capital investment. Other companies could be tempted to follow, keen to demonstrate that energy transition investment is not at odds with healthy investor returns.

Companies included in our Corporate Strategy and Analytics Service - Power and Renewables include: BP, EDF, EDP, EnBW, Enel, Engie, Equinor, Iberdrola, Ørsted, Plenitude, Repsol, RWE, Shell, SSE, TotalEnergies, Vattenfall

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.