Big Oil’s offshore wind journey is only just beginning

Demand for new projects heats up

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

Big Oil always goes in big. It has to, if any new strategic position is to make a material impact on its massive portfolios. And offshore wind is the big new thing the European Majors are seizing upon, an ‘oven-ready’ zero-carbon technology with big growth prospects. Just this week, BP and Total made headline-grabbing bids in the latest UK offshore wind lease round.

But today offshore wind is still a tiny market. Can it feed the voracious appetites of the multitude of energy companies wanting to get in on the action? I asked Søren Lassen, Head of Offshore Wind Research, and Norman Valentine, Director Corporate Research, who are about to release our first benchmarking analysis of the Majors’ strategies for offshore wind.

What’s the opportunity?

Capacity growth is going to be huge and sustained over decades. Offshore wind is niche today at 35 GW, just 6% of global wind capacity, most of which is onshore. But recent technology advances – bigger turbines, higher capacity factors, floating turbines – have got offshore wind to the cusp of scaling up. We forecast global installed capacity will exceed 200 GW by 2030. The established markets are all in northern Europe and China, the next wave – US, elsewhere in Europe and Asia – is just opening up.

What do the Majors bring to the party?

The developments fit neatly into Big Oil’s skill set in offshore development, there are operational synergies and the intermittent renewables power (typically priced on power purchase agreements) adds another dimension to energy trading. Besides financial muscle, the Majors can leverage their international footprint to access new markets, an advantage over local-focused utilities. In time, offshore wind portfolios may be as global as upstream oil and gas is today.

What’s the progress so far?

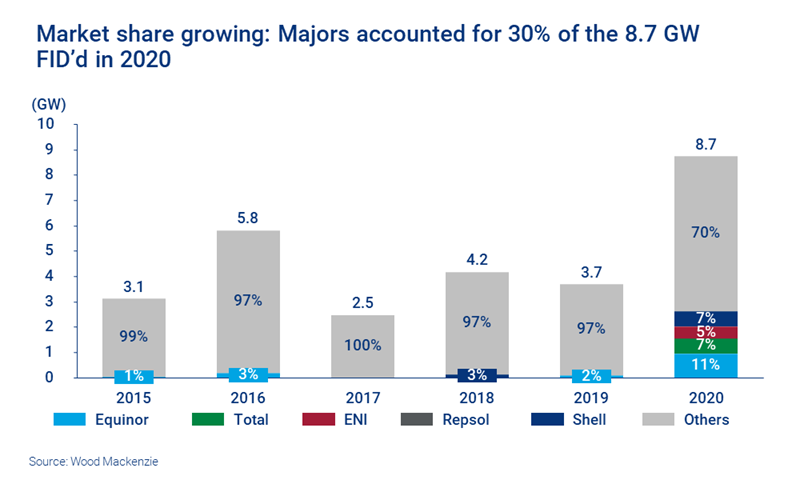

Coming a little late to the party, the Euro Majors’ operational capacity is just 0.7 GW, 3% of the global total outside China. But they are on a mission and have secured 30% of the 9 GW that achieved final investment decisions in 2020. The pipeline’s not just growing but also maturing, with pre-development projects at different stages. It’s also diversifying across geographies and technologies – for instance, the Euro Majors are pushing early into floating offshore wind.

How big do they want to be?

The ambition is stratospheric. The Euro Majors (excluding Shell) have a target for renewables, including solar and onshore wind of 125 GW by 2030 – six times their present offshore wind pipeline exposure. If they maintain their recent market share of 30% in new projects, then that would give them 60 GW, based on our forecast for installed offshore wind capacity in 2029 of 200 GW. It’s quite a tall order in our view.

Are asset prices being squeezed?

The concern is that there’s simply not enough supply to meet the demand fuelled by the arrival of the Euro Majors into the market. This week’s UK Round 4 lease auction (LR4) showed how aggressive Big Oil can be – the winning Irish Sea bid from BP/EnBW for 3 GW of £1.8 billion (total option fees over four years, more if delayed, in payments to the UK Crown Estate) was roughly double those of the other winning bids. Total was the other successful Euro Major (with investor GIG) for 1.5 GW. On a net basis, BP (19%) and Total (9%) accounted for almost 30% of the proposed capacity awarded.

A host of factors made the UK LR4 highly attractive: it’s the leading offshore wind market and project scale is among the biggest. The terms all offered 60-year leases (long enough for two turbine life cycles and much longer than the longest-life accessible oil and gas projects) with the developers’ preferred pricing mechanism (low risk, government-backed contracts-for-difference). BP/EnBW’s Irish Sea sites have advantages in proximity to shore, water depth and expected permitting process.

Are the Majors paying too much to get in?

You have to be in it to win it. Offshore wind developers with global ambitions need credentials to participate and partner in future tenders anywhere in the world.

Yet looked at in isolation, paying a big option fee upfront will make it harder to achieve the double-digit returns the Euro Majors aim for from renewables. To claw back the 300 bp to 500 bp effective cost in option fees, developers will have to ensure discipline on project delivery, execution, capital and operating expenditure; and that any synergies whether trading, finance or tax are maximised. Our modelling suggests project returns in high single digits are still achievable.

As with any acquisition or diversification into a new activity, Big Oil will need to continuously and clearly articulate the value proposition as it commits increasingly large amounts of capital into new energy, including offshore wind.

Where does offshore wind fit in new energy strategies?

It’s one of a number of core options where the Euro Majors are gaining exposure. Most are simultaneously building out solar and onshore wind; but offshore wind has bigger project scale and higher capacity factors. Equinor aims to be an “offshore wind Major”, focused on being the best-in-class operator – it’s already the leading oil Major with net equity capacity of 12 GW, more than the rest put together. But the others are working hard to catch up. BP and Total, in particular, are placing increasingly bigger bets on the technology. Shell is more customer focused – it sees offshore wind as part of its integrated value chain that supplies low-carbon energy to its customers.

Offshore wind will be a core part of integrated zero-carbon portfolios, which will include carbon capture and energy storage. It will also have a central role to play in commercialising power-to-X technologies like green hydrogen.

Where are the next big tenders?

After UK LR4 and Equinor and BP’s success in the 2.5 GW New York tender, there’s a lot more to come in 2021. We expect more than 23 GW to be up for tender in Europe (UK, Poland, Netherlands, Denmark), Japan and the US, almost as much new capacity as is already online outside China today. On top of that, there is another 15 GW of lease acreage to be awarded this year. We expect the Majors to participate in most of these.

There’s very strong alignment in offshore wind that’s helping to push the transition forward. Big Oil and its competitors want more projects, and governments need to ‘feed the beast’ to help meet their net-zero targets.

Visit our website for more information on the Corporate New Energy Series including the forthcoming benchmarking study of the Major’s offshore wind strategies.

Wood Mackenzie clients can access the series via the client portal