Counting carbon: how to set oil and gas industry emissions targets

Five key ingredients of a meaningful emissions target

1 minute read

To achieve Paris Agreement objectives to limit global warming to 2 °C above pre-industrial levels, oil and gas demand must peak in the next decade and the world must cut net emissions to zero by 2050. Consequently, there is ever more pressure on heavy emitters, such as oil and gas companies, to adopt and disclose climate-related metrics, targets and strategies. Investors, lenders and governments alike are demanding greater transparency and action.

Oil and gas firms are increasingly committing to emissions-reduction goals, but their scope and methodologies vary. So, how can the industry set standardised, meaningful emissions targets that enable investors to assess risk in a 2 °C world?

This article is based on The energy transition of the oil and gas sector, a recent presentation from our Carbon Research team. Fill in the form for a complimentary slide pack, with presentation highlights and charts. Or read on for an introduction to the five key components of an oil and gas industry emissions target.

Substantial changes ahead under a 2 °C scenario

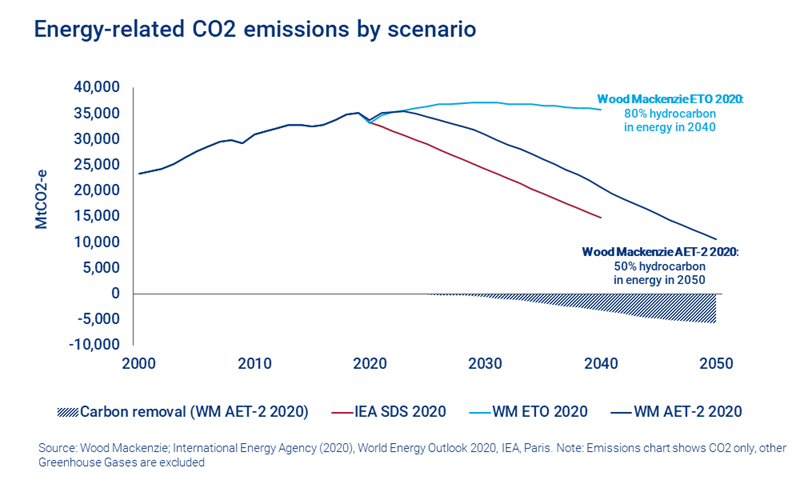

Limiting global warming to 2 °C by 2050 will require significant shifts in how energy is consumed and generated. Under our Accelerated Energy Transition (AET-2) scenario, hydrocarbons would supply 50% of the world’s energy needs by 2050, versus 80% under a business-as-usual scenario.

Oil demand would peak in 2023 under this AET-2 scenario, followed by gas in 2035. This demand would be met instead through electrification with renewable power and zero-carbon fuels such as clean hydrogen. Despite this significant decline, any use of hydrocarbons to generate energy results in carbon emissions. Therefore, to achieve net zero emissions by mid-century, we would need to remove as much carbon dioxide as we put into the atmosphere, if not more, through natural sinks and carbon capture, utilisation and storage, including direct air capture.

These shifts have significant implications for corporate strategies, in terms of portfolio composition, financial returns and emissions management. Crucially, progress must be closely monitored, measured and reported.

Demands for climate disclosure and action are growing

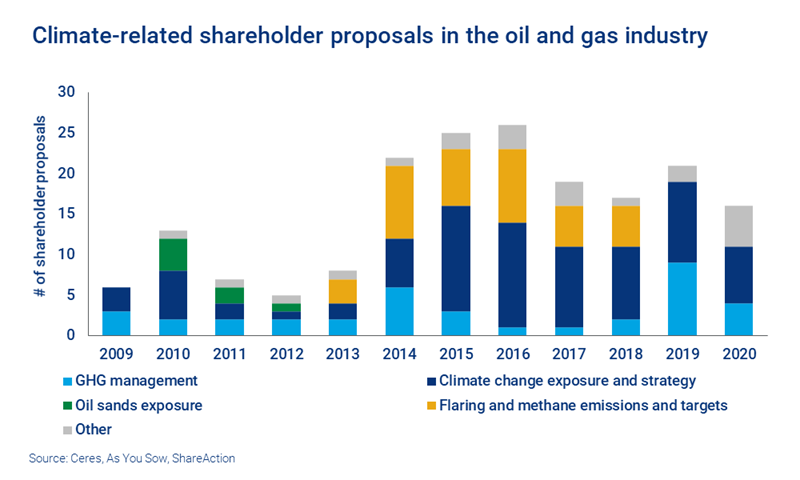

Demands for climate-related disclosures are nothing new, but the number of shareholder proposals pushing for such information has increased. Demands are focused on business exposure under a 2-degrees scenario and the adoption of emissions targets.

The Task Force for Climate-Related Financial Disclosures (TFCD) has made recommendations on the information that firms should disclose to help investors price climate-related risks and opportunities into their decisions – and these recommendations are a key reason for the rise in investor proposals.

The TFCD has also developed supplemental guidelines for heavily exposed sectors, such as energy, which call for additional detail in key areas pertaining to scenario analysis, mitigation measures and metrics, including emissions breakdowns by scope, forward-looking projections and financial data.

TFCD recommendations will become the norm

The recommendations and guidelines are largely voluntary, though there are moves to make them mandatory, starting in the UK this year. Regulatory mandates will accelerate their adoption, as will investor pressure. The one area where we have already seen a notable uptick in adoption is metrics and targets, with a particular focus on net zero and Scope 3 emissions targets.

Scope 1 emissions include direct emissions from operations, while Scope 2 relates to indirect emissions from purchased electricity. Scope 3 is a broad category encompassing up to 15 different sources, the most significant category for oil and gas being end-use combustion.

The key ingredients of meaningful emissions targets

Most companies have targets for Scope 1 and 2 emissions, but Scope 3 targets are less common. Regardless of scope, there is wide variability in how these targets are defined. Some companies set targets on a net equity basis, while others set targets only for operated assets. Many targets relate to emissions intensity, while a smaller number address absolute emissions. Additionally, there are differences in timelines and ambition.

We believe that to be meaningful and allow for comparison between companies and against global climate objectives, emissions targets should:

- cover Scopes 1, 2 and 3, including third-party products sold

- be based on net equity interests in all assets

- encompass absolute and intensity-based targets

- achieve net zero by 2050-2070

- include short- and long-term targets.

Setting targets is one thing, achieving them is another

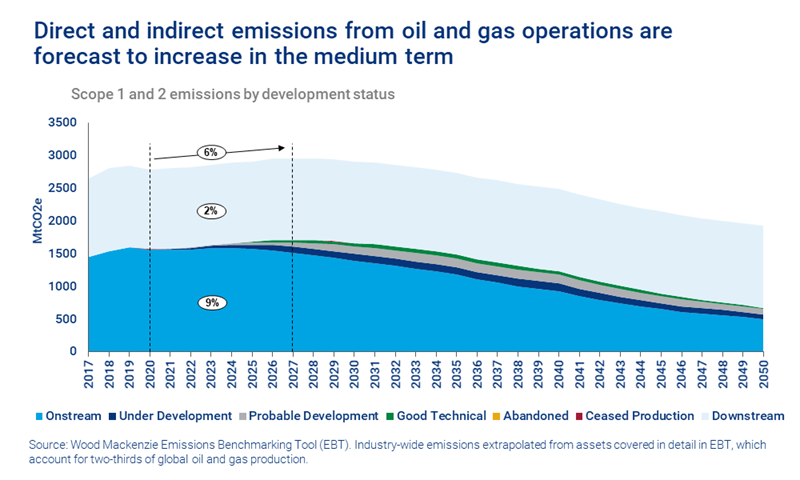

Our Emissions Benchmarking Tool models emissions from more than 3,000 oil and gas assets globally. We estimate that emissions from the industry will continue to rise through 2027. We expect emissions to increase more slowly than production, but even without additional investment, direct and indirect emissions from assets producing or in operation today are still likely to total 2 GtCO2e by 2050.

What’s driving these emissions? How does emissions intensity compare across different resource themes and asset types? And how much can be mitigated by current technology applications? To find out more, fill in the form at the top of the page for a complimentary copy of the presentation slides and charts.