Big Oil’s separate paths to decarbonisation

Will the US Majors target net zero?

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

There’s more than one way to set about decarbonising an oil and gas giant. The Euro Majors are diversifying away from oil and gas, making significant investments in renewables and have plans to invest all along the low-carbon value chain. They’ve also set net-zero 2050 emissions targets, a sending a strong message to stakeholders on the direction of travel.

The US Majors are treading a more conventional path. ExxonMobil and Chevron are yet to set net-zero targets. Their strategy is all about hydrocarbons, but for a business that’s more efficient, creates more value and emits less carbon. I asked Tom Ellacott, SVP Corporate Analysis, how he sees the US companies’ approach evolving.

First, pressure is building on net-zero targets – even from within US industry. Two of the biggest Independents declared net-zero targets in Q4 2020 (ConocoPhillips, Scope 1 and 2 by 2050; Occidental, Scope 1 and 2 by 2040, Scope 3 by 2050). Other Independents have already followed their lead. The influence of investor demands on ESG shouldn’t be underestimated.

US government policy will be another catalyst. It’s no coincidence that the timing of the Euro Majors’ pivot was heavily influenced by the EU. The bloc had championed decarbonisation and committed to net-zero by 2050 following the Paris Agreement in 2015.

Washington is now catching up with the rest of the world. One of President Biden’s first acts was to sign an executive order for the US to re-enter the Paris Agreement. Next will be the US commitment to net-zero emissions by 2050 in the coming months, ahead of the COP 26 in Glasgow in November.

There may be no legal obligation for US companies to fall into line with federal net-zero targets. But it’s going to be awkward for big industry players to swim against the tide as the Biden administration rolls out its climate plan and begins decarbonising the US economy.

Second, the US Majors ‘get’ decarbonisation. They’re now more open about the challenges of the energy transition, and how they intend to deal with them. That much was obvious in the strategy presentations of the last week in which both ExxonMobil and Chevron set out their stall to align with the Paris Agreement, and to leverage their competitive advantages in the transition to a lower-carbon future.

The foremost competitive advantage is what they already do. The goal is to make the integrated oil and gas business more sustainable: by reducing methane intensity and eliminating routine flaring in upstream, sourcing renewables to power operations and, in refining and chemicals, shift the product slate to biofuels, lightweight plastics and innovative new materials.

The Euro Majors’ master plan is bigger than just getting to net zero: it’s to ensure there’s a viable and growing energy business when oil and gas falls out of the mix.

The Euro Majors’ strategy for ‘legacy’ oil and gas is broadly the same. It’s just that they’ve chosen to take on the risks of building a broad-based new energy business in parallel. Renewables, the one technology that’s commercially scalable today, is the starting platform. There are seed investments in a range of low-carbon technologies and customer-centric earnings streams, too. The Euro Majors’ master plan is bigger than just getting to net zero: it’s to ensure there’s a viable and growing energy business when oil and gas falls out of the mix.

The US Majors’ zero-carbon technology strategy is centred on carbon capture and storage (CCS), another competitive advantage. It’s not new and they already do it – ExxonMobil and Chevron are global leaders. A meaningful carbon offset wedge from CCS will be essential to meet global net-zero targets. There’s enormous growth potential. We forecast global capacity needs to increase from 42 million tonnes today to 4.2 billion tonnes by 2050 in our 2 °C scenario.

CCS though is a long-dated option on decarbonisation. The technology’s proven, but because it’s not commercial, it’s tiny. Policy support in the US is favourable, and we expect support to grow outside, although it’s not yet high on the EU’s agenda. In any case, carbon prices will need to triple to see much higher deployment.

CCS is the final piece of a complicated jigsaw for the world to get to net zero. The US Majors are also weighing up the opportunities in technologies where they don’t yet see competitive advantage – renewables, biofuels, hydrogen and natural sinks. Caution is understandable where competitive advantages aren’t obvious, and it may pay to be a fast follower rather than first mover. At some stage, though, they will need to step up and build a diversified set of low-carbon cash flow streams.

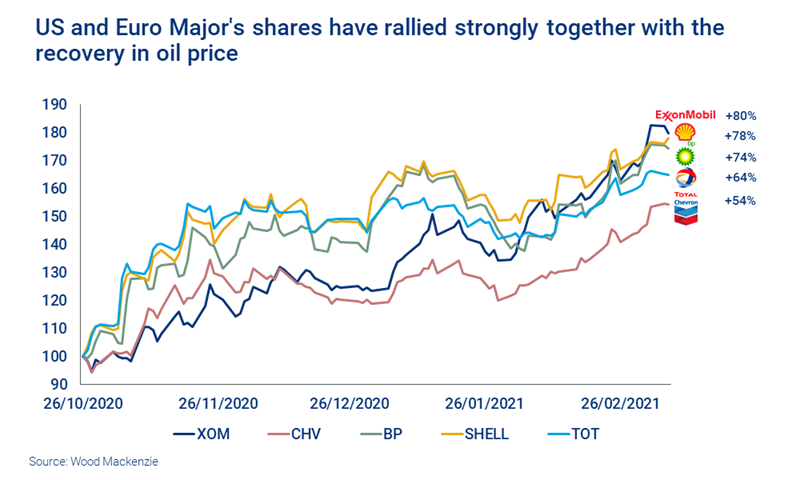

Third, are US Majors doing enough to decarbonise or are Euro Majors pushing too hard, too fast into new energy? With investors, the jury is still out. After a tumultuous 12 months where share prices were whiplashed by the oil price collapse and recovery, and BP and Shell cut dividends, it’s not clear either strategy is winning – yet.

The US Majors should be wary of interpreting that as a free pass. The pressure to shift from a defensive position on decarbonisation to net-zero growth is only going to increase as US climate policy shifts decisively and ESG demands from stakeholders intensify.

Our view is that oil price risks are on the upside in the next few years. That should favour oil and gas-focused companies, including the US Majors. The big question is how aggressively ExxonMobil and Chevron will use an upcycle to position for a more ambitious low carbon future – and net zero.