US residential solar finance will falter in 2020

Third-party ownership and loan volumes will both drop this year

1 minute read

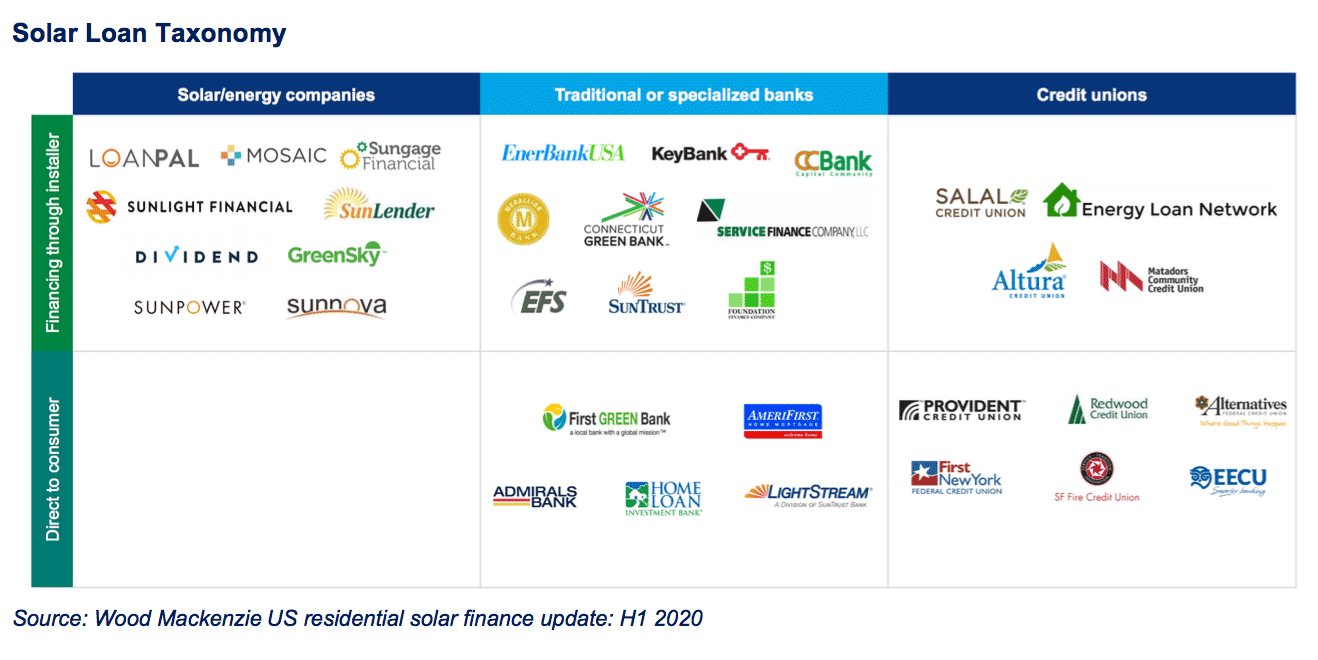

Residential solar loans claimed 54% of the United States residential solar financing market in 2019, according to our new analysis. Thats a 31% market share increase for solar loans versus 2018.

All major solar loan providers experienced growth in 2019, with Loanpal retaining the top provider spot.

However, 2020 will not tell a similar growth story for US solar finance.

Volumes to take a nosedive

Of the different US residential solar financing segments, cash will be hardest hit due to coronavirus, declining 42% this year versus 2019 levels.

Third-party ownership and loan volumes will both drop this year by 21% and 23%, respectively.

Default rates on US solar loans are in the spotlight. Although consumers have mostly kept up with payments so far, it remains unclear how long this will last as government assistance winds down.

However, we think it’s unlikely that higher default rates would actually drive loan providers out of business in the short term.

Of more pressing concern: Many installers are vulnerable to a prolonged economic downturn. The more installers that go out of business, the bigger the gap in the market for financeable projects as financiers lose installer partners.

We have reduced our 2020 and 2021 US residential solar forecast by 31% and 26% respectively, due to the economic impacts caused by the virus.

Bright spot: ABS transactions

Despite the residential solar market contraction, recent solar asset-backed securitization (ABS) transactions point to a faster-than-expected recovery for investments in the industry and provide evidence that investor confidence remains high.

Our latest report on US residential solar finance finds that 2019 was the biggest year ever for solar asset-backed securities, topping $1.9 billion.

Following this banner year, there was just one transaction in 2020 before the coronavirus upended markets. Then, after four months of no activity, the market woke up in June with four completed ABS transactions.

Loanpal was the first financier to be involved in a solar securitization after the onset of Covid-19. Goldman Sachs pooled Loanpal originated loans and sponsored two transactions, totaling 373 million. Loanpal also announced an additional transaction with GoodFinch in July 2020.

US solar asset-backed securitizations had reached nearly $1.5 billion in transaction value in 2020 as of July.