与我们分析师联系

How CTO/MTO will affect the global olefins market

Kelly Cui, Olefins Senior Consultant, discusses China’s aspiration to switch gears from being the world’s leading importer of olefins to becoming self-sufficient via CTO/MTO.

1 minute read

Kelly Cui

Research Director, Petrochemicals

Kelly Cui

Research Director, Petrochemicals

Kelly is an expert in the coal-to-olefins (CTO) and methanol-to-olefins (MTO) sector.

Latest articles by Kelly

-

Opinion

Which global steam crackers are at most risk of closure?

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Why crude-to-chemicals is the obvious way forward

-

Opinion

Coronavirus to disrupt China’s chemicals sector more than SARS

-

Opinion

Can China’s CTO and MTO industries survive the threat of massive steam cracker investment?

-

Editorial

Why is China the early adopter of CTO/MTO

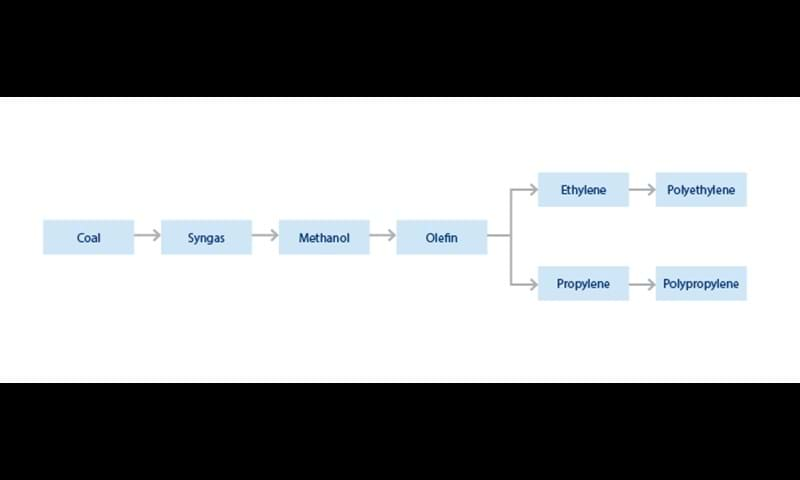

China has historically seen rapid rises in both ethylene supply and demand growth. Its supply has been dominated by steam crackers, which accounted for 98% of total supply in 2010. Demand growth was robust at 7% between 2010 and 2016, and it’s developing much faster than supply. To meet the increasing demand, China still needs other sources, such as coal- and methanol-based olefins (CTO/MTO). This method uses China’s abundant coal reserves and domestic and imported methanol resources, and it reduces China’s dependency on imports of olefins and derivatives.

In 2010, China started its first CTO unit in Inner Mongolia with DMTO technology. In the past six years, China’s CTO/MTO production capacity increased from 1% of the country’s total olefins production capacity to 17% by year-end 2016. By 2025, we expect this share to increase further to 29%.

As China’s CTO/MTO aspirations continue, how economically competitive will they be? How will they impact Chinese olefin prices, and how do they compare with other production routes globally? Find out in our ‘China’s coal and methanol-based olefins study’ brochure below.