Taking the strain How upstream could meet the demands of a delayed energy transition

January 2025

January 2025

Barring a radical shift in policy and investment, the world is edging towards a slow-paced transition. Fossil fuels remain cheaper and more accessible than many lower-carbon alternatives. Inflation and budgetary pressures have weakened government and corporate resolve to double annual expenditure to the estimated US$3.5 trillion required to build a low-carbon energy system and deliver on the goals of the Paris Agreement.

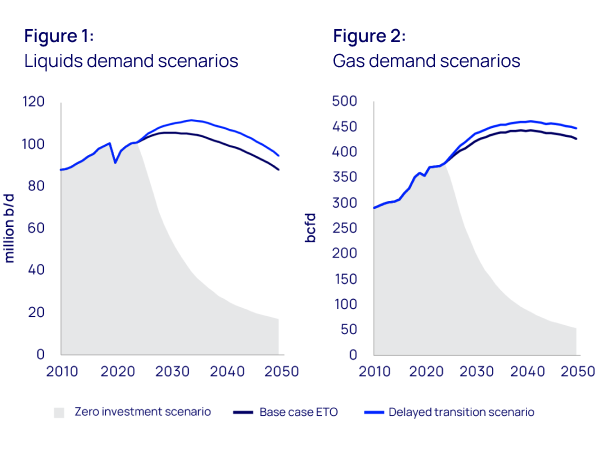

In our base case, the world is on a 2.5 ºC pathway, with liquids demand slowly peaking early next decade around 106 million barrels per day (b/d) and gas a decade later at over 440 billion cubic feet per day (bcfd). The upstream industry and its support sectors can deliver the required supply with only a modest increase in investment and service-company capacity.

However, the implications of a delayed energy transition would be very significant. Our delayed transition scenario assumes a five-year delay to global decarbonisation efforts. This would result in a 3 ºC pathway requiring 5% more oil and gas supply. Liquids demand would average 6 million b/d (6%) higher than our base case to 2050, and gas demand would average 15 bcfd (3%) higher than our base case.

Meeting rising demand in the near term in either the delayed scenario or the base case poses few challenges. Plenty of liquids are available, with non-Organization of Petroleum Exporting Countries (OPEC) supply continuing to grow and 6 million b/d of OPEC+ volumes, which represents several years of global demand growth, currently held from the market.

In contrast, a combination of stronger-for-longer demand growth and the natural decline of production from existing fields would present a stiffer industry challenge. The liquids supply increment is roughly equivalent to the volume of a new US Permian basin; additional gas supply is on a par with current production from the Haynesville Shale or Australia.

There are plentiful resources around the world to tap, but investment would have to increase materially. More spending would put significant pressure on the supply chain, parts of which are already running near capacity. Higher development costs would, in time, lead to higher oil and gas prices, with some implications for the global economy.

We answer five key questions in this edition of Horizons. Where would the additional oil and gas supply come from? Could the supply chain cope? How much more upstream investment would be needed? How would cost inflation affect the price of oil and gas? And can the industry amend its disciplined approach?

Question 1: Where would the additional supply come from?

Oil – calling on the big hitters

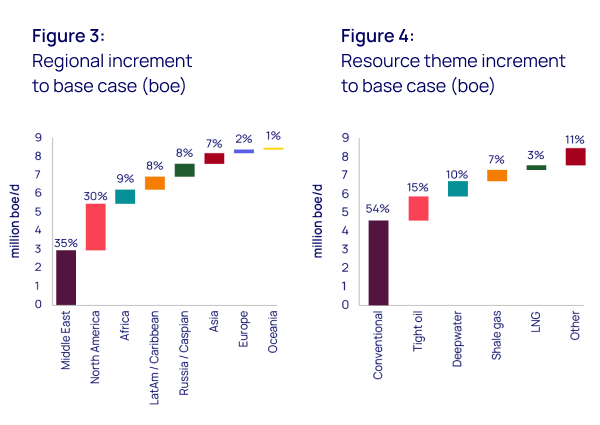

The Middle East and US Lower 48 are most able to ramp up supply. Both have investors that are typically supportive, access to capital, and freedom to act given fewer societal, environmental or access issues than elsewhere.

For the Middle East’s main producers, setting capacity and supply levels is a strategic choice rather than a resource constraint. We already assume the region’s market share increases in our base case and believe it would also be able to step up in a higher-for-longer scenario to meet more than 40% of the total liquids demand uplift.

North American producers would not respond with the raw growth-led aggression of past upcycles, despite the incoming US administration’s calls of “drill, baby, drill”. Yet the sector is price responsive and supply would react. In total, North America would supply almost 30% of the increment.

As with previous upcycles, supply from the rest of the world would creep up relative to our base case. Key contributors to the final 30% of additional supply include Latin America and Africa’s deepwater sectors, while Russia and the Caspian, Asia Pacific and Europe would also produce more than our current forecasts.

Gas - a more nuanced story

Meeting the 3% increase in global gas demand in a delayed transition scenario is a less challenging ask than that of oil. Almost half of the additional gas supply would come as a by-product of the heightened liquids-driven activity, including associated gas from areas such as the US Lower 48’s Permian basin. Dry gas plays in the US and around the globe would provide the rest.

The liquefied natural gas (LNG) sector would face a tougher challenge. US LNG exporters would be among the leading players capable of supplying the 40 million tonnes per annum (6%) of additional demand, exerting upward pressure on domestic Henry Hub gas prices. Qatar would also seek to seize the opportunity, leveraging its low-cost resource base. However, higher demand could incentivise supply from other sources, and buyers are already keen to diversify supply beyond these two behemoths.

Question 2: Could the supply chain cope?

The upstream supply chain – already close to its limits – would be severely stretched

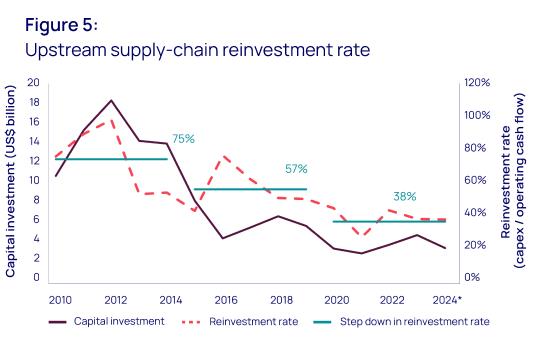

The global upstream supply chain has been right-sized over the last decade to suit current upstream spending, which averages half a trillion dollars per year (project development costs excluding exploration and overheads, 2024 terms). Moderate capacity expansion and continued fleet renewal should be enough to meet our base-case demand outlook to 2050.

However, certain segments are already creaking at the seams. Increasing activity would be bad news for producers’ costs. The service sector has run down capital investment for a decade, and capacity in most sectors has only just begun to creep back upwards.

Service companies, like operators, have been disciplined, focusing more on efficiency, exerting pricing power and capturing margins than adding capacity. They are leaner and better performing today than in decades, making the relationship between activity, capacity and pricing increasingly non-linear.

A delayed transition would pile on the pressure

A delayed transition would lead to virtually all regions and segments feeling the effects of crew and equipment shortages. We see four main inflation hotspots.

North American onshore: the region’s supply chain can spool up faster than most, but higher demand signals would have to be clear and sustained, while stakeholders would have to be supportive before capital would be committed to fleet expansion. A rush to add capacity is unlikely. Instead, prices and capacity would rise incrementally to match activity, offset by efficiency gains.

Deepwater: in our base case, activity reaches a plateau the industry can only just meet through continued operational improvements. Inflation already runs hotter than the rest of the industry.

Adding more rig, vessel, installation and subsea kit demand would crack the mould. Rig owners, through consolidation and fleet downsizing, have earned pricing power they would be reluctant to dilute. Experienced crews and shipyard availability are other constraints. Delays, cost overruns and inflation would manifest quickly and bite hard. Yet the sector’s returns would remain robust. New builds and refurbishments would take time, but capacity would creep up.

The Middle East: the region is already a hotspot for oil, gas and LNG investment. US$60 billion of project contracts have been awarded in the last two years and up to US$40 billion more are expected in 2025. Timelines and budgets are already under pressure. If the region’s major producers respond to the delayed energy transition scenario’s higher demand signals by adding even more supply capacity, further cost inflation and overruns would rapidly follow.

LNG: a new wave of developments will follow the expected lifting of the pause by the Trump administration. Higher global LNG demand will add to existing upward pressure on engineering, procurement and construction costs in the US and elsewhere as supply diversifies.

Rest of the world: some countries and sectors would be relatively immune to inflation, including those with government-controlled or integrated supply chains, such as China and Russia, and onshore and shallow-water sectors with excess service capacity.

Question 3: How much more upstream investment would be needed?

Spending would have to rise by 30%

A simple extrapolation of 5% more demand into 5% more spending would be inaccurate and an oversimplification. We have calculated the sector’s cost elasticity by integrating our field-by-field annual supply models with our global supply-chain analysis.

The results are non-linear, but in round numbers are pleasingly simple to explain:

5% more demand = 10% more activity = 20% higher global unit development costs = 30% more total investment.

This means US$659 billion of annual development spending versus US$507 billion in our base case, and US$17 trillion versus US$13 trillion in total to 2050 (all in 2024 terms).

This includes an assumption for continued operational efficiency improvements, which the industry could very well outperform, mitigating some of the inflationary impact.

Question 4: How would cost inflation affect the price of oil and gas?

Higher cost of supply would mean higher prices

Pre-sanction greenfield projects are almost fully exposed to rising costs and supply-chain bottlenecks. For the 95 largest conventional undeveloped projects in our Lens dataset, 20% cost inflation raises breakevens by more than US$15/bbl (up 28%) at a 15% discount rate.

Project returns would fall from 22% to 16% under existing corporate planning prices, which currently average around US$65/bbl, and rising unit costs would not be the whole story. Building capacity would dilute the quality of crews and equipment resources, leading to delays, cost overruns and further returns deterioration.

Oil prices would be materially higher

In this analysis, we calculate oil prices based on long-term fundamentals, cost of supply and the assumption that the marginal barrel sets the price. The behaviour of the industry’s low-cost producers remains paramount. We assume OPEC unwinds its current production cuts over the next few years and continues to expand capacity and grow production into the medium term.

Even in our base case, OPEC supply on its own will not meet global demand growth. Investment elsewhere is needed, too. The industry is developing its most advantaged, low-cost/low-carbon barrels first, replaced with lower-quality resources beyond peak demand. Reserves growth from existing fields, new project developments and more exploration are also needed, and the required incentive is higher prices. This dynamic is exacerbated and accelerated by a delayed transition.

Our global Oil Supply Model forecasts a Brent price rising to more than US$100/bbl during the 2030s in a delayed transition scenario. It falls towards US$90/bbl by 2050, averaging around US$20/bbl higher than our base case over the period (all in 2024 terms).

The outcome is, of course, critically dependent on OPEC behaviour. The group could chase market share with a more aggressive unwind or show more investment restraint than we assume. Either would have a substantial impact on prices.

Gas price would also rise, but become increasingly decoupled

Much of the incremental gas demand from a delayed transition would come from North America, with both power demand and LNG expansion running hotter than our base case. While gas associated with increased oil supply comes at a relatively low cost, over time, US gas prices would rise above our US$4/mmbtu 2030 base-case forecast, incentivising more non-associated gas.

Higher LNG demand would ease the risk of prices crashing on the arrival of the much-anticipated wave of new supply over the next five to seven years. Meanwhile, higher oil and Henry Hub prices would mean higher oil-indexed and spot LNG prices, as US LNG would remain the marginal supplier.

Question 5: Can the industry adapt its disciplined approach?

The metrics that drive strategic decisions would need to evolve

The Majors and other companies use multiple metrics to gauge investment suitability, chief among them are new project’s economics and emissions. To meet the spending requirements of a delayed transition, the industry’s current strict capital discipline edict would have to change or, at least, what defines discipline would have to evolve, for example:

1. Returns: corporate targets today average around 15% for oil. Achieving this with 20% cost inflation requires planning price assumptions to rise from US$65/bbl to around US$80/bbl in real terms.

2. Breakevens: the thresholds set by companies, typically US$40 to $50/bbl today on a net present value (NPV10) breakeven basis, would need to rise to account for cost inflation.

3. Emissions: technology will incrementally improve many projects, but for others, mitigation is an expensive task. Today’s corporate targets, often set at or below 20 kgCO2e/boe, would be at risk.

Corporate planning prices would increase if the outlook for the market improved, with increased confidence in demand longevity. In that environment, higher development unit costs and breakevens would likely be tolerable.

Solving for emissions would be harder. Operators must ultimately trade off mitigation costs with emissions intensity. Those with the strictest emissions targets might either find their projects less competitive than those without, or they would have to aggressively pursue offsets to unlock more carbon-intensive supply without compromising project cost metrics.

Stakeholder influence would be critical

How quickly investment metrics evolve would depend on how stakeholders view oil and gas investment fundamentals. For the required investment to show up, the whole upstream value chain, from operators to governments to investors to banks and other lenders, would have to buy into stronger market fundamentals and firmer prices.

Very few would advocate a return to the debt-driven growth-at-all-costs mentality of the 2010s in the belief of perpetual demand growth, and all would be keen to avoid getting caught out by the sector’s typical boom-bust cycle. After all, it has only been five years since many assumed the transition was accelerating and the upstream sector was headed for terminal decline.

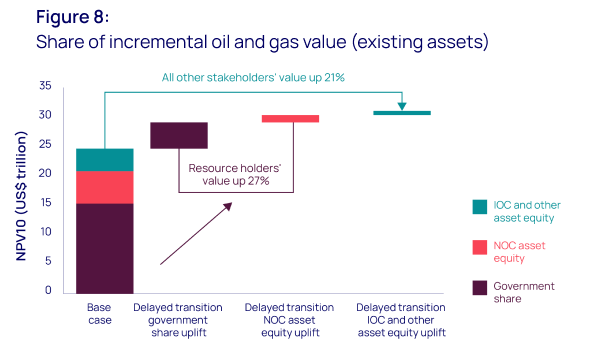

Higher prices would shift sentiment

The incentives to support investment would be strong. US$100/bbl translates into incremental government tax revenues and direct national oil company (NOC) equity interests of US$6 trillion, and a US$1 trillion increase in corporate valuations, just for existing commercial assets (on an NPV10 basis).

Like project returns, many of the key corporate benchmarks that investors track are price dependent. Operating cash-flow margins and reinvestment rates (capital deployed/operating cash flow) would look more favourable than today, despite higher costs. And operators could invest for growth while still allocating an increasing amount of free cash flow to investors.

But while increasing price is a key determinant of the appetite to invest, confidence would take time to build. Steady incremental demand growth, which is the outcome of our equilibrium-based demand model, would be the fastest way to consistently draw capital into the sector. Volatility – which would be more likely in a delayed transition scenario – creates friction.

Got questions? Join Horizons Live

At Horizons Live on 27 January at 9.30am GMT our panel will discuss the key themes of this month's report – and tackle your questions in a Q&A session.

Explore our latest thinking in Horizons

Loading...

Why sign-up?

By submitting your details you’ll gain access to the latest Horizons report, part of a thought-leadership series exploring the themes shaping the energy natural resources landscape. You’ll also receive the Inside Track, our weekly newsletter, so you won’t miss out on future editions.