Anticircumvention investigation paralyses US solar

But new executive action is expected to bring relief

1 minute read

Michelle Davis

Head of Global Solar

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

In late March, the US Department of Commerce formally launched an investigation into claims that companies in Southeast Asia are circumventing existing anti-dumping and countervailing duties (AD/CVD) applying to imports from China. The risks and uncertainty introduced by investigation have wreaked havoc on the industry. Shipments of equipment from the four named countries have virtually stopped. Development activity has stalled for most of the industry.

Then on June 6th, the Biden administration announced a two-year delay of new AD/CVD tariffs on solar cells and modules imported from the four named countries in the investigation (Cambodia, Malaysia, Thailand and Vietnam). The situation is fast evolving, but this new action is expected to bring near-term relief to the industry.

In our US Solar Market Insight Q2 2022 report, created in collaboration with the Solar Energy Industries Association (SEIA), we analyse the impacts of the anticircumvention investigation on each segment of the industry across multiple scenarios. Fill in the form for a complimentary copy of the 19-page executive summary. Or read on for some key highlights.

Near-term uncertainty shrinks 2022 installation volume

The most damaging element of the investigation is the near-term uncertainty it has caused. Until a preliminary ruling is issued on August 29th, solar cell and module manufacturers don’t know what new AD/CVD tariffs might apply to them. And while such tariffs have ranged from the low teens to 100% for major manufacturers over the last few years, new tariffs could be as high as 250%, depending on the conditions met by the manufacturer.

The investigation has already caused immense damage to the industry. Roughly 80% of all solar module supply to the US comes from the four countries named in the allegations. Given the uncertainty of tariff levels, most manufacturers have halted shipments to the US since late March. Southeast Asian factories have idled operations, leaving projects without secured equipment facing months of delays and unknown pricing impacts. Many in the solar industry have resigned themselves to several months of minimal-to-no development activity.

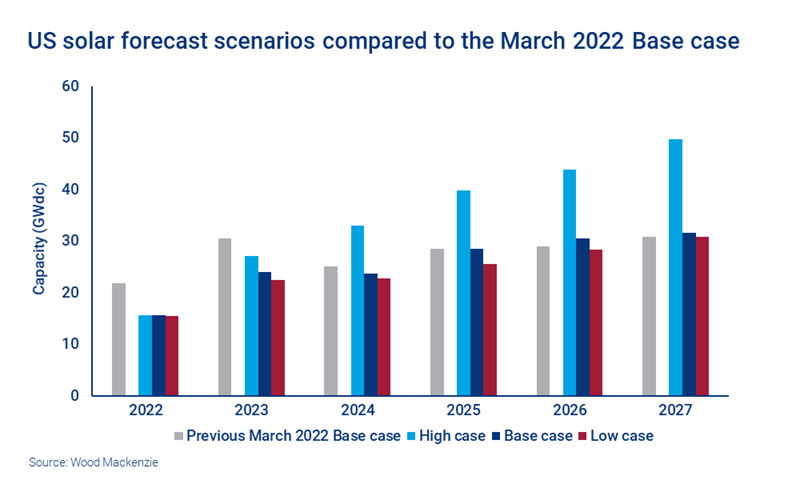

As a result, we have reduced our 2022 Base case outlook for new US installations by 29% or 6.3 gigawatts (GW), to 15.6 GW. Most of this reduction comes from the utility-scale solar segment, for which we expect installations to be 40% lower than in our previous outlook. While severe, these downward revisions are slightly buffered by the fact that some product had already been shipped into the country before the investigation was initiated.

Executive action brings near-term relief

The solar industry breathed a sigh of relief when the Biden administration’s action was announced on Monday. Even though there are still details to be worked out, the action eliminates the painful near-term uncertainty that the investigation has caused.

That being said, the last few months of uncertainty have certainly taken their toll. Wood Mackenzie’s base case outlook reflects current industry expectations, with much of the damage to 2022 capacity additions already experienced by the market.

All in all, the two-year tariff delay is expected to create approximately 2-3 GW of upside potential to Wood Mackenzie’s 2022 base case outlook. Importantly, this assumes that Southeast Asian facilities rehire workers and restart module production quickly. We’ll be tracking this closely to examine the precise impacts on the US solar supply chain in more detail.

Three scenarios examine different near-term policy outcomes

For this US Solar Market Insight report we’ve created three different forecast scenarios, to account for multiple near-term policy uncertainties. In addition to the anticircumvention investigation, the industry is still awaiting the potential passage of clean energy policies in a federal reconciliation bill (originally included in the Build Back Better Act). The assumptions for these scenarios are as follows:

- Low case = Affirmative preliminary ruling in the anticircumvention investigation (tariffs are imposed on the four named countries); no passage of federal clean energy incentives package

- Base case = Negative preliminary ruling in the anticircumvention investigation (tariffs are not imposed on the four named countries); no passage of federal clean energy incentives package

- High case = Negative preliminary ruling in the anticircumvention investigation (tariffs are not imposed on the four named countries); passage of federal clean energy incentives package

The near-term uncertainty caused by the investigation is already baked into all three of these forecast scenarios. In our low case, which is now unlikely given the Biden administration’s announcement, we assume a tariff level of 41%. This is similar to current tariff levels imposed on Chinese imports from major manufacturers. If new AD/CVD tariffs were to be imposed in late August, it would have reduced our five-year outlook by an additional 8.5 GW, on top of the 12 GW reduction already accounted for in the base case.

By contrast, our high case demonstrates how federal clean energy incentives would dramatically boost solar build by 36% in the next five years. These clean energy policies include an extension and expansion of the investment tax credit and production tax credit, a new standalone storage ITC, tax credits for solar manufacturing, and direct payment options for tax credits.

The full report explores the impact of the anticircumvention investigation on US solar in greater detail. Fill in the form at the top of the page for a complimentary copy of the 19-page executive summary.