与我们分析师联系

How the top microgrid developers do business

Of nearly 200 microgrid developers in the United States, these 17 are worth watching

1 minute read

Microgrids are emerging as a key tool for resilience. As of January 2019 we tracked 2,430 operational microgrids across the United States, developed by 187 developers.

Most of those 187 developers* have only developed one project, and many of them are also the end customer.

But 17 of them are not customers, and can claim at least two projects each. This small group of developers has executed over 90 percent of the country’s microgrids.

That means this select group of 17 developer are especially worth watching. What do their strategies say about the future of microgrid development?

Technology-neutral versus product-led

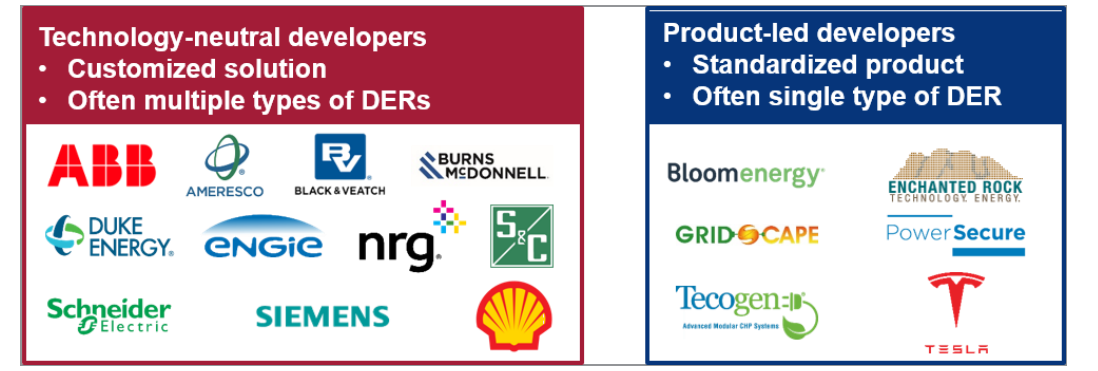

According to my recent research insight, these 17 developers all employ either a technology-neutral or a product-led strategy.

Technology-neutral developers typically integrate a generation or energy storage asset on the customer site that predates the microgrid.

These developers are generally microgrid control companies, energy service companies or engineering, procurement and construction providers.

In contrast, product-led developers focus on standardized generation and energy storage products. These systems are often installed on sites that do not have existing generation or storage assets.

While some product-led developers integrate standardized energy storage and generation systems, these solutions tend to rely on a generation asset. These companies can be organized based on the type of product they provide: natural-gas-fueled products, diesel or solar-plus-storage.

Top microgrid developers by strategy (technology-neutral vs. product-led)

Source: Wood Mackenzie

Strategy and scale

Except for Schneider Electric, only product-led developers have completed more than 10 microgrid projects each. This suggests that completing many microgrids can be more easily achieved with a standardized product rather than a technology-neutral approach.

One example of a successful product-led approach is the path taken by the Southern Company. Through its subsidiary PowerSecure, Southern Company has led microgrid deployment in the U.S. in each of the last four years in terms of both capacity and number of installed systems.

However, differences in average project size illustrate that developers using a technology-neutral approach will be more likely to compete with one another than with companies using a product-led strategy and vice versa.

Technology-neutral developers are optimized to handle larger and often more complex projects. While the average system size across all product-led developers hovers around 1 megawatt (ranging from 0.2 to 1.5 megawatts), the average system size for each technology-neutral developer ranges from 2 megawatts to 27 megawatts.

What's next?

PG&E’s recent solicitation for 522 megawatts' worth of microgrids at 20 substations in fire-prone regions indicates the increasing role for microgrids in resilience efforts. This solicitation is an opportunity for technology-neutral developers due to the complexity of the projects and scale required.

The U.S. microgrid market did not grow last year, but growth is expected to pick back up in 2020. As the market grows, the opportunity for both technology-neutral and product-led developers will grow with it.

*When we talk about the “lead developer” for a microgrid, we define that as the organization responsible for securing financing; leading or sub-contracting feasibility studies, engineering, procurement and construction; and operations and maintenance. If a microgrid project team can be likened to an orchestra, the lead developer is the conductor.