Get in touch

-

Sonia KerrSonia.kerr@woodmac.com

+44 330 174 7267 -

Kevin Baxterkevin.baxter@woodmac.com

+44 408 809922 -

Vivien LebbonVivien.lebbon@woodmac.com

+44 330 174 7486 -

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Oil & gas Majors share just 8% of global low-carbon hydrogen capacity

Increased market share expected as investment builds for low-carbon hydrogen

3 minute read

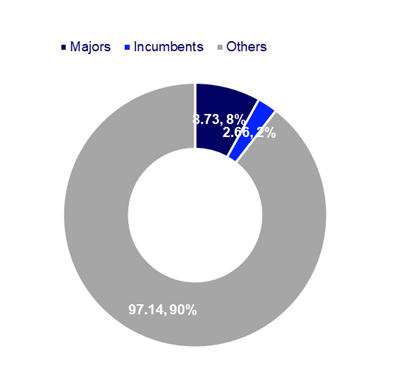

Oil and gas Majors have just an 8% market share of announced global net low-carbon hydrogen production capacity, which equates to 102.6 million tonnes per annum (Mtpa), according to latest analysis from Wood Mackenzie. The Majors are focused on getting small-scale projects operational before 2030 to pave the way for industrial scale-up next decade.

In Wood Mackenzie’s base case, global low-carbon hydrogen production grows from 1 Mtpa in 2023 to 200 Mtpa by 2050, as outlined in its Energy Transition Outlook published in September of this year.

“The Majors may only have a modest share of the low-carbon hydrogen pipeline today, but a likely trove of unannounced projects could change the landscape quite quickly. The sector is also ripe for consolidation, with over 750 participants in projects announced to date. We expect the Majors’ market share to increase as low-carbon hydrogen hits an investment inflection point,” said Bridget van Dorsten, Senior Research Analyst at Wood Mackenzie.

The Majors’ share of the global net announcement pipeline:

Note: Net capacity (Mtpa), % share. Source: Wood Mackenzie Lens Hydrogen & Ammonia

Note: Global net announced capacity (Mtpa), % market share. Source: Wood Mackenzie Lens Hydrogen & Ammonia

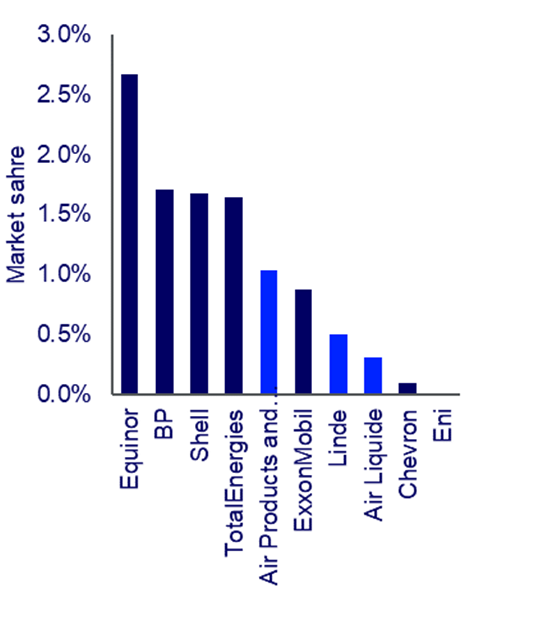

Between the Majors, Equinor, BP and Shell have the largest shares of the announced low-carbon hydrogen capacity. Equinor ranks first in total announced production capacity, largely due to its H21 project, while ExxonMobil ranks top in advanced development capacity.

“BP, Shell and TotalEnergies have the most exposure to green hydrogen, mirroring their top-ranking renewable power positions. Equinor and ExxonMobil are leading the charge in blue hydrogen, taking advantage of CCS leadership. Shell stands out in having captured the largest number of projects with BP also well positioned, to have limited portfolio concentration risk,” van Dorsten said.

The Majors are more dominant in the blue hydrogen sector

The Majors have built more exposure to blue with a 23% market share as they look to leverage areas of competitive advantage, such as upstream gas positions and downstream infrastructure. Blue hydrogen projects provide early scale for the low-carbon hydrogen market, compared to much smaller electrolyser deployments in the space, and the Majors have existing expertise in methane reformation facilities.

van Dorsten said: “Blue hydrogen projects can be cost-competitive with some of the carbon intensive hydrogen that we see on the market today. This, in addition to its ability to provide low-carbon hydrogen at-scale, is its greatest advantage against green hydrogen – and provides incentive for the Majors to prioritise the technology.”

The sector is a core target for the US Majors and Equinor, which are leveraging their CCS positions into blue hydrogen projects. Blue hydrogen and CCS are important enablers in the Majors’ drive to build low-carbon value chains. ExxonMobil’s acquisition of Pioneer will also provide more advantaged gas in the Permian to fuel the development of an integrated blue hydrogen business.

The Majors only have 5% of the green hydrogen market, with the European Majors at the forefront. The Euro Majors will leverage their renewable power portfolios in a drive for integration with green hydrogen facilities. The US Majors lack exposure to green hydrogen, reflecting their strategic choice not to participate in wind and solar to date.

“The question remains whether a focus on blue hydrogen might result in missed opportunities, once green hydrogen reaches an investment inflection point. After all, green hydrogen is projected to compromise 70% of global low-carbon hydrogen supply by 2050. This raises the broader question of whether molecule-only portfolio integration will result in a strategic disadvantage for the Majors. But the sector is still at a very early stage and the Majors have time to adjust their portfolios. We expect the sector to enter a phase of consolidation once there is better visibility on commercial scale-up,” said van Dorsten.

Editor’s Notes

Wood Mackenzie defines Majors as the world’s seven largest integrated International Oil Companies (IOCs), including bp, Chevron, Shell, ExxonMobil, Equinor, Eni and TotalEnergies. Incumbents defined as AirLiquide, Air Products and Linde.

Lens Hydrogen & Ammonia

Lens Hydrogen and Ammonia provides detailed analytics data and combined workflows across the integrated natural resources value chain providing businesses with decision intelligence like never before. Lens Hydrogen enables businesses to examine market fundamentals and evaluate project economics across a complex value chain, from production to storage, transport, and distribution, through to end use sectors.

For more information, visit Lens Hydrogen.