Get in touch

-

Sonia KerrSonia.kerr@woodmac.com

+44 330 174 7267 -

Kevin Baxterkevin.baxter@woodmac.com

+44 408 809922 -

Vivien LebbonVivien.lebbon@woodmac.com

+44 330 174 7486 -

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Volatility expected in metals markets as they adapt to accelerated energy transition pressures

Investment in new metal supply totalling $200 bn is essential to meet demand

3 minute read

The current metals super-cycle that is a major component of the global energy transition could stall due to a gloomy global macroeconomic environment, geopolitics and a lack of investment in new production facilities according to analysts from Wood Mackenzie.

Speaking at a press briefing in London, Nick Pickens, Research Director of Global Mining at Wood Mackenzie told reporters that US$ 200 billion (bn) of new mining projects were required by 2030, as well as more efficient and creative methods of recycling existing scrap metals.

“A 7-10-year lead time for new mining projects makes meeting supply/demand requirements difficult.” Pickens said. “Combined with mid-term uncertainties for demand and metal prices, the situation does create some serious headwinds for the metals super-cycle.”

Complex Copper

Pickens added that copper markets would continue to be volatile as end-users clamoured for the metal to support increased electrification.

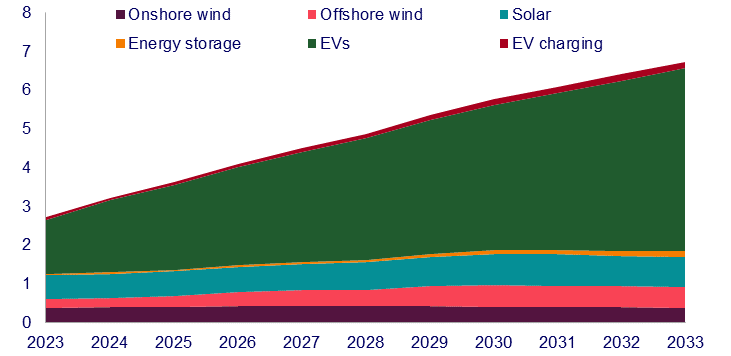

“Products such as copper wire rod and electrodeposited foil are used extensively in the manufacture of electric vehicles [EVs] and renewable energy equipment,” Pickens said. “This means investment in support infrastructure to underpin copper end-use demand is essential moving forward."

Copper: End-use demand from green sectors (Mt)

Source: Wood Mackenzie

Pickens added that new projects were required to meet long-term demand, but added that scrap will also play a pivotal role for a long-term solution.

“Governments need to support the increased use of scrap copper.” Pickens said. “It offers lower carbon intensity than new copper, making it a more attractive solution for end-users looking to lower emissions."

Supply may not meet demand for battery raw materials

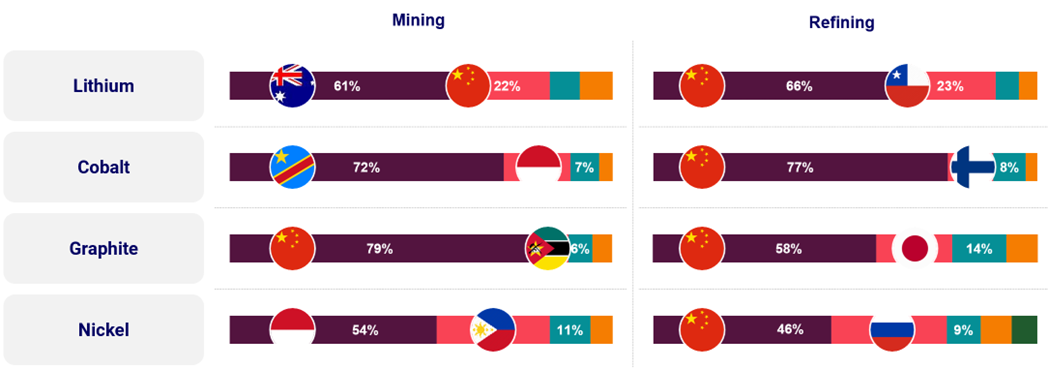

The booming demand for battery raw materials has seen markets become increasingly volatile Sue Shaw, Head of Energy Transition & Battery Raw Materials told reporters at the event. She added that meeting future demand is challenging due to heightened supply risks. And while government incentives will be essential to diversify supply chains, they can also restrict raw material availability.

“Prices for battery raw materials will remain volatile, but future cycles are becoming more sustained as markets are showing signs of maturing,” Shaw said. “The pressure to deliver is huge even with recycling.”

Supply of lithium, graphite, nickel and cobalt depends on only a handful of countries and regions

Source: Wood Mackenzie

Bleak demand for aluminium

Ami Shivkar, Aluminium Analyst at Wood Mackenzie told reporters that a downturn in aluminium demand in Europe was expected due to the region struggling with inflation, higher interest rates and a sharp slowdown in the manufacturing and construction segments.

Citing Wood Mackenzie forecasts, Shivkar said that a cumulative global surplus of 1.1 million tonnes is expected between 2023-2025.

“Prospects for 2024 will hinge on better economic performance in the major markets and a return to restocking across the aluminium supply chain,” Shivkar said. “The silver lining is that exchange inventories continue to fall and, all things being equal, should be supportive for prices."

Nickel prices expected to fall

Sean Mulshaw, Director of Nickel Markets at Wood Mackenzie told reporters that the current nickel market was oversupplied and this would have a negative impact on prices. With a surplus of 1 million tonnes expected by 2025 he expects prices will fall accordingly.

“Despite the big surplus prices have resisted dropping below US$20,000 a tonne until recently,” Mulshaw said. “This surplus looks set to last for the rest of the decade so producers will need to be ready for this.”

Corporates braced for earnings decline

Bulk commodity price weakness will contribute to a fall in mining companies’ profits in 2024 according to Wood Mackenzie forecasts. James Whiteside, Head of Corporate Metals & Mining told reporters that new investment will suffer as companies prioritise debt reduction.

“A preponderant concentration on meeting shareholder pay-out expectations takes precedence, while endeavours associated with growth and decarbonisation take a backseat,” Whiteside said. “Most companies are committing less the 10% of capex to decarbonisation and renewables, and even less on exploration and evaluation.”

He added that a modest silver lining amidst this scenario is the notable headway observed in the transition towards renewable power generation by mining companies, achieved through investment in self-generation or Power Purchase Agreements (PPAs).