Sign up today to get the best of our expert insight in your inbox.

Artificial intelligence and the future of energy

A catalyst to transform energy efficiency and reduce the costs of new technologies

7 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

View Prakash Sharma's full profileArtificial Intelligence is the next big thing in energy, dominating discussions at all levels in companies, banks, investment funds and governments. Just as the internet and mobile communications led to higher global economic growth by boosting trade and productivity, AI and advanced computing capability are expected to deliver transformative change. Besides a shot in the arm for the global economy, AI could be a boon for the energy industry by raising demand, driving efficiencies, enabling low-carbon technologies and even addressing climate change.

Energy companies are still in the early stages of embracing AI and exploring the potential it could unleash. Prakash Sharma and I asked WoodMac’s experts what role AI might play in the energy and resources sectors and where the greatest opportunities and risks are.

Is it a shot in the arm for the global economy?

Global GDP doubled in the past 25 years, lifting average per capital income by 50% and raising living standards. But amid sluggish productivity gains and challenging demographics in key markets, the big question is whether the global economy can double again by 2050 as we forecast.

AI and machine learning might just be the catalysts that productivity growth needs. Generative AI promises to turbo-charge automation and efficiency, reduce costs and perhaps solve the issue of shrinking working-age populations. Capital investment in AI technology and the resulting boost to productivity might even unlock GDP upside. The very wide range of estimates for the economic benefits, though, hints at uncertainty. And there are other concerns.

Diminishing returns are likely. Easier-to-learn tasks and processes will be replaced first. Those that are harder will require more time and investment for potentially lower returns. Productivity gains may be overestimated if diminishing returns are not factored in. Such gains must also factor in AI “hallucination”, the significant errors AI systems make.

Will unintended consequences emerge? AI poses a risk of a disruptive supply-side shock to labour markets. Going beyond solving the shrinking working-age problem, it may make many jobs – including high-skilled, white-collar roles – obsolete and permanently increase structural unemployment. As more income flows to capital technologies instead of the displaced labour, inequality could widen sharply. In the absence of greater redistribution in economies, an invigorated populism could stoke civil unrest and challenge the democratic capitalist system.

Power and renewables

The utility sector is central to the growth of AI, which relies on huge power loads to run hyperscale data centres. We estimate the current 25 GW of power draw by US data centres (5% of total US electricity demand) could more than double by 2030. US utilities are already struggling to meet demand with grid-connected supply. Massive new-build generation capacity will be required, mostly gas, and perhaps the deferral of older US coal-gas plant retirements – both with serious implications for meeting emissions reduction targets.

Post-2030, more data centre demand could sit behind the meter, tied to new technologies such as SMR nuclear and next-generation geothermal. We are starting to see big tech companies signing up new power purchase agreements with early-stage geothermal and nuclear projects. Meanwhile, independent power producers are considering developing data centres at their existing generation facilities – off-grid, causing concern for grid operators.

Substantial investment will be required to strengthen the grid itself and meet the expected surge in demand for grid connection. Grid system operators will have to manage higher flows, variable supply and rising demand. New technologies such as Dynamic Line Rating will be needed.

Generative AI is already impacting the utility space. GE Vernova recently spun off ThinkLabs, which will offer a copilot-like tool for control room operators. The idea is to learn grid physics, offering operators feedback and suggestions that they don't have today. This will become increasingly important as experienced workers retire.

Machine learning will enable better anticipation of solar and wind patterns to modulate power flow and optimise electrolyser operations. Generative AI will facilitate the development of these models and improve how asset developers and operators interact with them, optimising asset performance and portfolios.

National data security will be bracketed alongside energy security. The challenge of data centres will be global, not just for the US.

Oil and gas

Ambition across the sector is rampant, with BP calling out AI in its latest results as contributing to US$2 billion of its targeted cost savings by 2026. Digitalisation has been widely used for a decade across the upstream value chain, a platform that AI will progressively build on. The potential is huge and wide-ranging across a number of areas – subsurface and exploration, automated drilling and production, operational optimisation, programme management, artificial lift, predictive maintenance and Quality, Health and Safety (including emissions reduction). AI will reduce unproductive capital, accelerate project development and help maximise returns.

The largest upstream players will be in the vanguard. ExxonMobil, for example, has invested in AI up front as a core part of a plan to reduce the cost of tight oil supply from its Permian tight oil acreage by up to US$7/bbl. The biggest tight oil operators will likely follow suit, seek to rejuvenate acreage in other basins, improve late-life well performance and ultimately flatten L48 declines.

From a refiner's perspective, predictive analysis is the next generation of sophisticated modelling that will enhance the continual performance improvement of operating assets, the industry’s core discipline for over a decade. Potential gains include refinery scheduling, process optimisation, operational integrity, maintenance and turnaround planning. All this will reduce unplanned outages and deliver higher value.

Metals and mining

For the mining industry, the growth in energy consumption from AI-related data centres may stretch already-stressed metals outlooks. Tin and aluminium demand will be boosted, but copper demand is the real winner.

There won’t be a big bang on the supply side – much of the investment in AI will be about optimisation to protect, perhaps enhance, margins. The risk is in AI-associated automation, which will displace people – posing a threat to the social license to operate mining activities. Companies will look for other ways to engage and support local communities such as conservation programmes.

It could rejuvenate exploration, with tech-backed companies such as Kobold and VerAI looking to enter the critical transition minerals space. AI could also use existing data to remap geologies and identify missed or deep-lying ore bodies. Blue-sky potential includes making more existing deposits economic – AI could find solutions for complex, inconsistent mineralogy or patchy and irregular orebodies by collecting data and running simulations of analogous deposits.

Four final thoughts

First, AI presents the ability to predict weather patterns, allowing governments and communities to better adapt to climate change impacts.

Second, the focus on meeting surging power demand from datacentres could prove short-lived. Infrastructure beyond 2030 could use light to deliver data around the world rather than electrical impulses, cutting power consumption by one-third.

Third, AI needs to be channelled to areas where it makes a net-positive impact on the environment. The current focus on meeting power demand from AI and data centres risks compounding the scalability challenge already confronting the renewables sector, which is limiting the pace of electrification in certain sectors. AI could be put to better use in advancing emerging zero-carbon power supply options such as nuclear fusion, SMR, geothermal or making hydrogen and CCUS affordable faster while continuing to improve its own process efficiency.

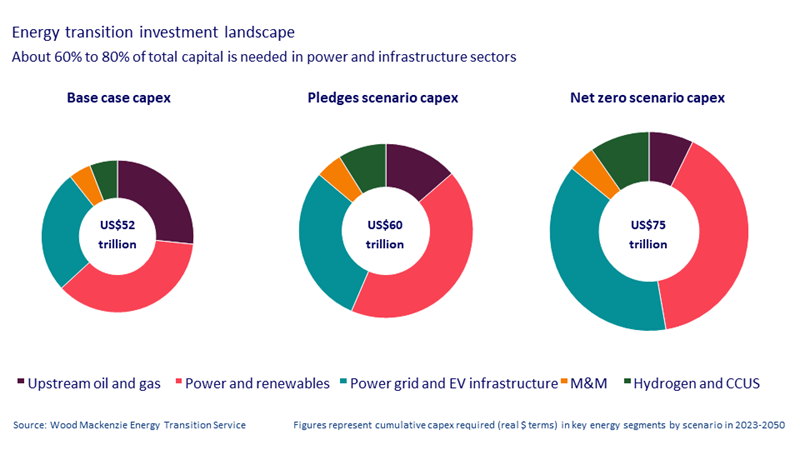

Longer term, the biggest opportunity for AI is to drive efficiency and cost reductions in 200-plus energy transition technologies. The size of the prize is the US$75 trillion investment in new supply we estimate will be needed in a net zero scenario.

The energy transition will be expensive – AI may bring technology costs down

Thanks to: Ben Hertz-Shargel, Michelle Davis, Prashant Khorana, Murray Douglas, Brian Gaylord (P&R), Robert Clarke, David Clark, Fraser Mckay, Tom Ellacott, Giles Farrer, James Whiteside, Mhairidh Evans (UCM), Massimo Di Odoardo, Ixchel Castro, Ann-Louise Hittle, Eugene Kim Shashank Sriram, Alan, Gelder, Peter Martin, Nick Pickens (Commodities), Prakash Khorana (Consulting), Chris Seiple (Vice Chair, P&R), Gavin Thompson (Vice Chair, EMEA), Julian Kettle (Vice Chair, M&M), Ed Crooks (Vice Chair, Americas)

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.