Thank you for attending. We will be back later this year with the LME Forum on October 15 in London

Optimists had hoped that 2025 could be the year where positive economic momentum combined with loosening monetary policy to supercharge demand for metals. Unfortunately, things are rarely that simple.

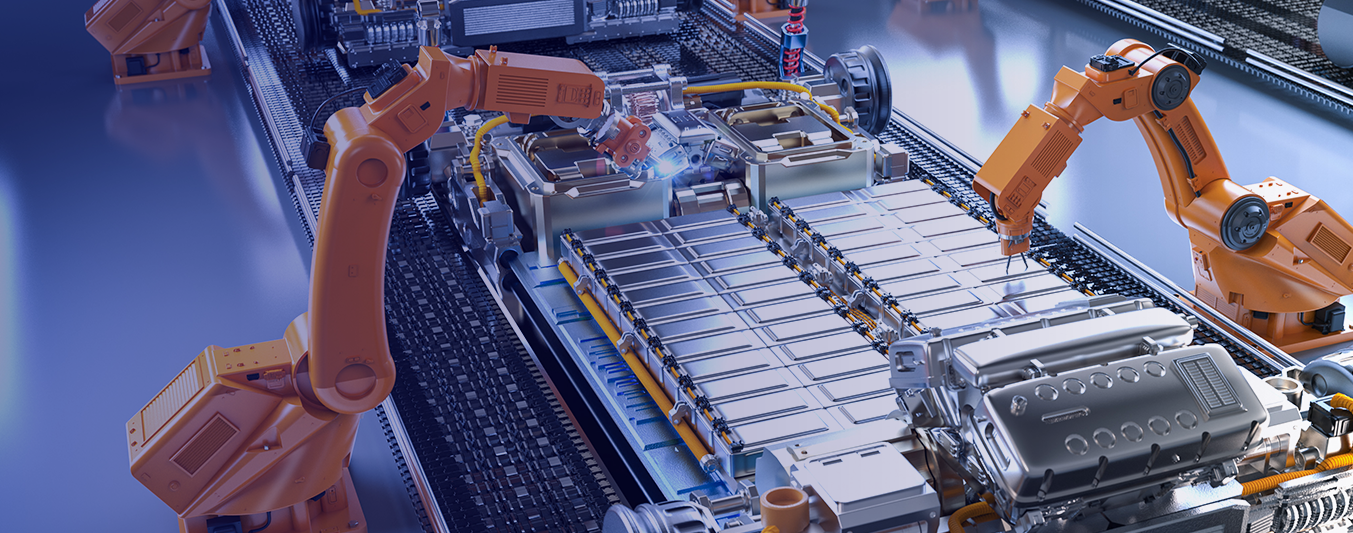

The outlook for metals was already complicated by deep concerns over China’s economic prospects. More worrying for metals investors was the broader deflationary effect of China’s processing capacity overhang in the EV, battery and renewables value chains. Trump 2.0 and his predilection for tariff diplomacy is now threatening to completely upend markets, stretching supply chains that were already under strain. Worse still perhaps, questions over delivery and longevity of US policy - and retaliatory measures - is transforming the risk around financial decisions.

To make sense of these seismic shifts, and their impact on the key commodities that underpin the energy transition, the Wood Mackenzie Future Facing Commodities Forum took place on 30 April 2025.

Topics that were discussed on 30 April:

- Metals markets: What has changed?

- Tariffs, trade and the energy transition

- Copper: Turning potential into growth

- Rare Earths: Unlocking their power

- Aluminium: Synchronising supply growth and emissions reductions

- Crunch time for the battery value chain

- Cathode & Anode: Waiting for recycling to make its mark

- Nickel: Looking for a route back to safety

- Lithium: How will the market rebalance?

2025 speakers included:

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

Latest articles by Prakash

-

Opinion

Energy transition outlook: Middle East

-

Opinion

Energy transition outlook: UK

-

Featured

Nuclear 2026 outlook

-

Opinion

Energy evolution: navigating the path to a sustainable future

-

The Edge

Five key takeaways from COP30

-

The Edge

Slipping climate targets and the “energy addition”

Emily Brugge

Senior Analyst, Copper Supply

Emily contributes to the Copper Markets and Copper Concentrates services.

Latest articles by Emily

-

Opinion

What’s next for copper?

-

Opinion

What’s next for copper?

-

Opinion

Copper: strategic insight amid policy risk and smelter margin pressures

-

Opinion

Copper: 4 things to know

-

Opinion

Four key takeaways from LME 2024

Bridget van Dorsten

Principal Analyst, Hydrogen

Bridget is a hydrogen-focused principal analyst on our Energy Transition Practice.

View Bridget van Dorsten's full profile

Suzanne Shaw

Head of Energy Transition & Battery Raw Materials

Suzanne specialises in commodities including cathode and precursor, lithium, cobalt, graphite, rare earths and lead.

Latest articles by Suzanne

-

Opinion

The 3 challenges to exploiting Greenland’s rare earths

-

Opinion

How will the new US Republican government reshape the global electric vehicle supply chain?

-

Opinion

Four key takeaways from LME 2024

-

Opinion

Three challenges to overseas expansion for the Chinese cathode sector

-

Opinion

What’s next for the EV and battery value chains?

-

Opinion

Battery raw materials: tracking key market dynamics

Shashank Sriram

Senior Research Analyst, Aluminium Markets

Shanshank has 10 years of Aluminium industry experience within technical and management roles.

View Shashank Sriram's full profile

Prateek Biswas

Senior Research Analyst, Transport and Materials

Prateek specialises in EV policy drivers, automaker electrification strategies and battery supply chain trends.

Latest articles by Prateek

-

Featured

Autonomous electric vehicles: four things to look for in 2026

-

The Edge

Will Chinese BEVs be a gamechanger in Europe and the US?

-

Opinion

Carjacked: electric vehicle policy under a Delayed Energy Transition scenario

-

Opinion

Have policy headwinds pushed electric vehicles into the slow lane?

-

Opinion

How will the new US Republican government reshape the global electric vehicle supply chain?

-

Opinion

Could new EU tariffs on Chinese imports slow EV adoption?

Egor Prokhodtsev

Principal Research Analyst, Transportation & Mobility

Egor is a senior research analyst responsible for battery raw materials demand modelling.

View Egor Prokhodtsev's full profile

Yingchi Yang

Research Analyst, Battery Raw Material

Yingchi focuses on supply of global cathodes and precursors.

Latest articles by Yingchi

-

Opinion

Three challenges to overseas expansion for the Chinese cathode sector

-

Opinion

Cathode and precursor: 5 things to look for in 2024

-

Opinion

Three reasons LFP cathode supply keeps expanding in an oversupplied market

Kane Carty

Senior Research Analyst, Cathodes and Precursors

Latest articles by Kane

-

Opinion

Three challenges to overseas expansion for the Chinese cathode sector

-

Opinion

Cathode and precursor: 5 things to look for in 2024

Sean Mulshaw

Research Director, Nickel Markets

Sean is an expert in global nickel, stainless steel and molybdenum markets.

Latest articles by Sean

-

Opinion

Nickel: looking for a route back to safety

-

Opinion

Nickel: looking for a route back to safety

-

Opinion

Steel alloys: a defining moment